Technical Outlook: SPX had a heavy sell-off yesterday and took price action below the 20-day moving average (just barely) at the close for the first time since the market rally started on February twelfth. SPY this morning is looking at a significant gap up to reverse yesterday’s losses, adding to the narrative of an

Technical Outlook: SPX was breaking below last week’s lows until the petroleum report came out and provided a massive boost to stocks, rallying 23 points off of their lows. In doing so, SPX quickly reclaimed its 5-day and 10-day moving averages. SPY looking at a gap down this morning, and with it, the

Technical Outlook: Biggest sell-off yesterday since March 8th, as price in one swoop dropped below the 5-day and 10-day moving averages. Two key price levels to watch today – 1) The Friday lows from last week. 2) The lows from March 24th. Particularly, if the latter should break, it would put in a lower-low

Technical Outlook: SPX pulled back yesterday to the 5-day moving average and bounced ever so slightly in the final 30 minutes of trading. Today the market is looking at a significant sell-off to start the day. It is important to remind yourself of what happened on Friday when the market sold off and the subsequent

Technical Outlook: The bullish strength of this market since mid-February was on full display Friday when the market gapped down significantly and pushed 16 points lower, bottomed within the first 30 minutes of trading and then rallied 29 points off of those lows throughout the remainder of the day. To put it mildly, gap downs

Technical Outlook: One of the most volatile quarters ever ended on a quiet note yesterday pulling back ever so slightly. Today’s morning weakness is looking at a respectable gap down. These gaps downs how been difficult for the bears to do anything with, often times leading to eventual, same-day, market rallies. Last April had a

Technical Outlook: Gap up yesterday held on but not in an overly convincing manner on the SPY – finishing slightly lower than its opening price. Volume trailed off from the day prior and is still well below recent averages. Potential bull flag pattern forming on the SPY 30 minute chart. Yesterday’s price action

Technical Outlook: SPX had a solid day yesterday following dovish remarks about future rate increases from Janet Yellen. Her dovish outlook as it pertains to rate hikes has been, in large part, the reason for the massive rally off of the February lows. Volume yesterday on the SPY was notably higher than recent days,

Any time you are trading on a roll, it is easy to start watching the dollars in the account. For example, today, I bought into Amazon (AMZN) at $581, it is now at $594. I bought Netflix (NFLX) yesterday at $100.24 and now it is at $104. Not to mention Mead Johnson Nutrition

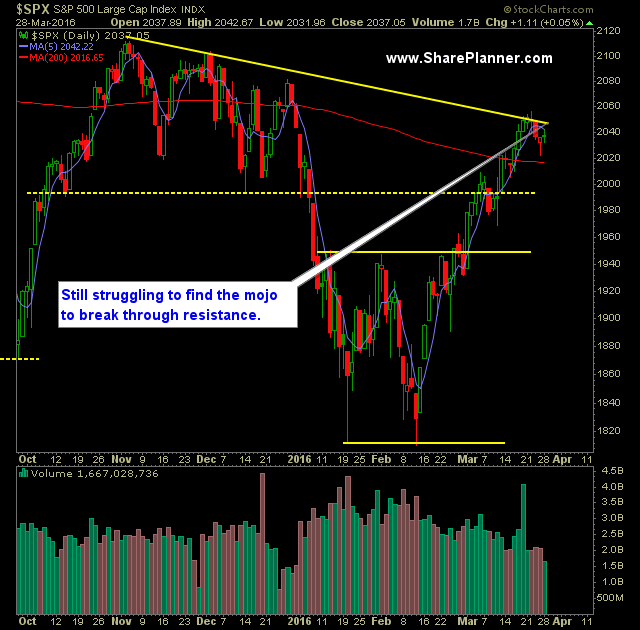

Technical Outlook: SPX traded flat yesterday on extremely weak volume – the weakest volume day of the year. SPY volume was only 10% higher than what was seen on Christmas eve. For the bulls the recent selling isn’t overly concerning as it extremely shallow and light volume. The 5-day moving average yesterday was tested