My Swing Trading Approach Neutral portfolio – I’ll go the direction the market decides to take today. Indicators

Today’s stock picks August has been a great month of trading so far. I’d encourage you to give it a try and make the rest of 2017 the best five months of your trading careers! Long Netflix (NFLX)

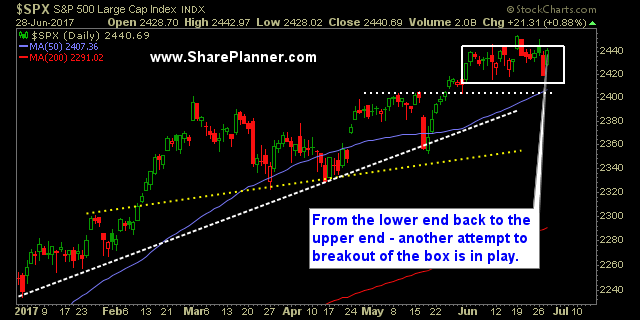

June saw continued success for traders in the Trading Block. I was quite satisfied with my swing trading results, especially when you consider just how mundane the overall market was. There was plenty of ‘back-and-forth in the stock market.

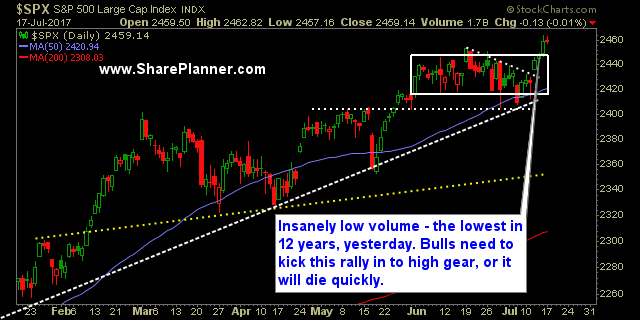

What was that yesterday? Where was the volume? That had to be one of the least interesting trading days in my entire trading career. I mean, it was horrible, miserable – and outright boring.

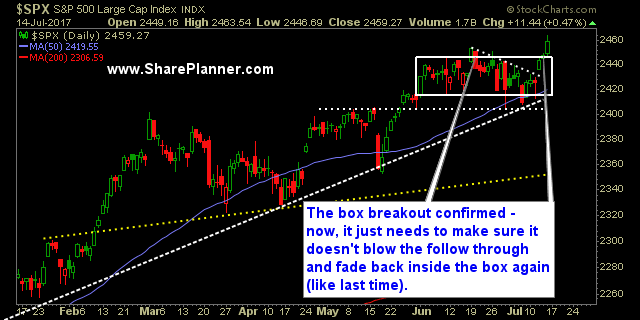

All time highs without a worry in this world. It really is impressive how the market will rebound every time from even the smallest of sell-offs to hit new all-time highs, time and time again. There is a lot of risk out there – tons of it. Despite all the horrible headlines that could readily

Nasdaq selling off again, SPX flat The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday's bounce looked reminiscent of the bounce following the May 17th sell-off,

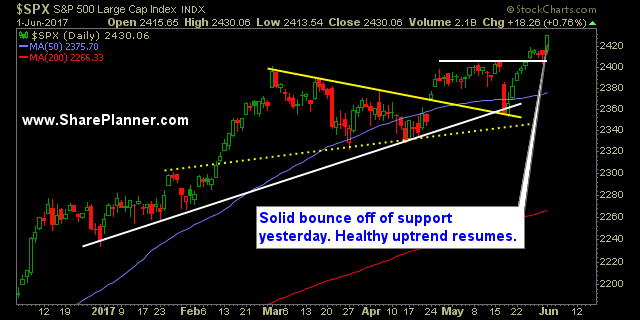

What a solid bounce yesterday for stocks off of short-term support When you have a 15 point pullback in today’s market over a 3-day period, it becomes a ‘Generational Bottom’ or better yet, a ‘Generational Buying Opportunity’ for the bulls. Yesterday the market had a solid rally, a bit unexpected, as I didn’t think much

Watch list stocks to trade Long Netflix (NFLX)

Stocks Watch to follow today include two longs and one short setup It is a boring market, I’m not going to like about that. Four days of straight doji candle patterns makes for not so great trading conditions. But that will change too…eventually. And when it does, whether it be tomorrow or a week from

Keep these stocks on your radar Low volume day on the market today, and tomorrow marks the last trading day of the first quarter, so there is always the chance we see some weird window dressing before the end of the trading session. This week has been fairly quiet – the biggest move came from