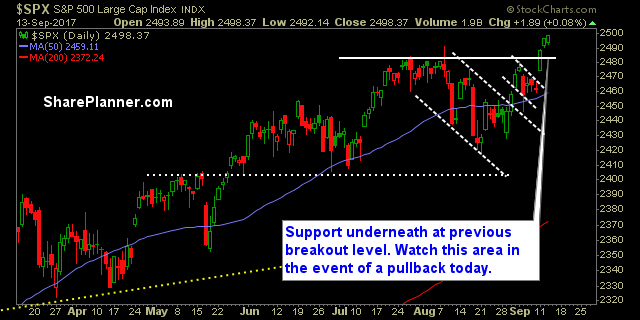

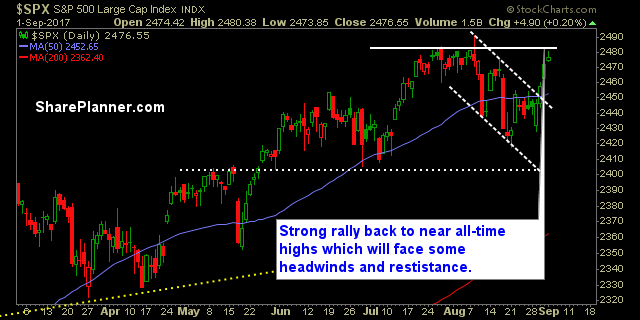

My Swing Trading Approach Looking to manage the current positions I have, raise the stop-losses, and curb some of my long exposure following the rally that we have seen this week. Indicators

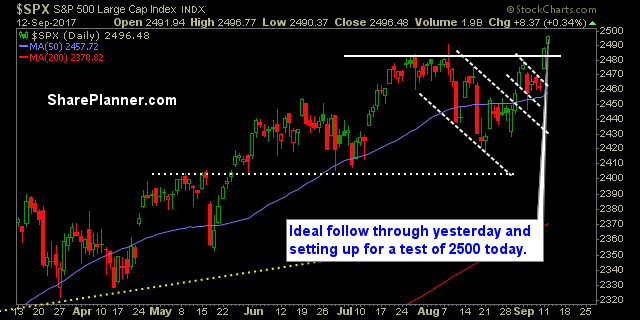

My Swing Trading Approach Looking to ride my current positions. Will look to add a few more positions while increasing my stop-loss along the way. Indicators

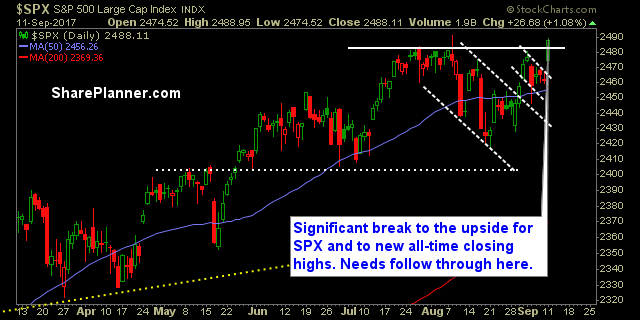

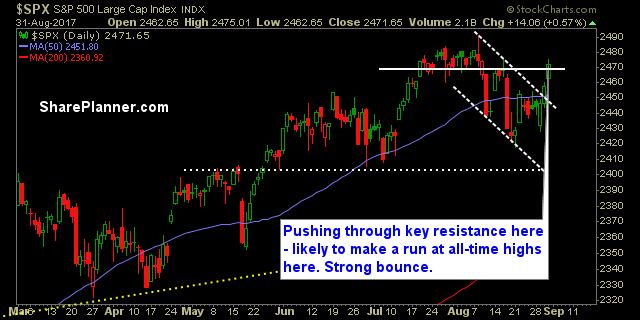

My Swing Trading Approach I’ve taken on a much more bullish posture to this market given that it broke out above the all-time high resistance level that had formed over the last two months. That area has broken, so being bullish here only makes sense. Indicators

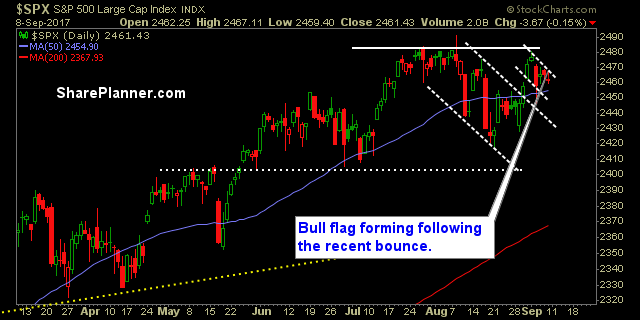

My Swing Trading Approach Neutral portfolio until it can be determined whether the market can break through resistance at all-time highs. Indicators

My Swing Trading Approach Ahead of a weekend where there is a major hurricane hitting Florida and North Korea planning on another missile test, I don’t want to get heavy to the long side. I’ll look to keep a neutral portfolio into the weekend. Indicators

My Swing Trading Approach SPX still struggling with pushing through July resistance at the all-time highs and establishing new ones of its own. Until that area breaks, it is hard for me to be overly aggressive to the long side. Indicators

My Swing Trading Approach North Korea overnight risk creates some pause for this market and the likelihood of some kind of boiling point being reached as a result of their provocations. As a result, it is difficult to get confidently long on this market, and best practice suggests playing both sides of the trade. Indicators

My Swing Trading Approach I’m concerned about the weakness coming into today, and may curb my long exposure while adding some short exposure. Indicators

My Swing Trading Approach The bounce of late has been a hard bounce, and more than a dead cat bounce. This bounce should be respected and played. The biggest risk to consider remains North Korea. Indicators

My Swing Trading Approach Slightly bearish portfolio, but ready to flip to the long side depending on how the Yellen speech at Jackson Hole goes. Indicators