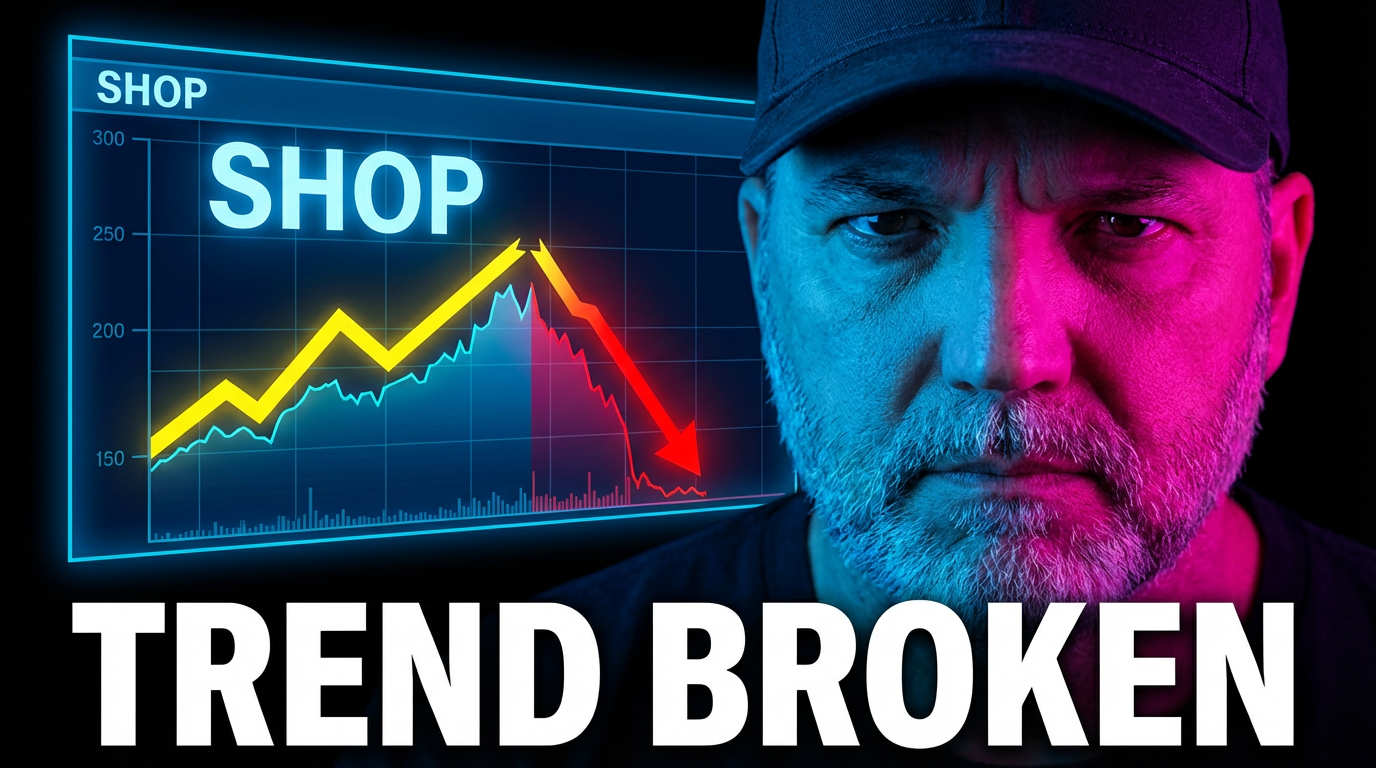

Shopify (SHOP) – Technical Setup Ahead of Earnings Shopify reports earnings tomorrow, and traders are gearing up for what could be a big move. SHOP has been pulling back significantly as of late, and as earnings approach, the stock is managing to bounce off of one key support level that could result in it testing

Shopify (SHOP) pulling back to the lower channel band and long-term support simultaneously. Watch for a bounce here.

SHOP finally bounced off of the rising trend-line.

Episode Overview One swing trader finds himself sitting on losses of 50-60% from trades made in years past where he did not manage the risk in any sort of way. What should he do now? Sell and move on or hold and hope that it comes back and he can recover his losses? In this

Episode Overview In the current market, where stocks are flying higher, and look like they could just keep going even higher, how do we manage the profits that come from some of these high flying semiconductor stocks like NVDA, SMCI, MSTR, or AMD? In this podcast episode, learn what Ryan does to manage the trade

$SHOP trading inside a megaphone, but very little else to comment on, not even crazy about what could be a bullish wedge that is forming. Chart is a complete mess, and half expect it to move back to $71 to test support. . $XLV pulling back to the rising trend-line from the October lows. Potential

Episode Overview In this podcast episode Ryan provides some simple solutions to focusing in on what is moving in the stock market on a daily basis and debunking the claim that following sector movements is a method of trading that is behind the curve of trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

Fiverr International (FVRR) declining trend-line getting retested on the pullback. Worth waiting first to see if it will bounce or not before trying to get long on it. Otherwise it may end up pulling back to the original breakout level. Snap (SNAP) finally pushing through long-term resistance. High risk for a head fake due to

Episode Overview As market volatility remains a recurring theme in the stock market, the ability to anticipate stock market crashes becomes invaluable for swing traders, even if you can't predict exactly when (as if anyone actually could). In this episode, I dive deep into historical patterns, warning signs, and the subtle indicators that might

Another day of selling in $SHOP could create a really good bounce opportunity off of the rising trend-line. Bull flag in $GS looks sharp, but a very problematic declining trend-line just above the breakout level. Bull flag developing in $ABBV - resistance overhead currently sitting at $161. Nice trade setup here. $PYPL Currently sitting at