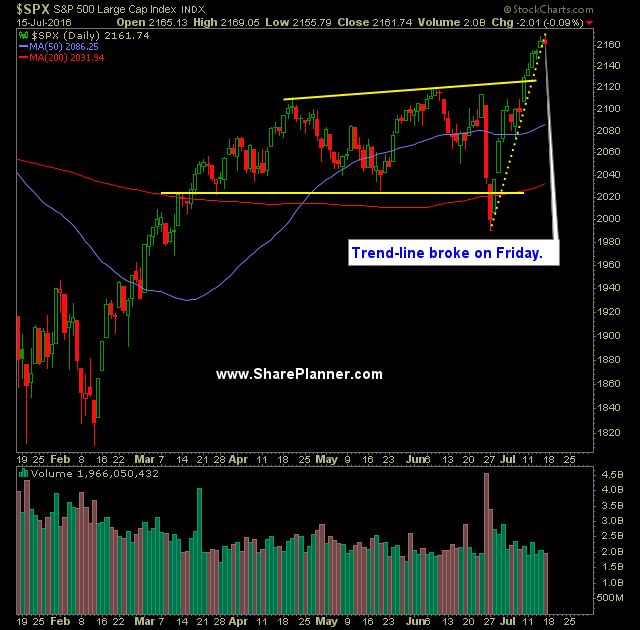

Technical Outlook:

- SPX finished lower for the first time after five straight green days.

- Futures following Friday’s close sunk on the failed coup attempt in Turkey. All those losses were erased with the opening print on Sunday night.

- 5-day moving average still holding strong on the current market rally.

- At this point, the market could really benefit from some consolidation, in order to avoid a sharp pullback.

- SPY volume increased for a second straight day, and came in at slightly above average.

- SPX 30 minute chart may be starting to see some consolidation on the 30 minute chart.

- VIX continues to trade lower, and move below key support at 13 – a support level that has held for the better part of two years.

- T2108 (% of stocks trading above their 40-day moving average) is starting to flat line a bit at 78-79% over the past few days.

- Oil continues to bounce around over the past 7 trading sessions. Most noticeable on the USO chart.

- Advancing stocks on a daily basis, compared to declining stocks have not been as strong over the past 2-3 trading sessions.

- I could easily see a pullback to the 2120 level which was the breakout area for this market, in the coming weeks, without ruining the upside potential of the market going forward.

- At this point, and with the election ahead, I’d expect the market to keep rallying higher. I don’t expect there to be a rate hike between now and the election. To do so would impact the market and thereby the election. I don’t think the Fed wants that, particularly since Trump has indicated that he would replace Yellen.

- There is a great deal of bullishness to this market right now despite the prevalent amount of worry. It has been over two years since the market has actually seen a legitimate rally and so it wouldn’t be surprising to see this market continue its current trend higher as shorts are forced to face the new reality of the market.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

My Trades:

- Sold CNI on Friday at $62.45 for a $4.0% profit.

- Covered RCL on Friday at $69.71 for a 3.9% profit.

- Sold NFLX on Friday at $98.37 for a 2.4% profit.

- Sold USO on Friday at 10.96 for a 1.4% profit.

- Added one new long position to the portfolio on Friday.

- May add 1-2 new swing-trades to the portfolio today.

- Currently 20% Long / 80% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone