AMD Post‑Earnings Sell‑Off Technical Analysis Advanced Micro Devices (AMD) post‑earnings reaction was dramatic and the stock plunged hard today, breaking key technical levels and leaving traders contemplating whether to throw themselves off a building. But sharp reactions like this often reveal high‑probability trade setups if we know what to watch. In today’s video, I break

AMD Just Blew Up — What’s Next? Advanced Micro Devices (AMD) just lit up the charts after announcing a chip supply deal with OpenAI, sending the stock sharply higher. But for traders, the real question is: should you chase this rally or wait it out? In my latest video, I dig into the technical chart

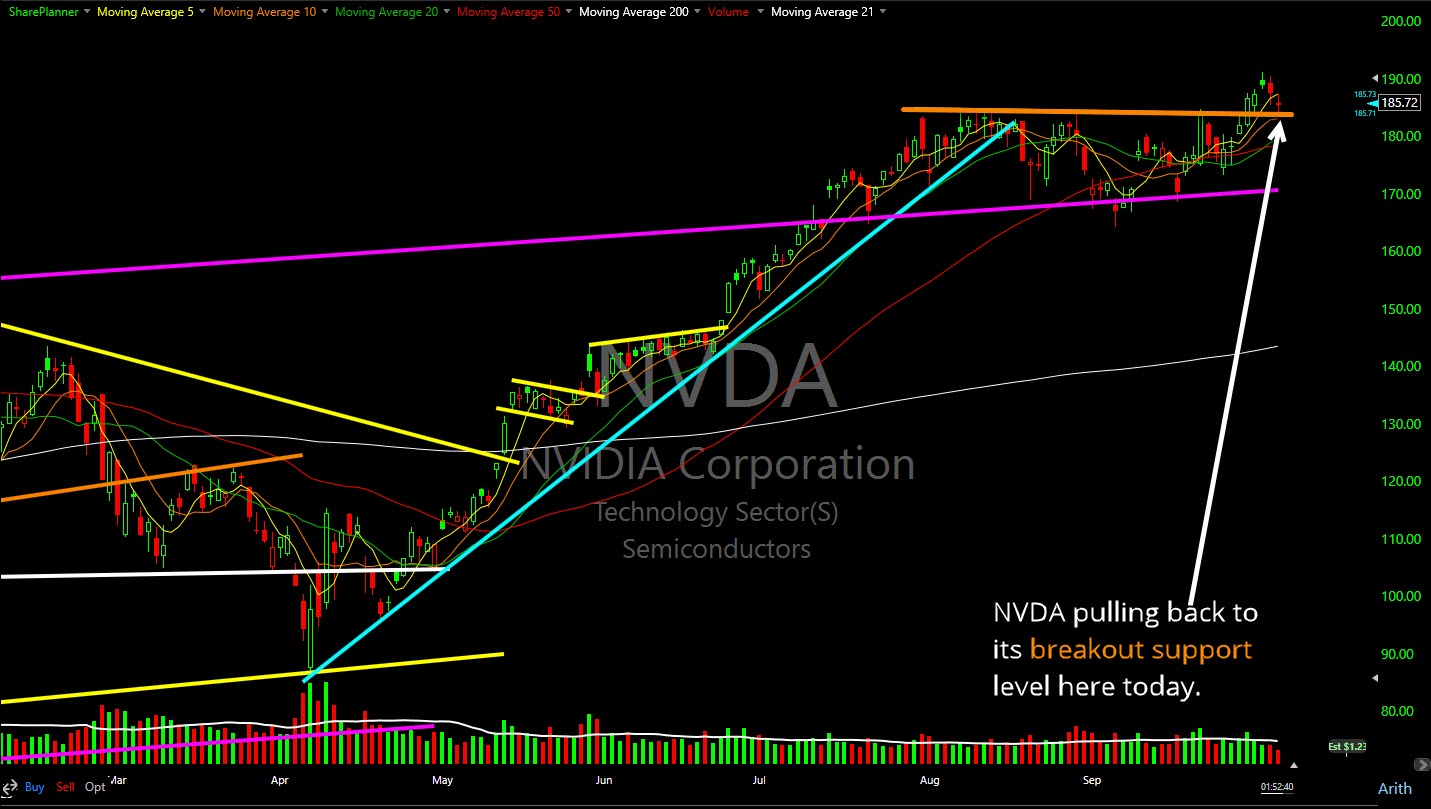

With news from Advanced Micro Devices (AMD) up over 25% today, Nvidia (NVDA) is pulling back to is breakout support level.

AMD with the double earnings beat! Advanced Micro Devices (AMD) reported strong Q1 2025 earnings, with revenue rising 36% year-over-year to $7.44 billion and adjusted EPS at $0.96, surpassing analyst expectations. The Data Center segment led the growth with a 57% increase, driven by EPYC CPUs and Instinct GPUs. In this video, I analyze the

Episode Overview When it comes to investing in a bear market, done right, we should be hoping for there to be a bear market not attempting to avoid it altogether. And we can do that when we are getting the right entries on our previous investments, and the manner in which we managed the risk

UP 7 straight days, but chart has hardly improved.

Episode Overview How to trade a stock split: in this podcast episode Ryan talks about the impact of what an announced forward stock split means for a stock that you are considering swing trading, or may already be trading. Also covered are the risks, and the strategy behind stock splits for investors and traders alike.

Buy the dip in semiconductor stock? Semiconductor stocks have plummeted over the past month. Is it now time to buy the dip in semiconductor stocks like Nvidia (NVDA) and Advanced Micro Devices (AMD), among others? In this video I discuss the potential for a bounce within semiconductor stocks and the SMH ETF as well as

Episode Overview In the current market, where stocks are flying higher, and look like they could just keep going even higher, how do we manage the profits that come from some of these high flying semiconductor stocks like NVDA, SMCI, MSTR, or AMD? In this podcast episode, learn what Ryan does to manage the trade

United Airlines (UAL) couldn't push through resistance, and instead resumed its current downtrend. Sets up well for a retest of the lower $30's. Advanced Micro Devices (AMD) despite pulling back about 5% today, for me it's not worth playing until it retests its rising trend-line and holds. The ideal way for me to play PayPal