Watch this major support level in Coinbase Global (COIN) going back to '22. Potential landing spot for the stock. Potential landing spot for Riot Platforms (RIOT) following the hard sell-off from $17, at the rising trend-line. So far for Walt Disney (DIS) a nasty head-fake on the chart.

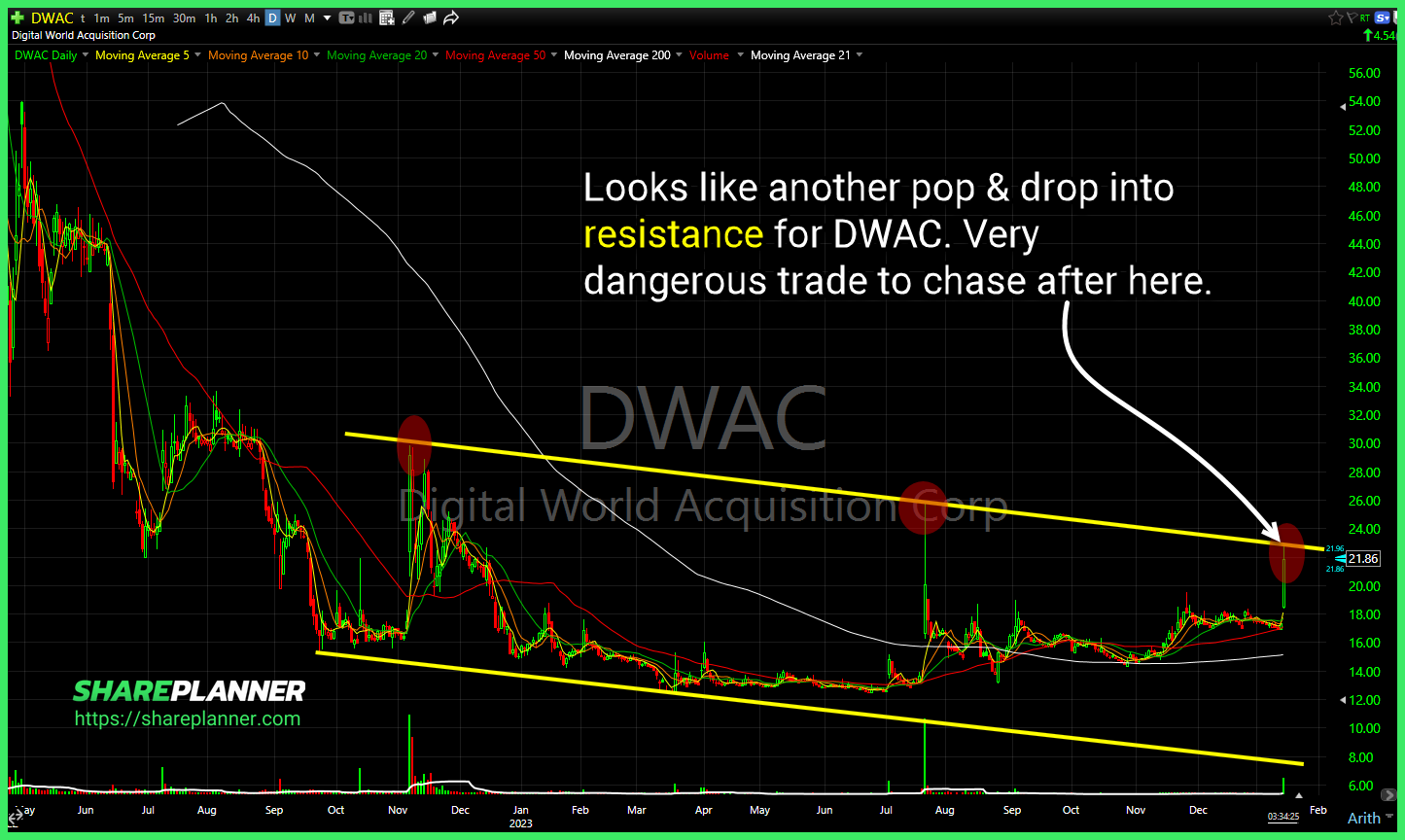

Looks like another pop & drop into resistance for $DWAC. Very dangerous trade to chase after here. $SPY bearish wedge trying to confirm. Essentially an inverse head and shoulders forming on $PYPL. Some potential support here today could come from the 50-day moving average as well.

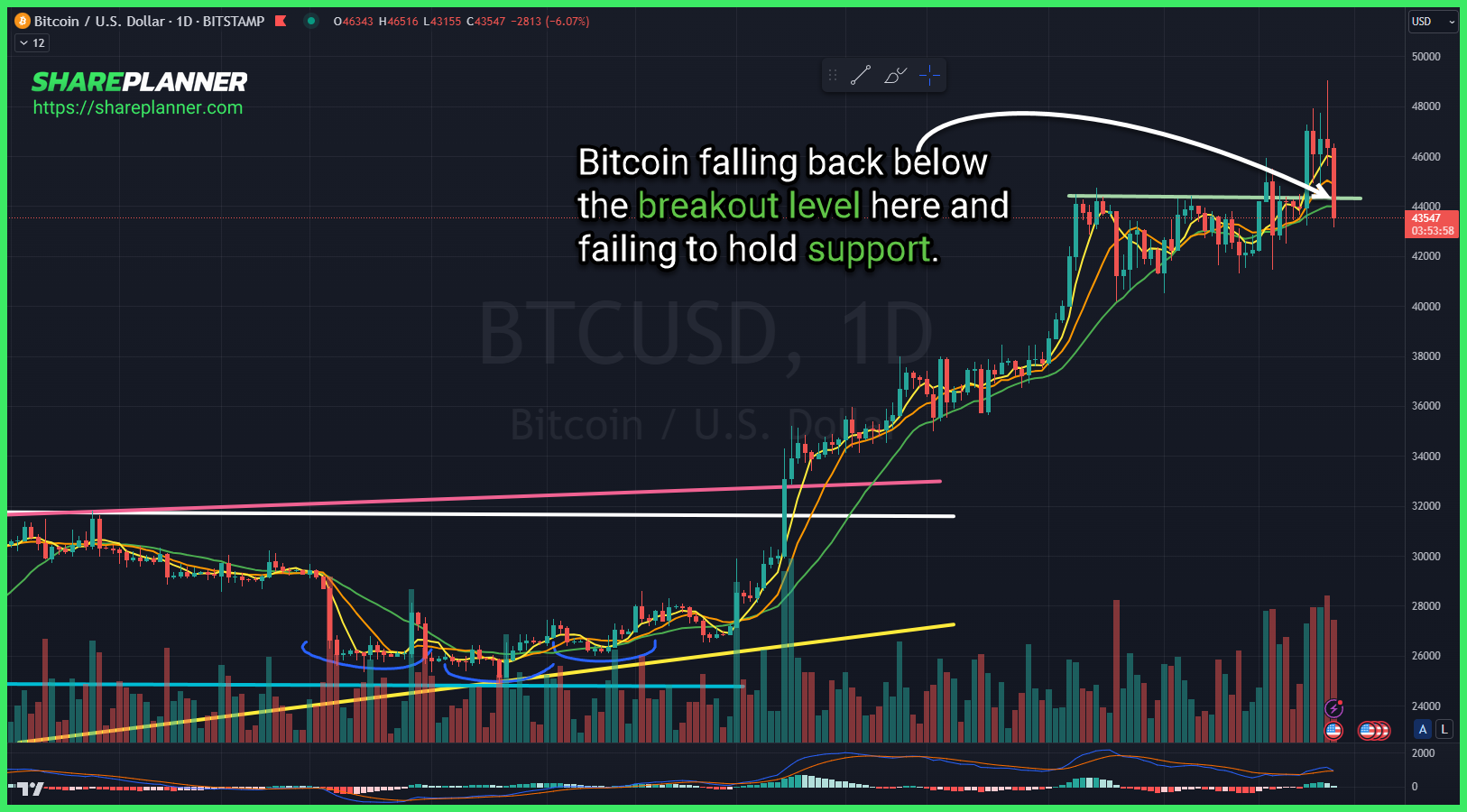

Bitcoin falling back below the breakout level here and failing to hold support. Double top formed in Delta Air Lines (DAL), just about to confirm. Baidu (BIDU) breaking to the downside on this triangle pattern.

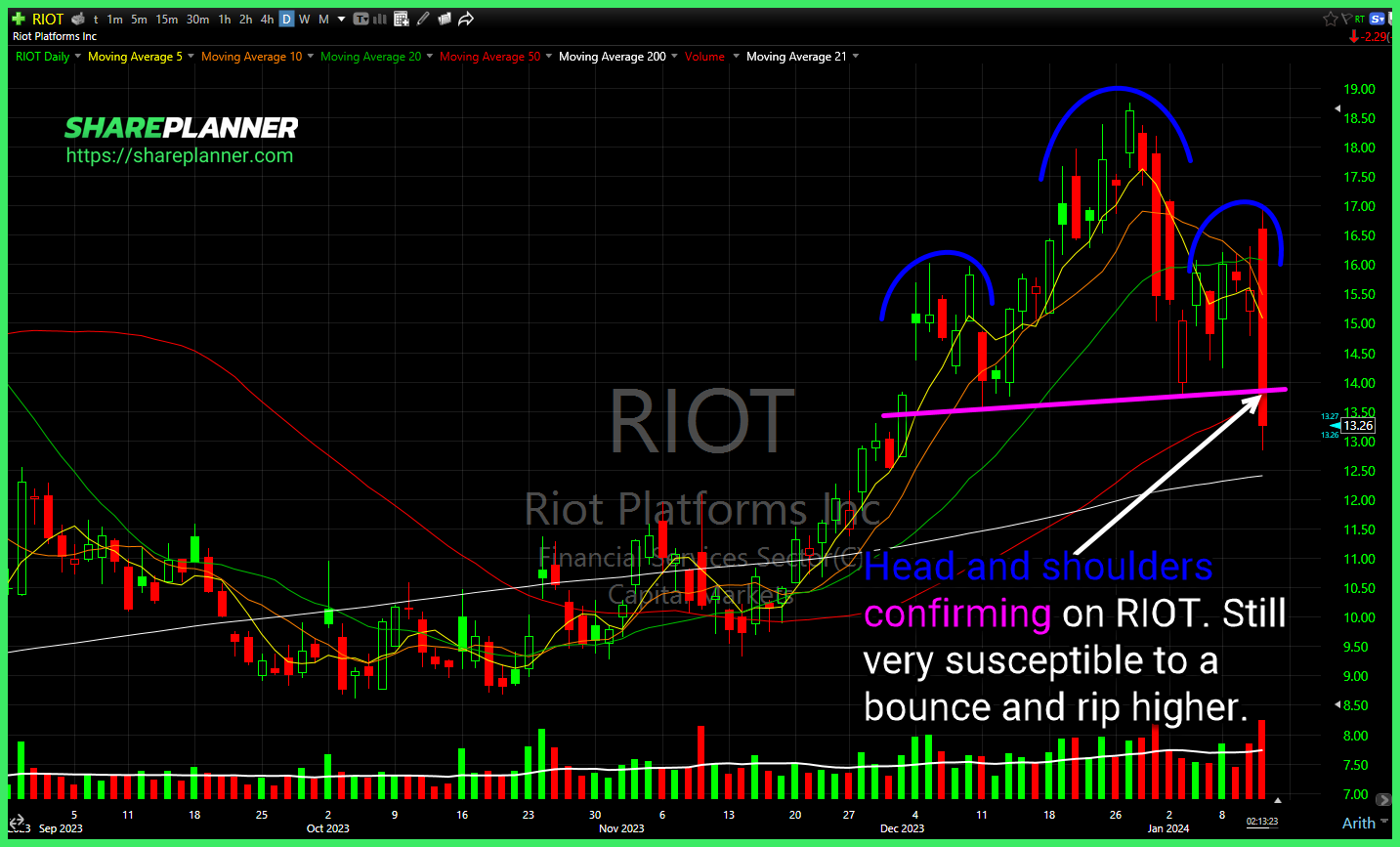

Head and shoulders confirming on Riot Platforms (RIOT). Still very susceptible to a bounce and rip higher. Take-Two Interactive Software (TTWO) Bull flag/consolidation at the recent highs. Support underneath, but needs to push out of the flag to get bullish on a swing-trade.

$TGT up against resistance on the weekly, and could be setting up for a break through and a run back to $181. Pullback to a key support level, and attempting to bounce here. Huge risk however if the ETF doesn't get approved. $BTC.X Solid bounce so far off of the rising trend-line for $SNPS. A

$VIX still refusing to break through this basing pattern over the last 1.5 months. Heading back towards the December lows with another volatility crush. $RIOT possible short-term head and shoulders forming, but not confirmed. $SMCI breaking out of its sideways channel today.

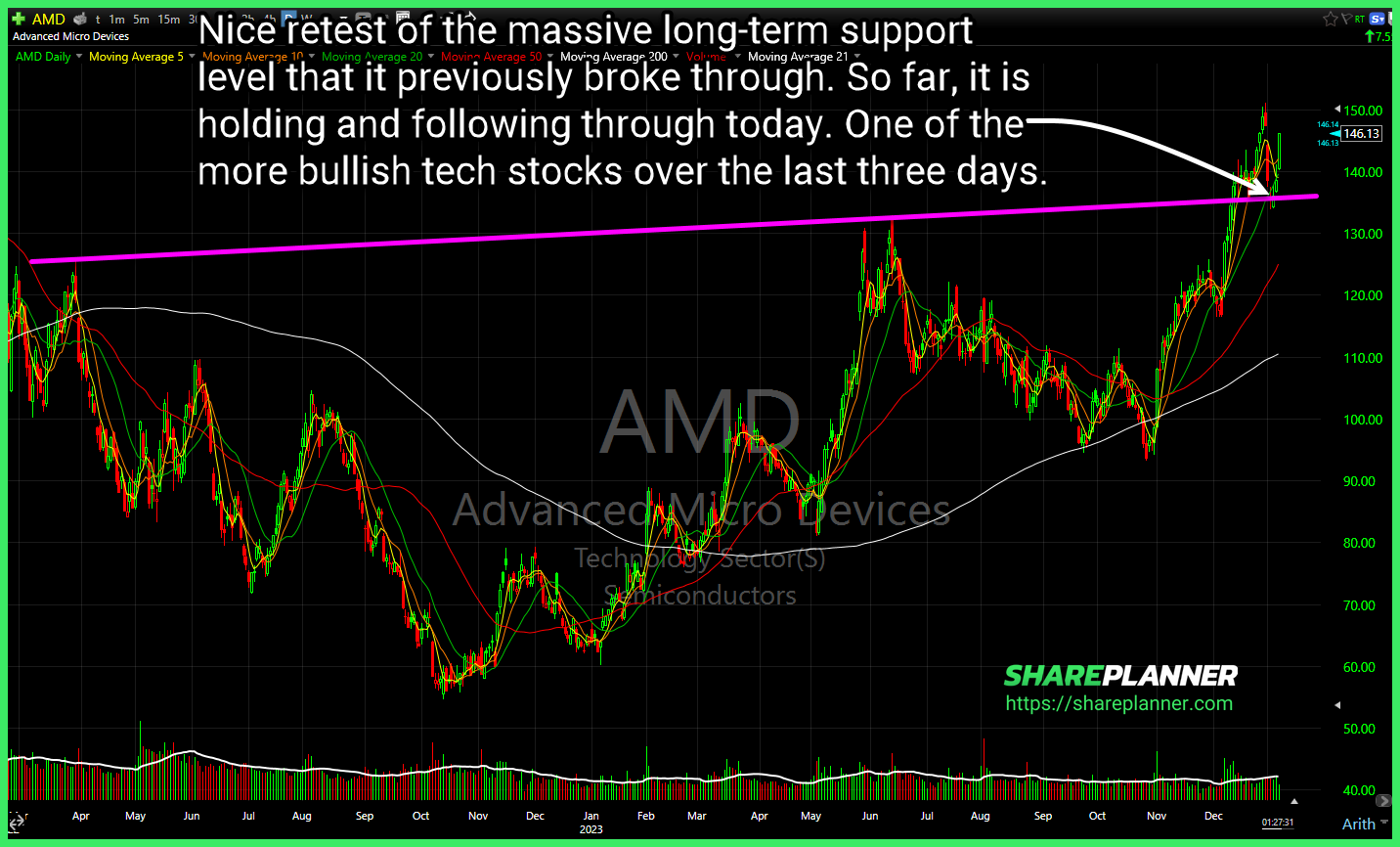

Advanced Micro Devices (AMD) - nice retest of the massive long-term support level that it previously broke through. So far, it is holding and following through today. One of the more bullish tech stocks over the last three days. Boeing (BA) attempting to find some support off of the 50-day moving average Solid

Cup and handle breakout on Mind Medicine Mindmed (MNMD) in play today. Starbucks (SBUX) long-term trend-line getting a test today. Nice ascending triangle in Truist Financial (TFC)following the base breakout in December. Nearing a secondary breakout here.

Strong move out of $PTON, but needs to show it can clear resistance. Similar pattern in mid '23 that resulted in another leg lower. Big base breakout for $QS today from its base. Not something I would want to chase here, except if it could consolidate at current levels in the form of a bull

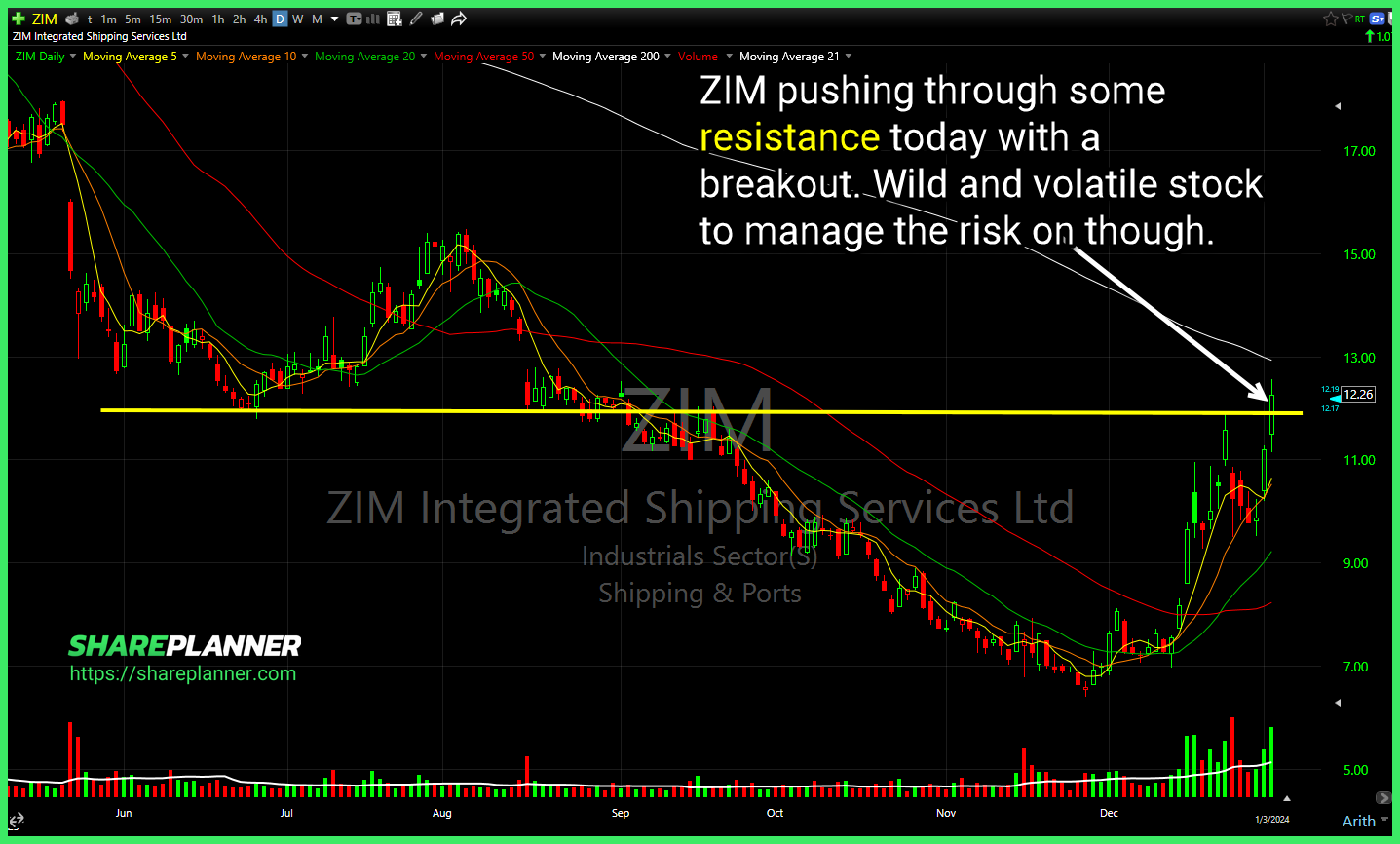

$ZIM pushing through some resistance today with a breakout. Wild and volatile stock to manage the risk on though. Short-term you have $MPLX breaking through some resistance but long-term there is a much bigger layer of resistance to be mindful of. $PSTG seeing declining channel band push back on the breakout attempt this morning. Difficult