Will bonds bring down equities? The bond market is experiencing significant turmoil and is on the verge of crashing, with U.S. Treasury yields surging to levels not seen in decades. The 30-year yield has surpassed 5%, reflecting investor concerns over rising inflation, mounting federal debt, and fiscal policy decisions. In this video, I delve into

Equites certainly don't care, but TLT breaking major support here.

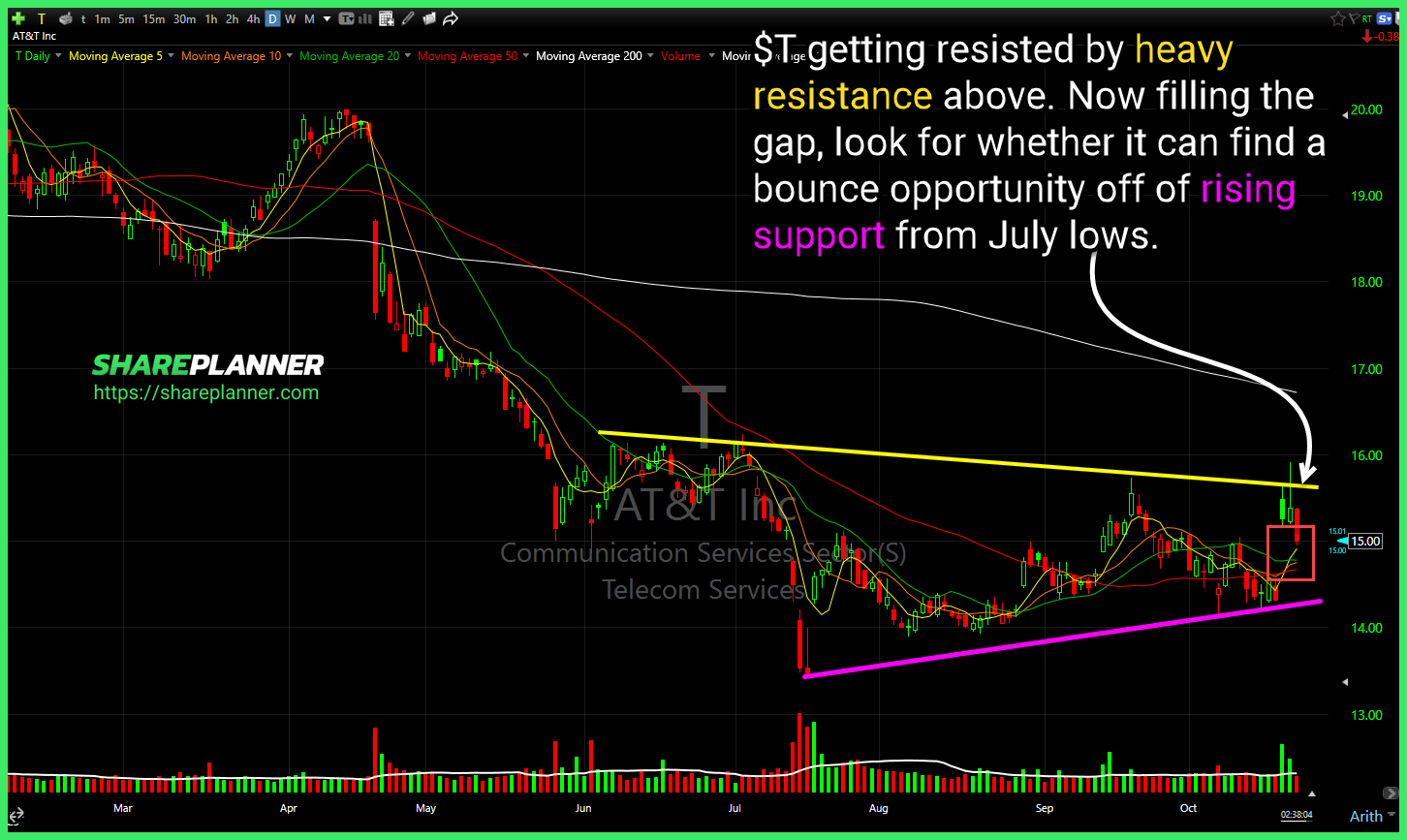

AT&T (T) getting resisted by heavy resistance above. Now filling the gap, look for whether it can find a bounce opportunity off of rising support from July lows. Coinbase Global (COIN) nearing some important resistance here. Watch for a potential breakout, but extremely important that it closes above this level, and not just an intraday

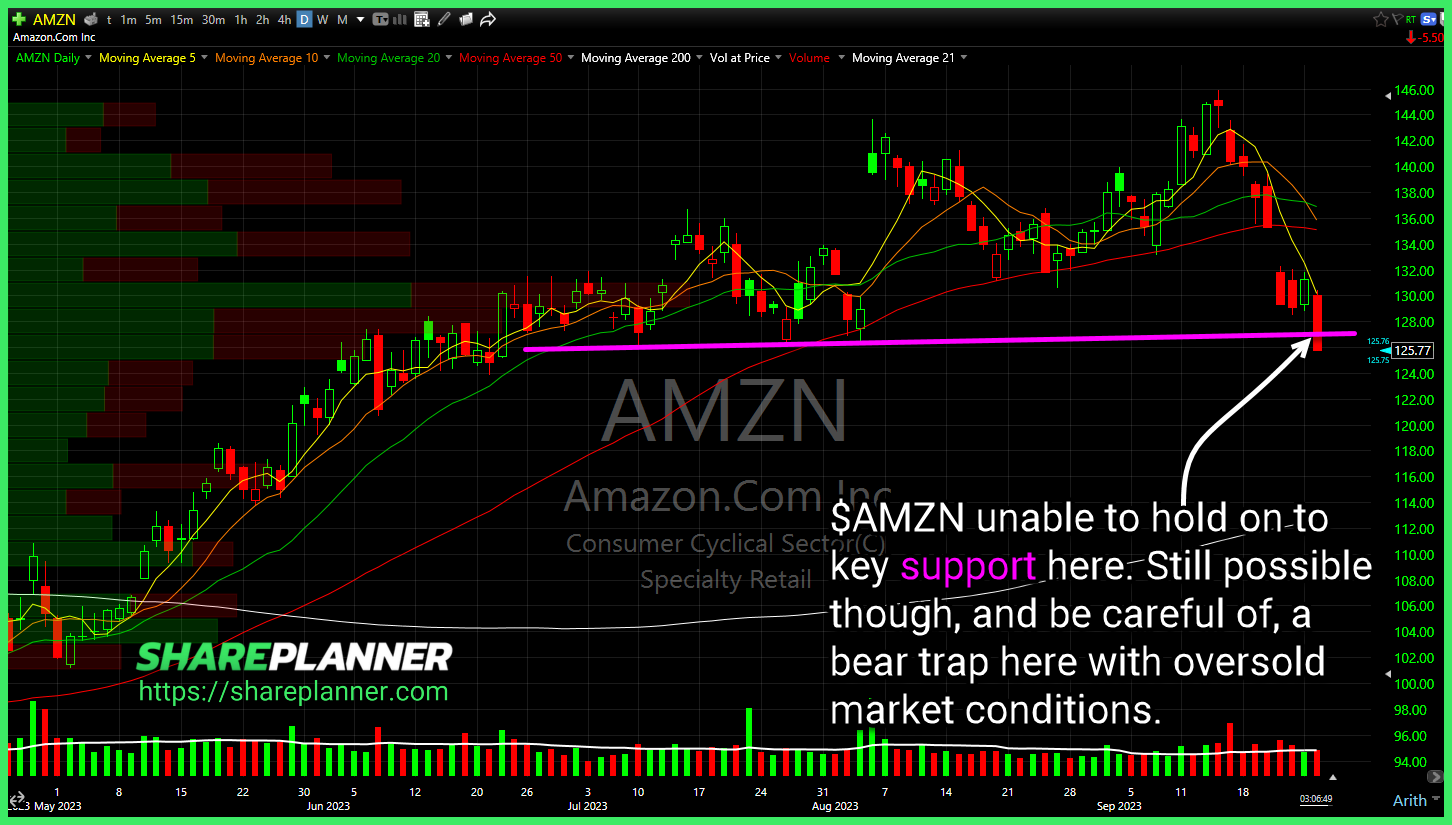

Amazon (AMZN) unable to hold on to key support here. Still possible though, and be careful of, a bear trap here with oversold market conditions. Ideal conditions for Uranium ETF (URA) entry would be on a pullback to the rising trend-line once a bounce materializes. Buying here at overextended levels, creates a high risk scenario

Episode Overview Is right now the time to consider buying into the bond market as prices are hitting their lowest levels in over a decade? In this podcast episode, I give you my take on how I am playing the bond market right now, using a very slow and steady approach. 🎧 Listen Now: Available

$TNX pushing above October '22 highs and breaking through some heavy resistance. $AMC rejection at resistance was the clue to get out. Now it is breaking major support going back to '22. Retested it on Friday and failed. For those that think $AMC is rigged, then why are you even trading it? Simple logic -

Watch the $ORCL bullish wedge for a potential upside breakout. $NCLH potential bounce area for the stock following a sharp earnings sell-off today. Anybody want to address the elephant in the room? $TLT $AMD nearing a breakout of the bull flag pattern that has been forming since June. Pushing through the $117's into the 118's

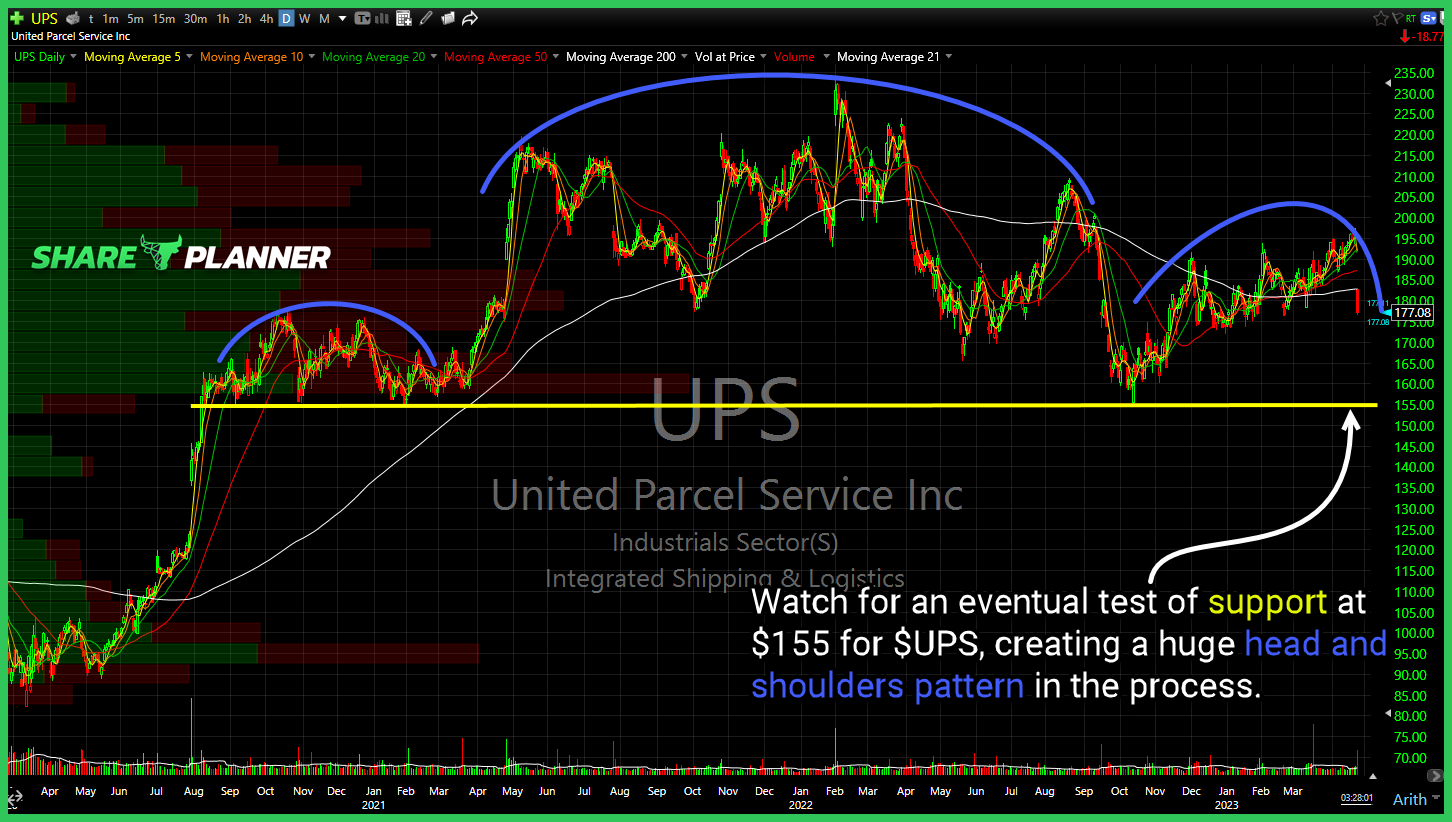

Watch for an eventual test of support at $155 for $UPS, creating a huge head and shoulders pattern in the process.

Episode Overview Ryan talks about how he approaches his dividend portfolio and the stocks that he looks to add to it on a regular basis. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] My First Real Vacation From TradingRyan shares his experience stepping away from the market for the first time in