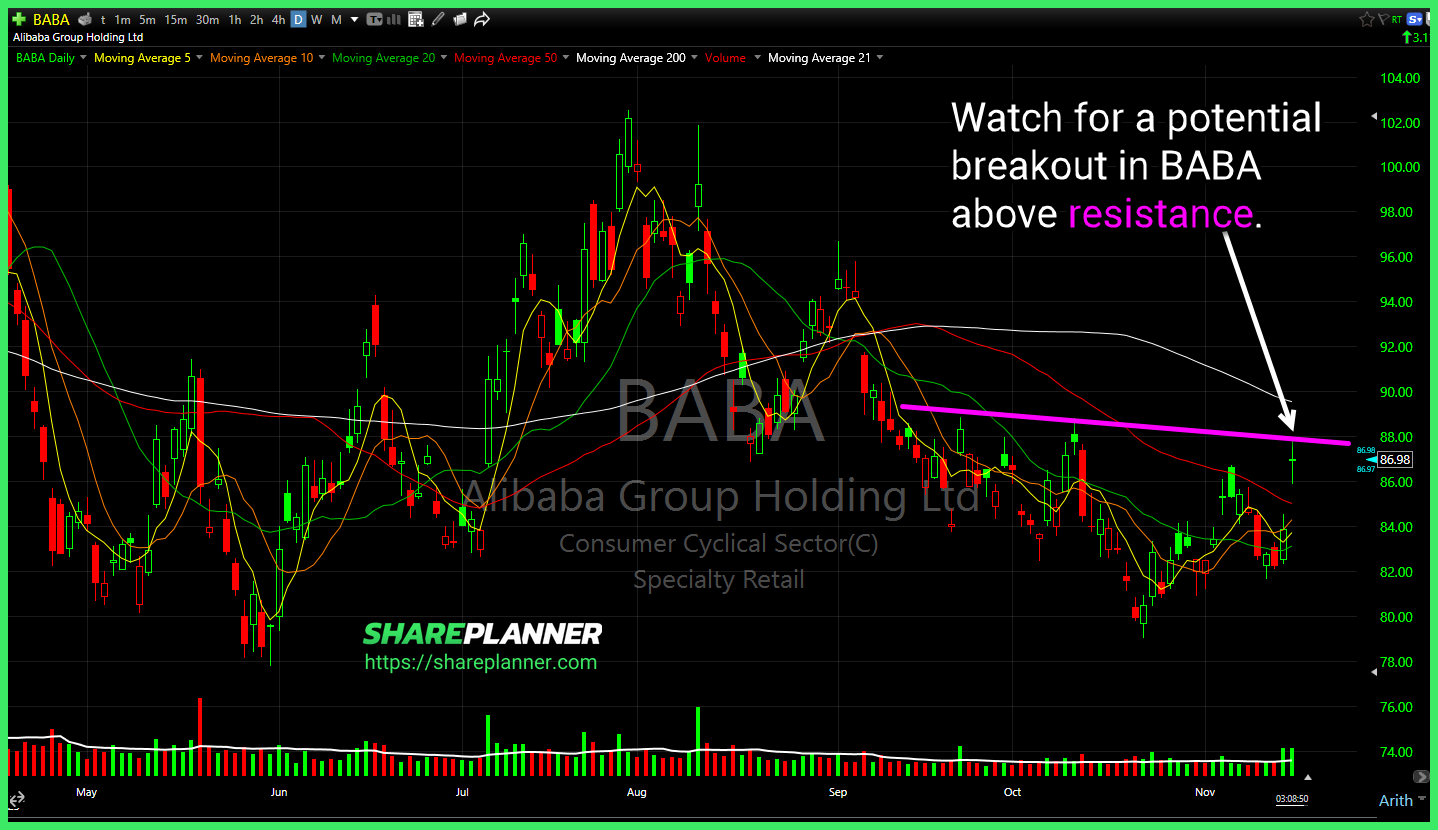

Not a huge fan of the risk component of the Alibaba (BABA) chart, but the pattern development is A+.

Huge breakout on BABA stock today But should traders expect this breakout to hold and continue the rally higher or will the Alibaba (BABA) reverse the breakout and pullback? After an 84% rally off the January lows, this stock is incredibly overbought. In this video, I provide my technical analysis for BABA and point out

Alibaba Group (BABA) inverse head and shoulders yet to confirm, and heavy declining resistance above. Previous bases similar to the current one never quite materialized with a breakout - something to keep in mind. Keep an eye on this bearish inverse cup & handle pattern on PDD (PDD). Not confirmed yet, but a break below

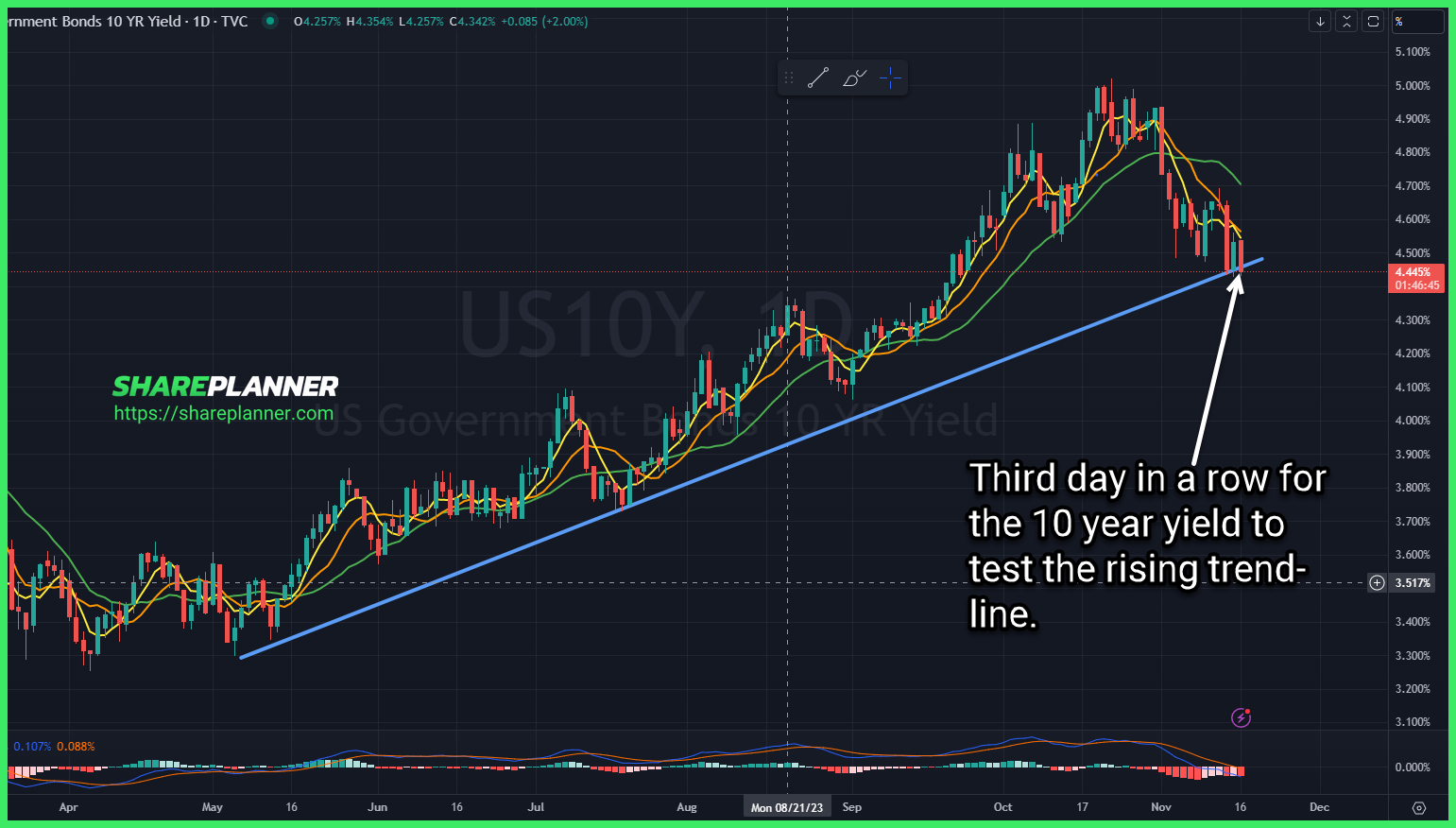

Third day in a row for the 10 year yield (TNX) to test the rising trend-line. Tesla (TSLA) Analysis Alibaba Group (BABA) testing support following a massive earning sell-off. This is a key area to hold going forward. Ugly reversal following yesterday's developing basing pattern.

Watch for a potential breakout in Alibaba Group (BABA) above resistance Vertex Pharmaceuticals (VRTX) testing lower-trend-line. Best to wait for evidence of a bounce instead of assuming gone will take place.

Strong post earnings run for Alibaba Group (BABA), but struggling to push through resistance. Needs to break through to jump start the next leg higher. Major support for Utilities ETF (XLU) still holding but a push below $64 support could spell trouble for the utilities sector. Big move out of Yeti (YETI) today

Match Group (MTCH) broke out and through its declining trend-line. I'm watching whether it pulls back to the trend-line and declining support for a potential bounce. Energy Sector (XLE) coming back to test the breakout support level. Watch to see whether it can bounce here. US Global Jets ETF (JETS) rising trend-line broken

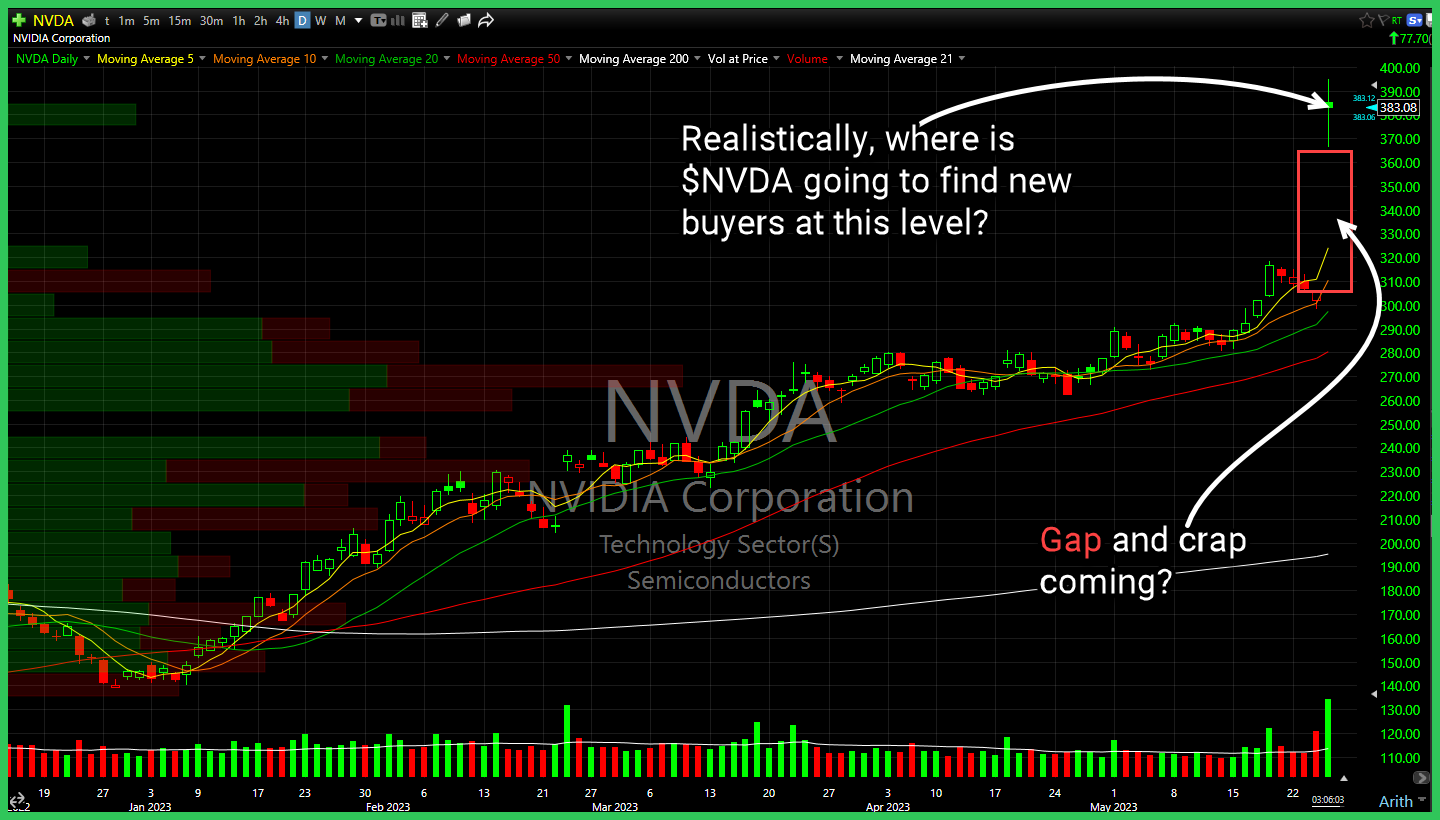

Realistically, where is Nvidia (NVDA) going to find new buyers at this level? Descending triangle pattern breaking to the downside on Alibaba Group (BABA) Significant breakdown taking place on Target (TGT) as it pushes below the lower channel band. Intel (INTC) breaking down through the triangle, and looking at a possible retest of

Goldman Sachs (GS) breakout of cup and handle pattern but I can't trust it ahead of 4/18 earnings. Alibaba Group (BABA) Bull flag pattern failed to breakout and broke to the downside instead. Second consecutive day where the Real Estate Sector (XLRE) could not hold the breakout level. Watch American Airlines (AAL) as

Watching for Super Micro Computer (SMCI)to pullback to the rising trend-line for a potential bounce play. Rumors of an AMC Entertainment (AMC) buyout by Amazon (AMZN) shooting stock price up, and potential creating a breakout scenario. However, in doing so it will keep a lot of long-term bagholders ($10+) from ever colonizing the moon. Lands