$GME so far is simply back testing previous support (now resistance).

$SNAP is another reason why I don’t gamble on earnings!

Even if $AMD breaks out of bull flag pattern there are multiple layers of resistance overhead that could cause problems for price.

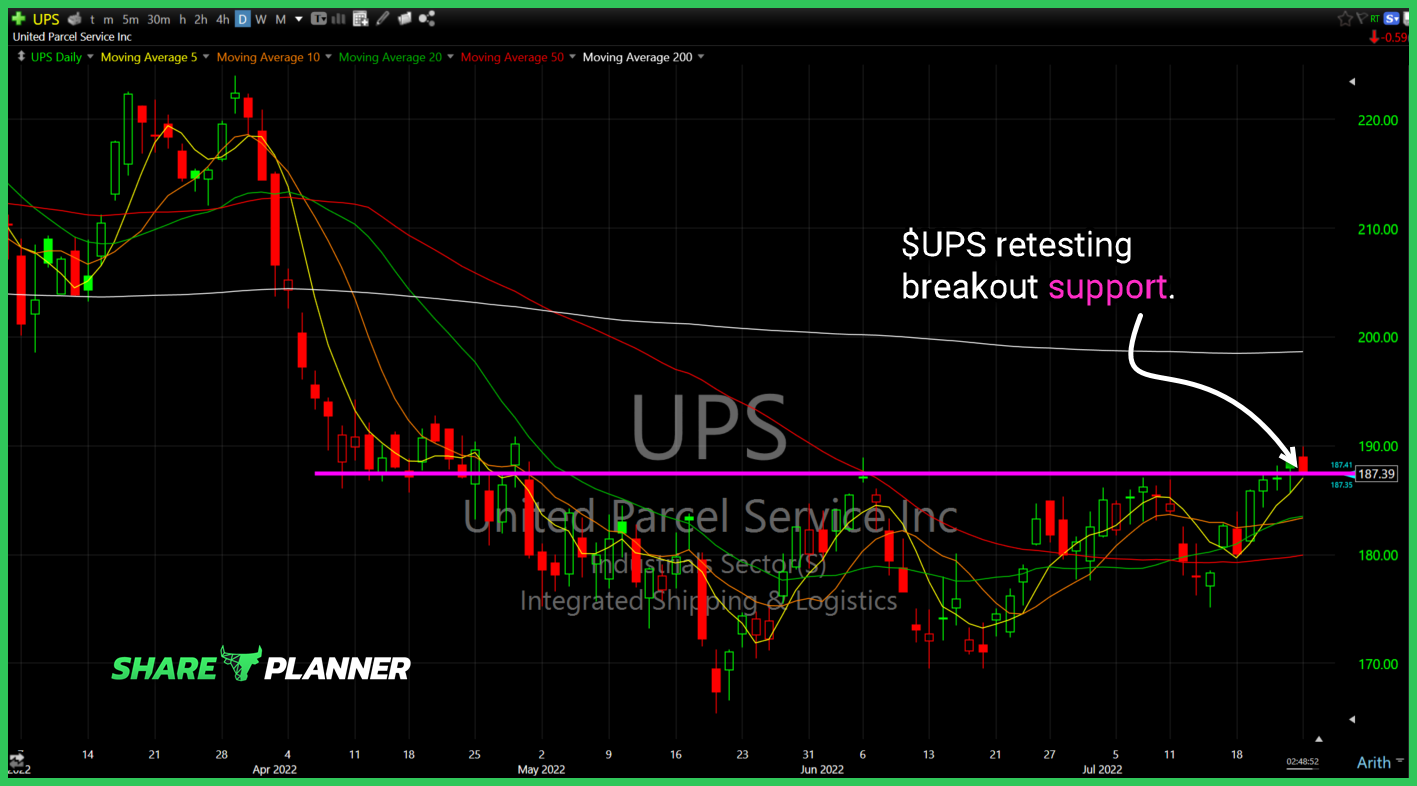

$UPS retesting breakout support. Needs to hold and bounce.

$SRG pushing through significant resistance – high risk/high reward play.

$VIX pushing above resistance. But can it hold that level into the close!?

$MULN Cup and handle pattern that needs to turnaround fast if it is going to keep the pattern in place.

Adobe Systems (ADBE) hard selling, but a silver lining? Treasury Bond Fund (TLT) long-term trend-line worth watching. American Electric Power (AEP) working that bull flag pattern today. Archer Daniels Midland (ADM) has done great of late, but getting overextended. Best entries would be off of the rising trend-line.

I'm doing the technical analysis trade updates for the latest and hottest stocks and what you should be buying vs selling, and what stocks you should be staying away from all together. In this video I cover: $FB $AMZN $AAPL $GOOGL $TLT $SHOP $BABA $JPM $BAC $OSTK $BLDP $APRN $AMD $CARS $AVGO $SPX $VIX.

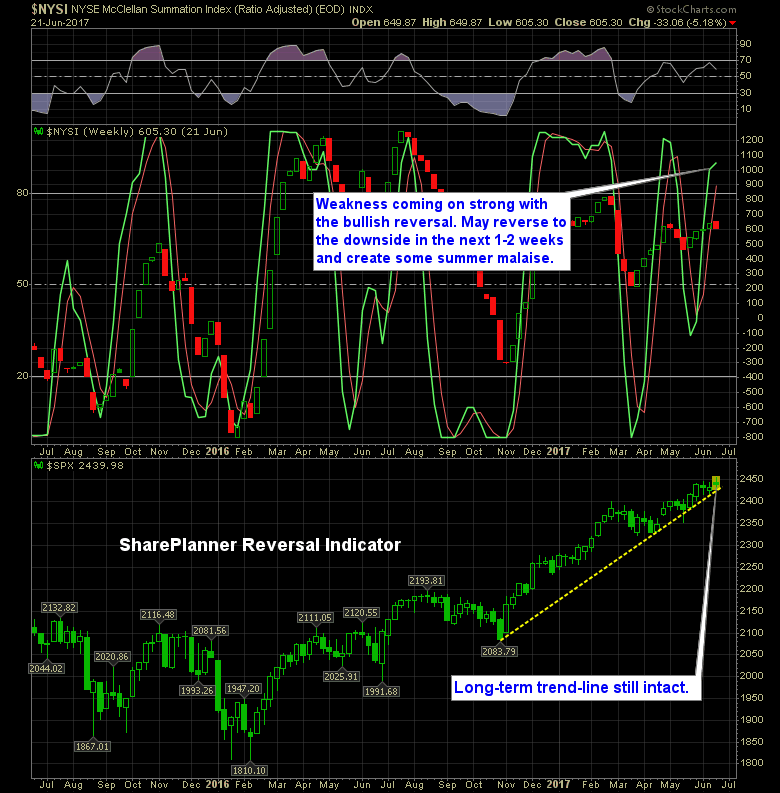

Is it time to reverse for the market or will we keep trucking higher? I came into today knowing that the bulls had to hold the 20-day moving average. That has been a level of support for them of late, and if they blew through it, that things could certainly get dicey.