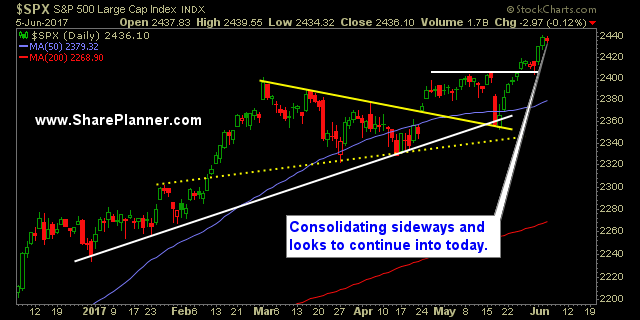

Barely a sell-off yesterday, market cooling off now When you can get a 3 point sell-off these days on the S&P 500, you might want to consider it a generational buying opportunity as stocks rarely do anything but go up these days.

Technical Outlook: Doji candle pattern yesterday, with today creating the potential for an evening star pattern should the market sell-off. With that said, there has been an impeccable resilience to price action of late, where every gap down or sign of weakness is immediately bought up by market participants. VIX is at a key

Technical Outlook: After a five minute, seven point dip yesterday, the market ended up rallying 21 points off of the lows of the day. The dip buyers remain in full control of this market. However, key resistance looms overhead and could be, with all the diverging signals, a selling point for the bears to be

Technical Outlook: Two straight days of consolidation at the rally highs. Weakness this morning across the board in the indices as a result of a failure for oil producing countries to agree upon a freeze in production. As a result, USO is looking at a potential double top in the short-term as it starts to

There isn't much to review from last week considering that I was stuck in jury duty for most of the week, and as a result no trades were placed - at least in terms of new positions. As a result, we have one position and it is our carry over from March with TLT that

Technical Outlook: Three day rally this week continues to maintain a strong course higher that will likely test 2100 either today or next week. Since the initial break, volume has dropped each of the last two days and was dramatically weaker yesterday and well below recent averages. Personally, I wouldn’t be surprised to see the

Technical Outlook: Strong open yesterday that was erased gradually as the day wore on resulting in a lower close. SPX dropped below the 20-day moving average again. Declining trend-line off of last July's highs remains a continuous level of support for the market. Possibility that the price action over the last two weeks has formed

Technical Outlook: SPX gave up all of its intraday gains yesterday after a strong gap up. Nonetheless, it managed to close slightly higher an in the process hold on to its 20-day moving average. An interesting development on the daily chart of SPX is the downside cross of the 5-day and 10-day moving averages.

Overall the week finished lower last week. We closed out some solid gains in Netflix (NFLX) and (AMZN), while struggling with our trade in SDS for a small loss. We saw a nice move out of TLT last week, which definitely helped matters, but our positions in SPXU and DIS hasn't done much to write