Something about those regional banks selling off that doesn't look right Anybody else seeing this? Zions (ZION) -13.5% Western Alliance (WAL) -11.3% Great Sothern (GSBC) -9.6% Truist Financial (TFC) -5.5% Regions Financial (RF) -6.1% Has all the feelings of the March '23 sell-off when the banks came crashing down and the Fed had to create

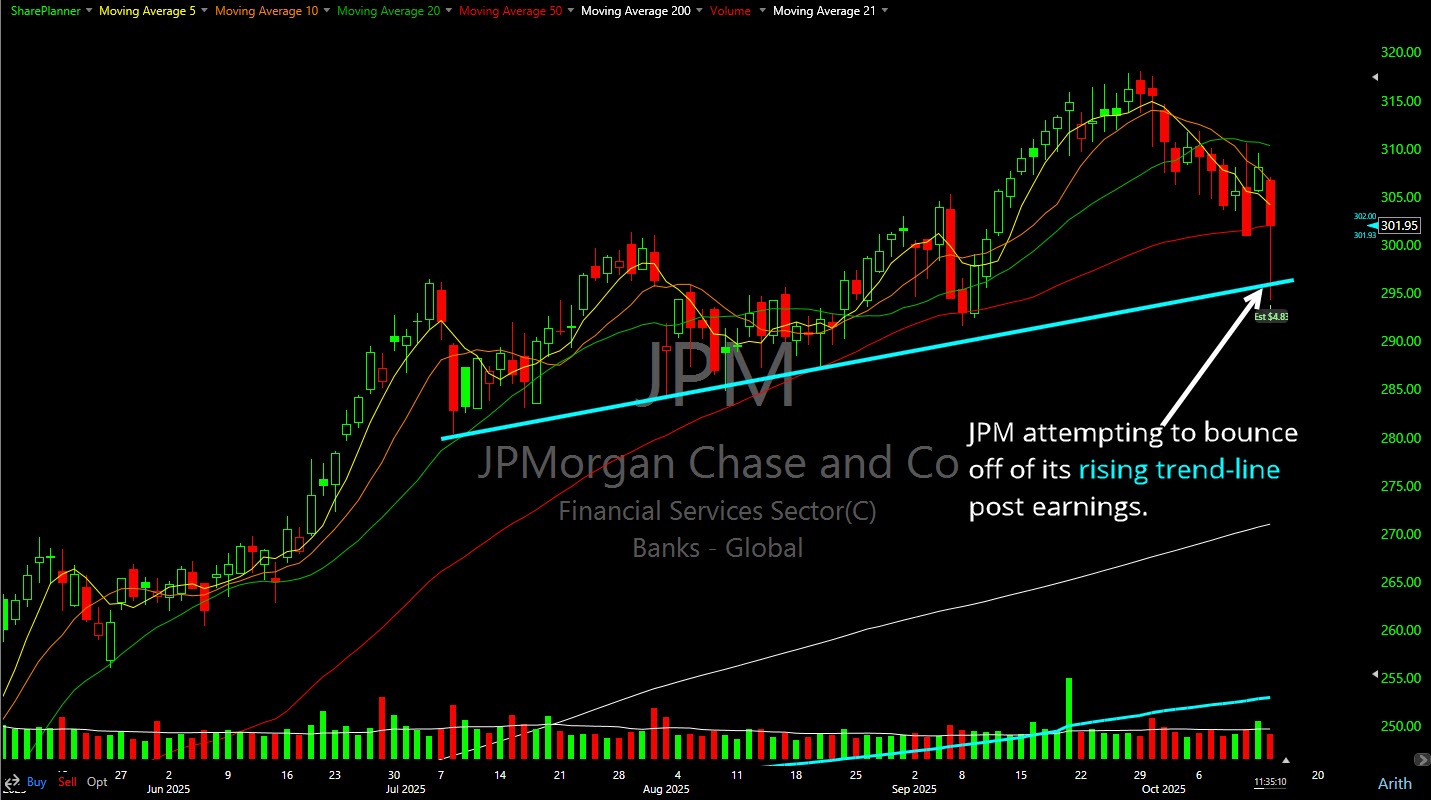

JPMorgan Chase (JPM) attempting to hold that support following its earnings report that it handedly beat expectations on.

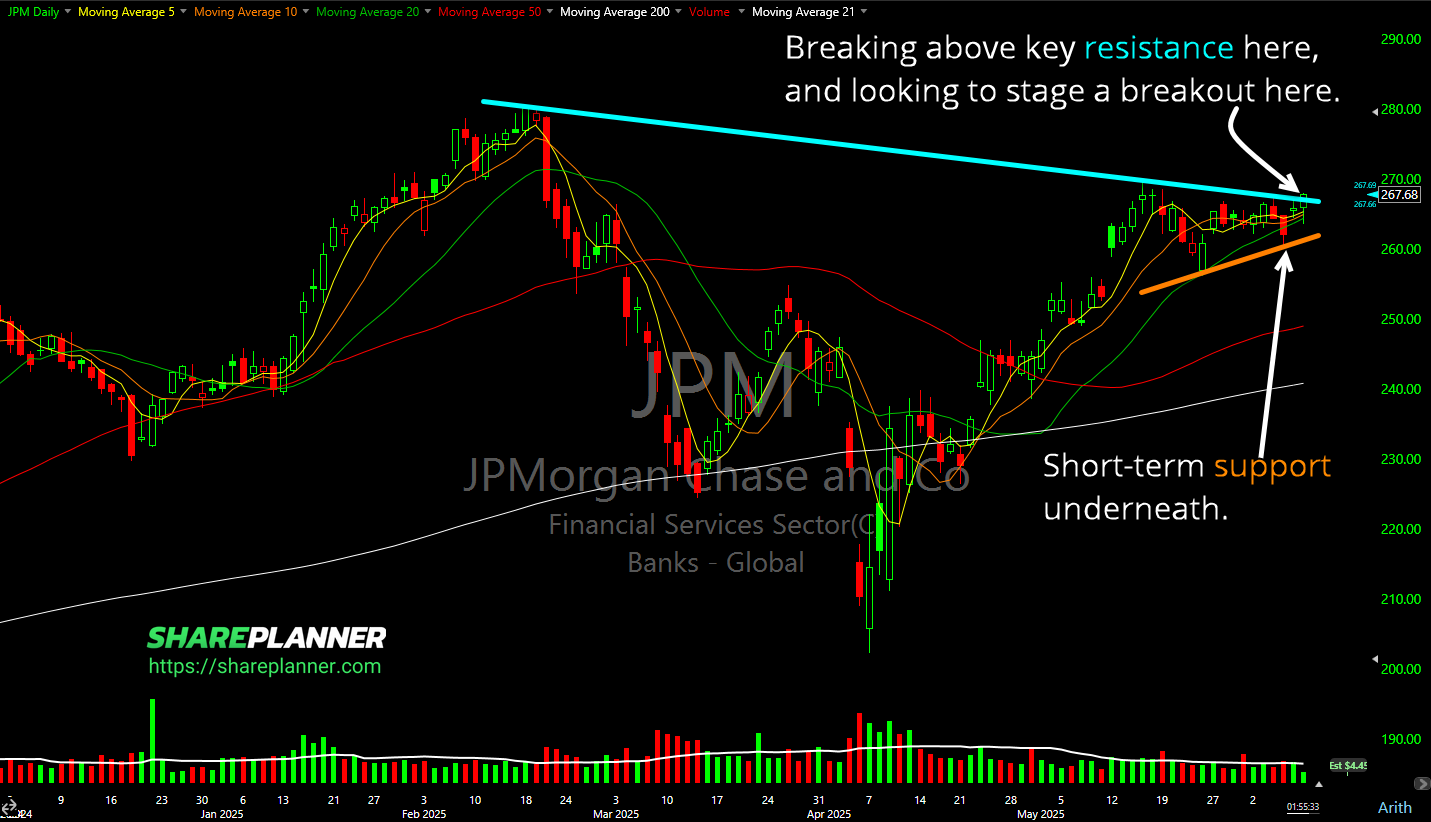

JPMorgan Chase (JPM) making a big move here and pushing through resistance originating in February of this year.

Episode Overview In this podcast episode, talks about when it is a good time to buy the dip in the stock market and how successfully buying the dip is really predicated on previously selling into strength. In this episode Ryan also dives into his approach for buying stocks that are perceived as being low, and

Episode Overview Is it necessary to have a set position size with every trade that you take as a swing trader? Or can it be based on feelings and that gut instinct as to whether how successful or profitable a swing trade could be perceived as being? In this podcast episode, Ryan details why using

Episode Overview When it comes to investing in a bear market, done right, we should be hoping for there to be a bear market not attempting to avoid it altogether. And we can do that when we are getting the right entries on our previous investments, and the manner in which we managed the risk

Episode Overview What should you look for when examining your past swing trades and what should you consider when looking into whether the trade was a well managed swing trade or not. Plus Ryan talks about some of the key signals for getting out of a profitable trade. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

$MA Continuation triangle in play here, and holding strong despite heavy market selling today. . $ALT Inverse cup and handle forming, and testing confirmation here. $JPM bearish wedge formed and testing rising support here. A break below $172.90 would confirm the bearish wedge here.

Three recent hits up against resistance on $JPM to be watchful of. If it pulls back, a break below $172 would confirm a bearish wedge. . ON $SLB: 1. Inverse cup and handle nearing confirmation. 2. If support hold it could result in a triple bottom, but support is going to need to hold, and

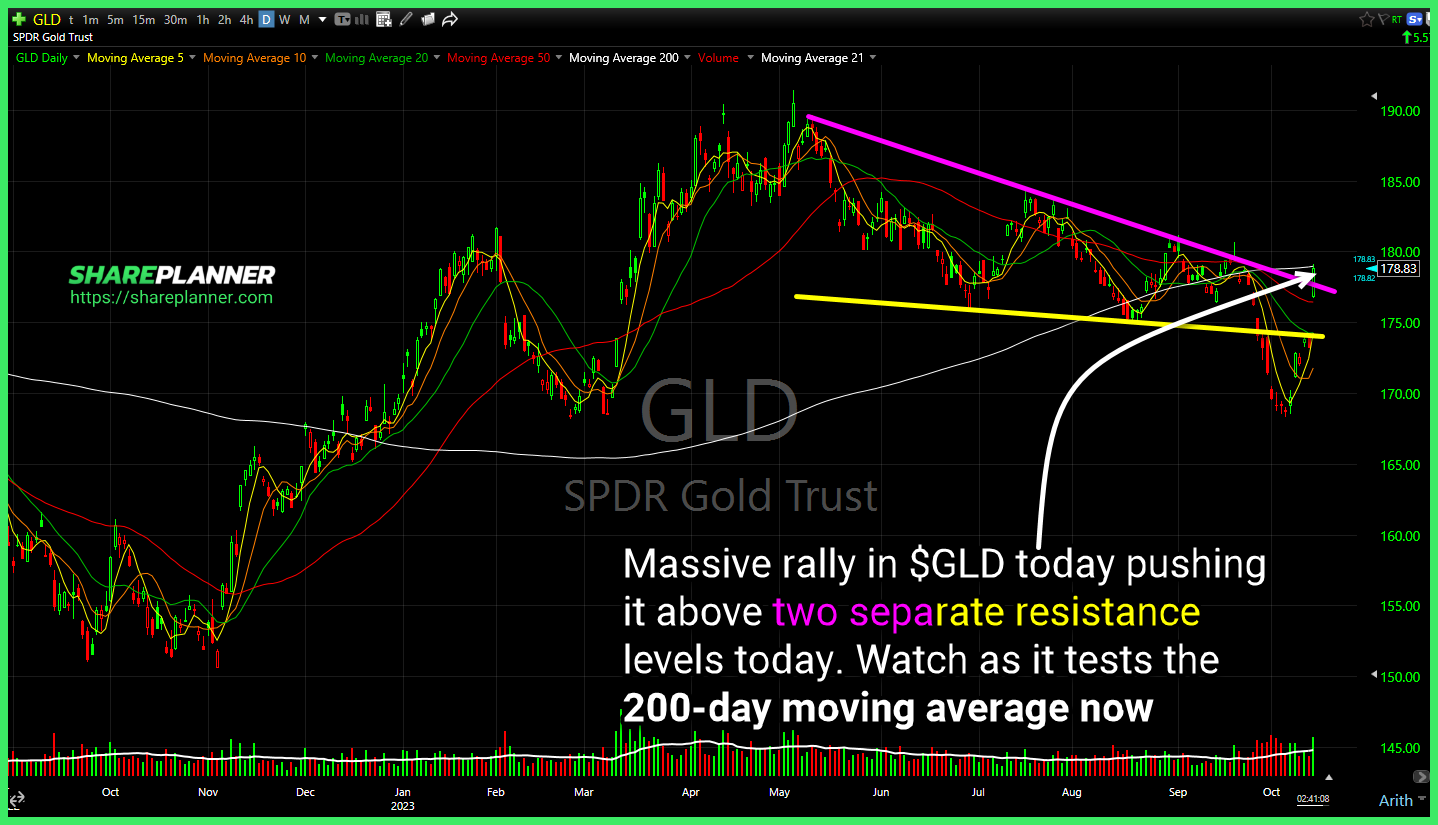

Massive rally in $GLD today pushing it above two separate resistance levels today. Watch as it tests the 200-day moving average now $VIX with a break back above major resistance. Key is to hold that level into the close. Rising resistance could prove important next week. A new layer of resistance is forming for $JPM