Just another buy-the-dip kind of day in the stock market. Typical Monday with price action sitting just a smidgen above break-even.

Thursday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Associated Banc (ASB)

My Swing Trading Approach Still long on the market. I dabbled to the short side some yesterday, it didn’t work. Now that is out of my system, I remain long and will look to add 1-2 new positions today on market strength. Indicators

September turned out to be a phenomenal month of swing trading for me and the members of the SharePlanner Splash Zone. September was the best yet in 2017 – and that is saying something considering that every month so far has been profitable for me in the stock market, and the most profitable of the

My Swing Trading Approach Raise the stops on existing long positions, and maintain the flexibility to get short as I have done over the past week of trading. Short setups are in play, if the weakness doesn’t immediately get bought up at the open. Indicators

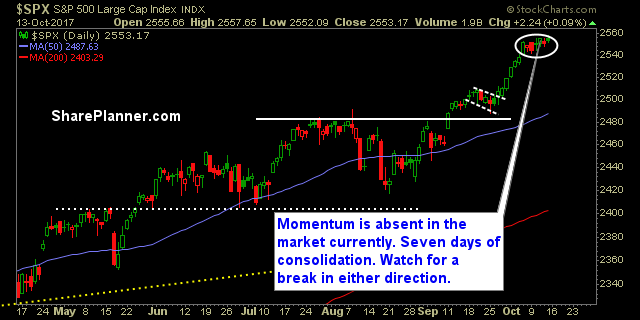

My Swing Trading Approach I have plenty of flexibility to play the market in either direction, depending on what the market ultimately wants to do. Only way I will get short is if the market shows signs of breaking down. Indicators

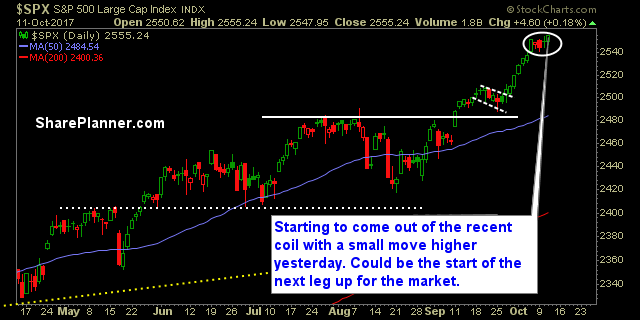

My Swing Trading Approach I’m looking to add some long exposure today, should the market show enough bullishness to support a move. Still maintaining the ability to get short quickly, should the opportunity arise. Indicators

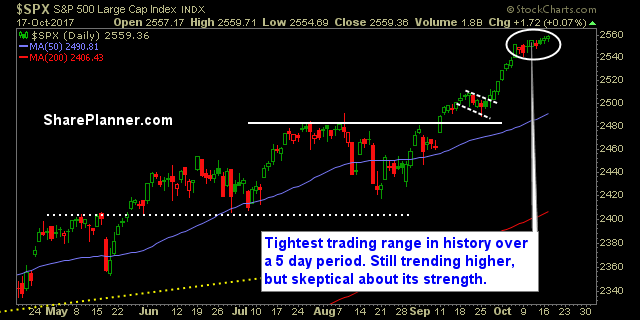

My Swing Trading Approach I would like more price action from this market, but I can’t force that. I have to wait for that to happen, and to place my trades accordingly. Right now, I don’t want to add additional long exposure, until this market can put together a decent breakout to the upside. Indicators

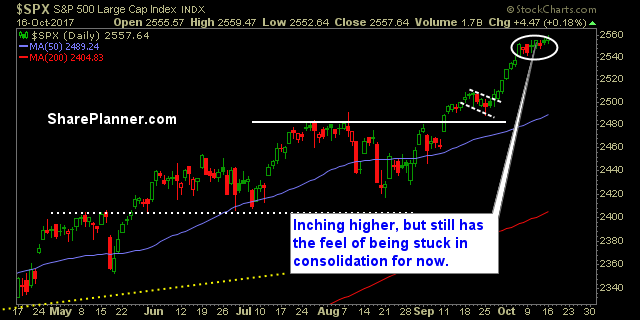

My Swing Trading Approach I’m nearing a point where I want to see price action move out of the recent price coil before getting any more aggressive on this market. As always, I’ll look for opportunities where appropriate, to book profits and move up stop-losses. Indicators

My Swing Trading Approach I won’t rule out adding additional position or two to the portfolio today, but I’m not looking to pile on in this market. Manage the trades that I have, trim the ones that don’t provide a solid reason to keep, and raise the stops on the rest. Indicators