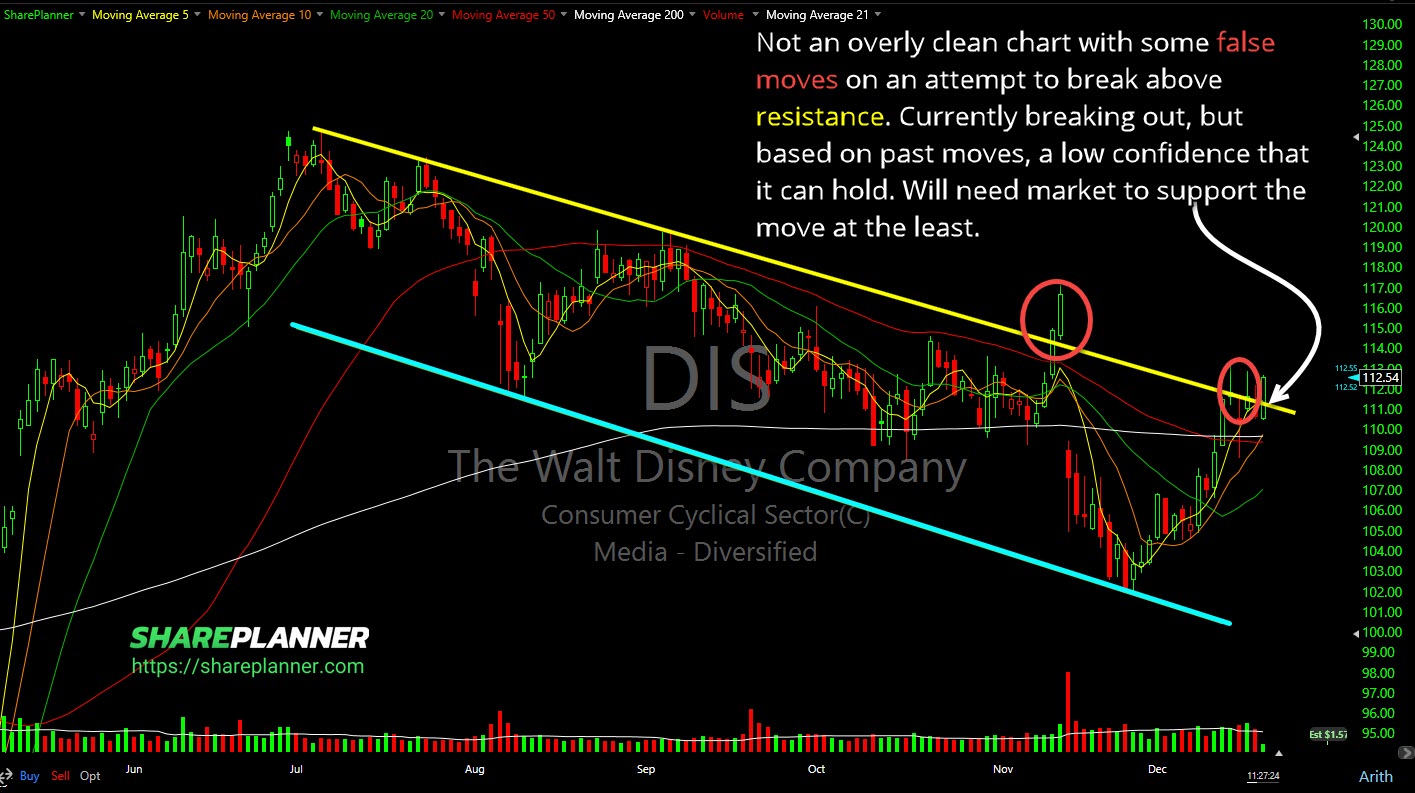

Walt Disney (DIS) currently breaking out, but based on past moves, a low confidence that it can hold.

Walt Disney (DIS) has made a nice move so far this week, but I'm not trusting it.

Episode Overview Ryan fields a number of questions from one of his swing trading listeners. Ryan discusses what to do when your capital exponentially increases, one of his more memorable good and bad swing trades, and how his trading strategy has developed over time. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps

Watch this major support level in Coinbase Global (COIN) going back to '22. Potential landing spot for the stock. Potential landing spot for Riot Platforms (RIOT) following the hard sell-off from $17, at the rising trend-line. So far for Walt Disney (DIS) a nasty head-fake on the chart.

DIS bull flag pattern, but also playable is the bounce off of the 50-day and 200-day moving averages. Keep watching the bull flag in NFLX...not in play today, but could be in the new year. T2108 (% of stocks above their 40-day moving average) remains extremely overstretched and seeing some divergence in the last three

Disney just dropped their earnings, and the stock took off on Thursday! But what does it mean for traders and investors? In this video I unravel the Disney's financial performance and couple it with an in-depth technical analysis of its chart. Whether you're eyeing that 'BUY' button or considering a 'SELL', this video aims to

Match Group (MTCH) broke out and through its declining trend-line. I'm watching whether it pulls back to the trend-line and declining support for a potential bounce. Energy Sector (XLE) coming back to test the breakout support level. Watch to see whether it can bounce here. US Global Jets ETF (JETS) rising trend-line broken

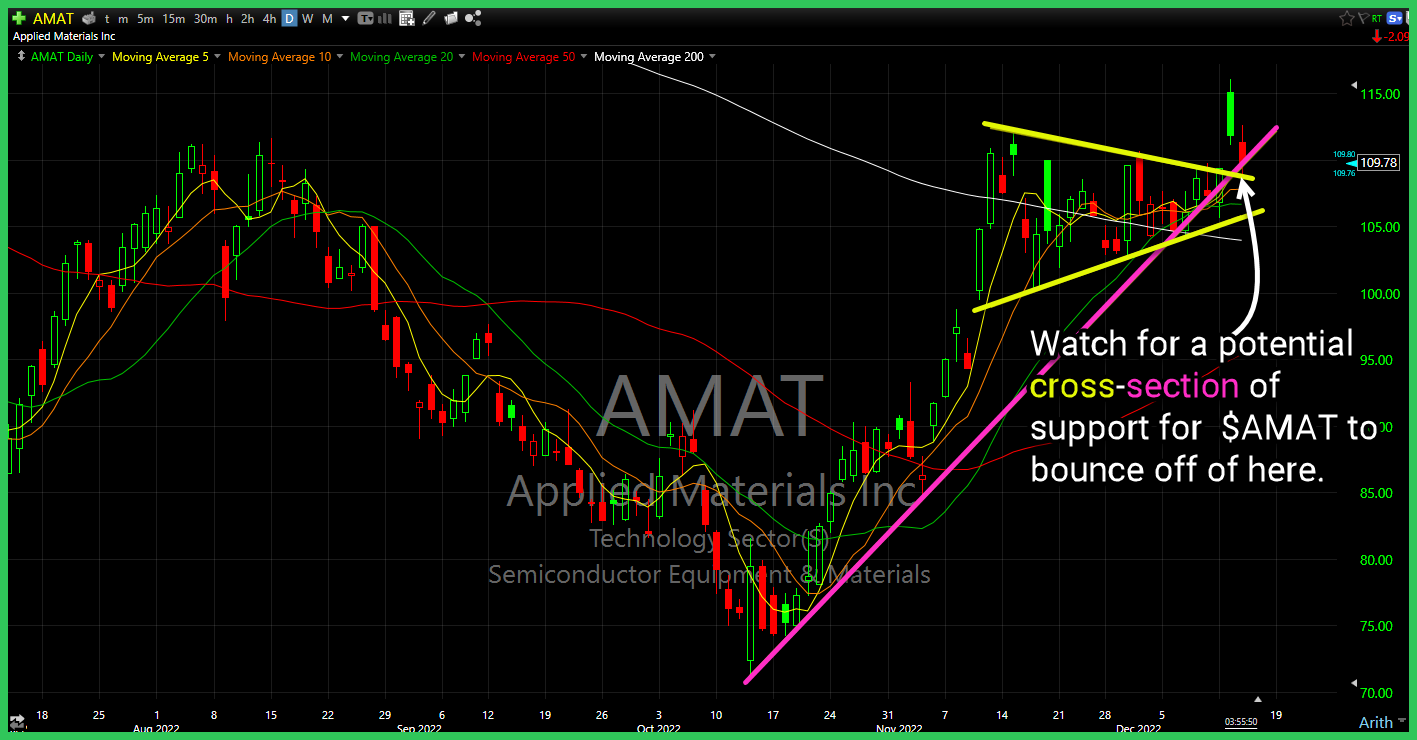

Watch for a potential cross -section of support for Applied Materials (AMAT) to bounce off of here. Nice cross-section of support for Garmin (GRMN) if it can bounce off of it in the coming days. Moderna (MRNA) finally pushing through major resistance. Walt Disney (DIS) with five straight days of gains, but even

Salesforce (CRM) testing short-term support - needs to hold. Walt Disney (DIS) might be finding some support here... wait and see. SoFi Technologies (SOFI) Blind loyalty in a stock, rarely gets you anywhere. Down 13 of the a 18 months its been in existence should offer a clue.

The best stocks to buy now for July 2020 is discussed in this video, including my take on Disney stock, Roku stock and three other trade setups. As the market attempts to climb out of the stock market crash of 2020, what are the best stocks to buy now? I provide the top stocks and