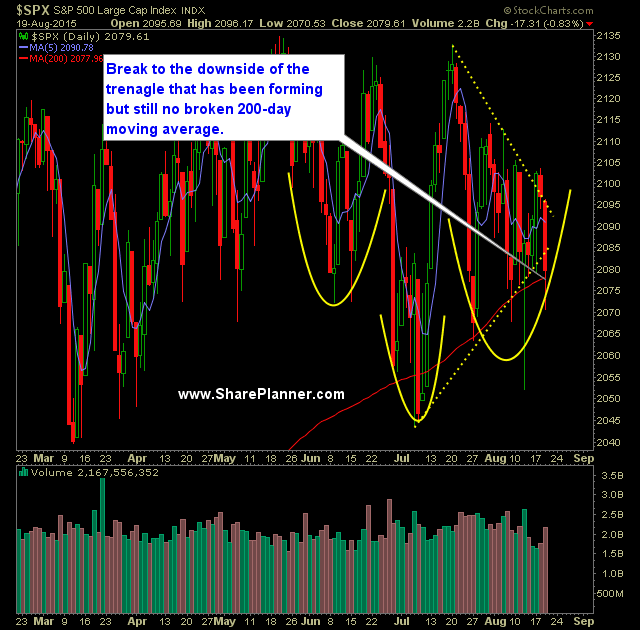

Technical Outlook: SPX had a wild and turbulent ride yesterday watching price drop 26 points, only to rally to break even on a leaked Fed minutes, followed by another drop of 17 points into the close. Today SPY is looking at its 8th straight gap down in the market. There has been plenty of

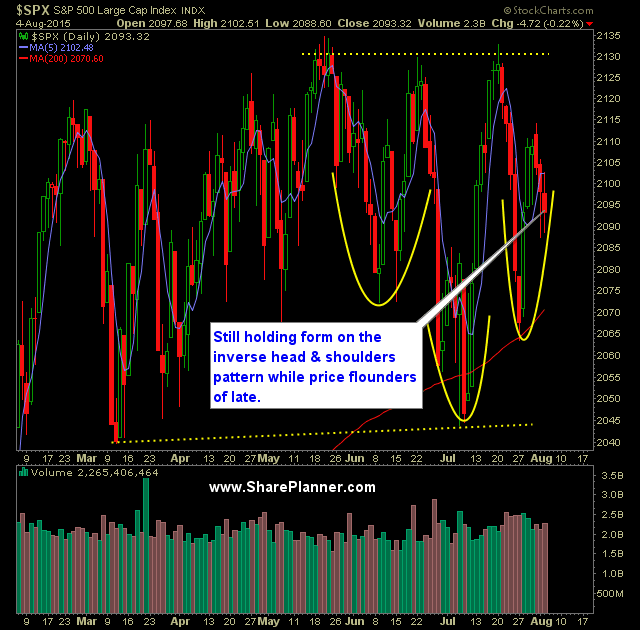

Technical Outlook: SPX pulled back yesterday to the triangle breakout area, but held the 20 and 50-day moving averages. The bears have had opportunities-galore over the past few weeks to drive this market lower. A push into the mid-2070’s and below the 200-day would greatly change the landscape of this market in the bear’s favor.

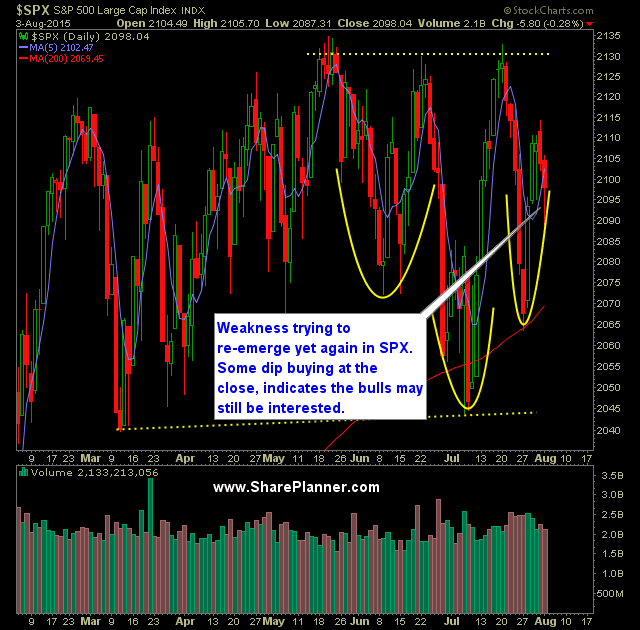

Technical Outlook: SPX broke and closed above the triangle I outlined in the chart below. Ideally, I would like to see price move beyond last week’s highs of 2105. Walmart reported discouraging earnings this morning which has weighed on futures some as a result. A break above 2115 today would greatly increase the odds

The Dip Buyers are working that tape today. Typical gap down, a push lower during the first hour of trading by the bears and before the hour can expire the bulls start buying up everything they can get their hands on. Yes, we have all seen this re-run a million times. That is why

Technical Outlook: SPX rallied nicely off the rising trend-line from the July lows on Friday. Candle on the SPX daily chart formed a nice bullish engulfing candle pattern. Despite some early morning weakness, and some not-so-great economic reports, SPX needs to rally above 2100 to break out of the triangle pattern. With Friday’s rally, SPX

Technical Outlook: SPX gave back much of its gains from the day yesterday providing a weak showing against what could have been a very strong day for the market. This is starting to become a regular phenomenon where the market is off to a nice start, the bears come in during the east coast lunch

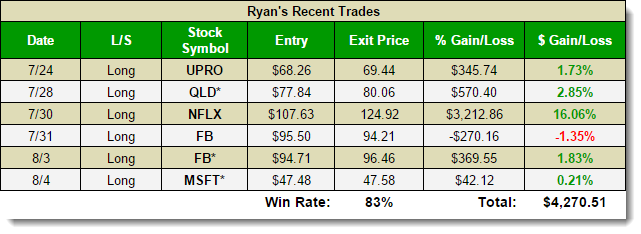

The market stinks...absolutely stinks. The bulls lack and edge and so do the bears. But in the SharePlanner Splash Zone, the profits keep coming in. Check out my most recent trades: * = Open trade Yes, that is a 16% gain in Netflix (NFLX) after buying it at $107.63 last Thursday and then selling it

Technical Outlook: SPX dropped for a third straight day yesterday on Fed talk of rate hike at September’s meeting. SPX pushed below the converging moving averages below the 5, 10, 20 and 50-day. A gap up this morning to take place. It will be essential that the lows of the first hour of trading

Technical Outlook: Another day of weakness in the market which has been the main theme of this market for the past two weeks. Despite 7 of the last 10 trading sessions finishing lower, the opportunity to profit from this market to he short side is very limited. The moves are very haphazard and lacks a