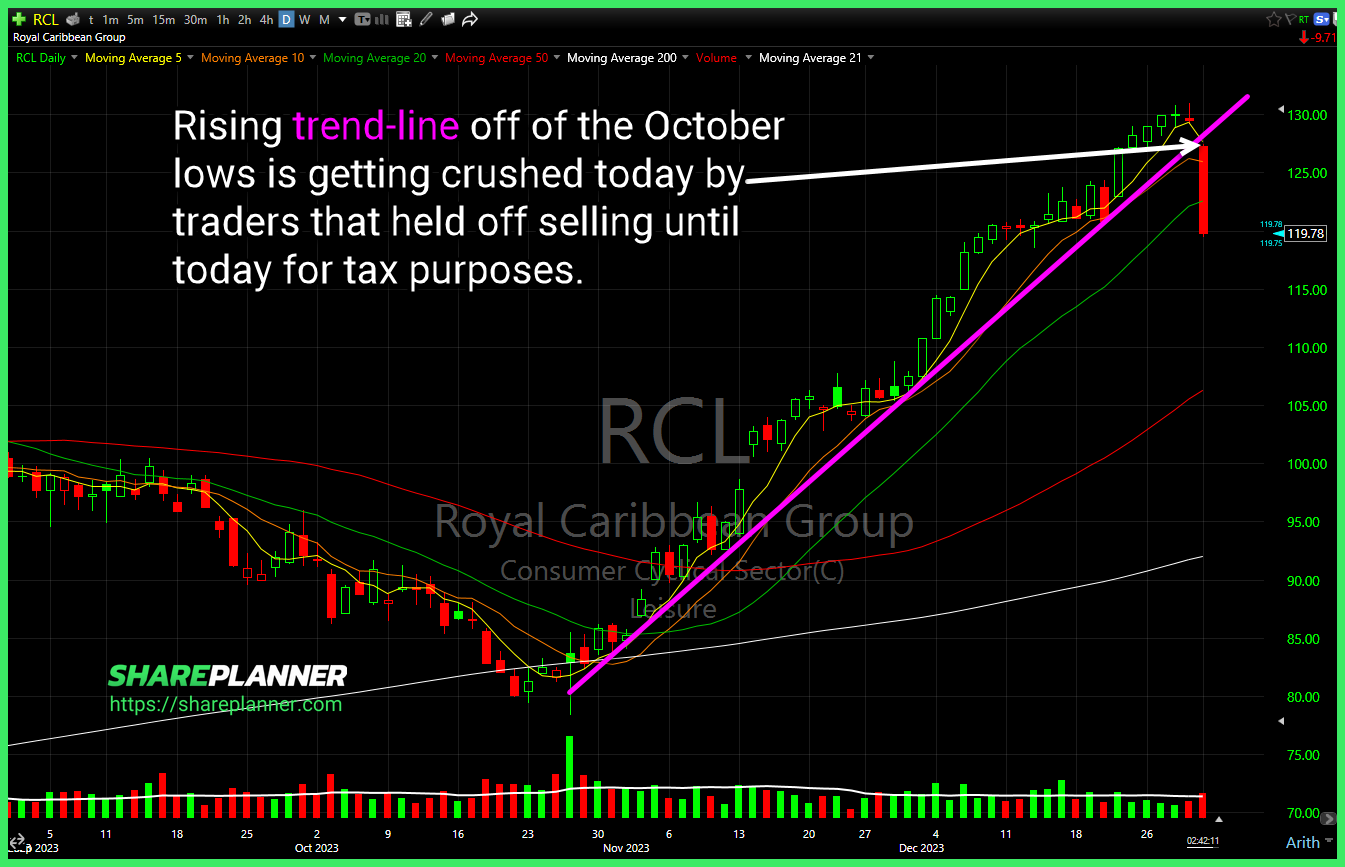

$RCL rising trend-line off of the October lows is getting crushed today by traders that held off selling until today for tax purposes. $ALGT holding the rising trend-line off of the November lows, despite breaking below it intraday. Will be key for it to hold this level into the close. $NEM pullback to its breakout

DIS bull flag pattern, but also playable is the bounce off of the 50-day and 200-day moving averages. Keep watching the bull flag in NFLX...not in play today, but could be in the new year. T2108 (% of stocks above their 40-day moving average) remains extremely overstretched and seeing some divergence in the last three

$EG parallel channel where price is testing the lower channel band looking for a bounce. $VSCO bull flag re-test. Needs to bounce here, if it is going to continue the breakout from last week. $PEAK long-term declining trend-line nearing a break to the upside. Solid consolidation underneath keeping a good risk/reward intact.

Be leery of rising resistance that has consistently pushed back on Tesla (TSLA) of late. SPDR Gold Trust (GLD) pushing through multi year resistance dating back to 2020. Fortune Brands Innovations (FBIN) bull flag working in the short-term, but long-term there could be some resistance that pushes back some. Not sure how difficult

Nike (NKE) broke its rising trend-line but may be attempting to find some support here that goes back to June. Pfizer (PFE) declining channel with a retest on the upper band here. If that breaks it has a longer framed declining trend-line to also contend with. Solid continuation triangle setting up for Williams

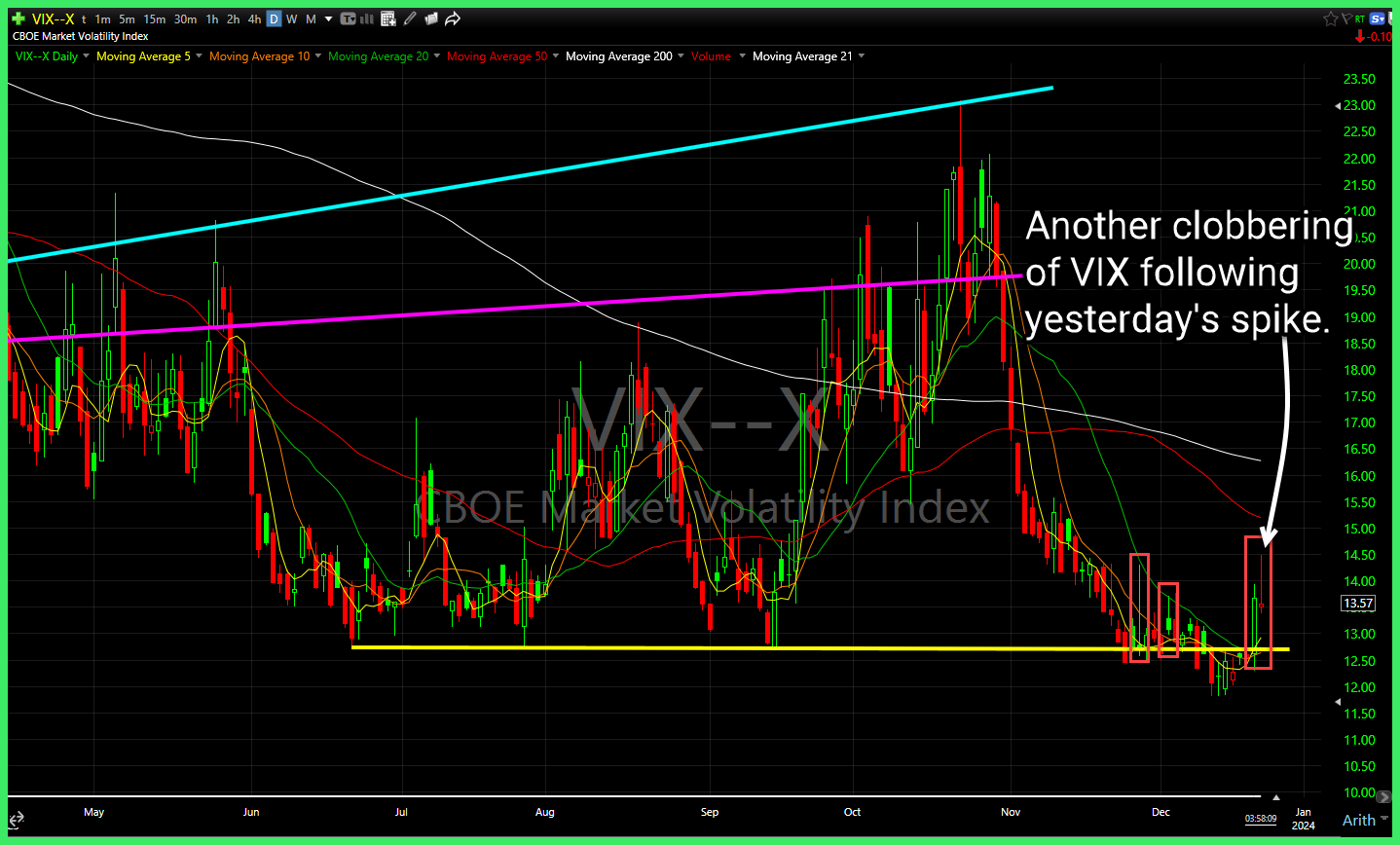

$VIX once again killed. $MP Strong breakout today for MP through resistance. $RCL recapturing the steep rising trend-line following CCL earnings coming in strong.

S&P 500 (SPY) Kinda looks like a rug pull if you ask me. Fedex (FDX) long-term trend-line worth watching especially as it is trying to hold it despite the massive gap lower. Diamond top on Alphabet (GOOGL) with a hard reversal and breakout to the upside which nullifies the pattern. Which is also

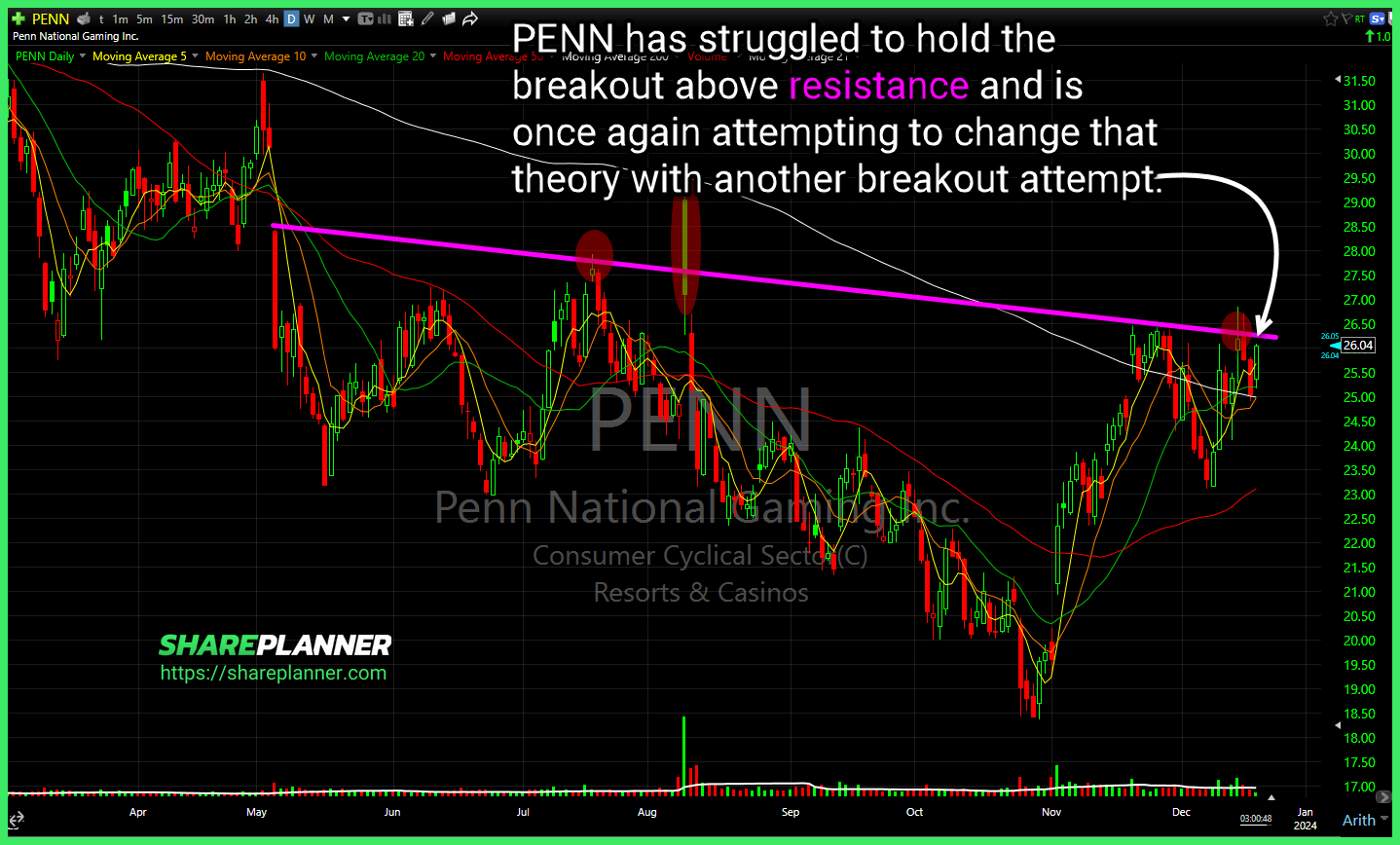

Penn National Gaming (PENN) has struggled to hold the breakout above resistance and is once again attempting to change that theory with another breakout attempt. Amazing breakout for Affirm (AFRM), but currently running into some long-term resistance that hasn't been tested in a while. Not sure whether it will reject price or not, but if

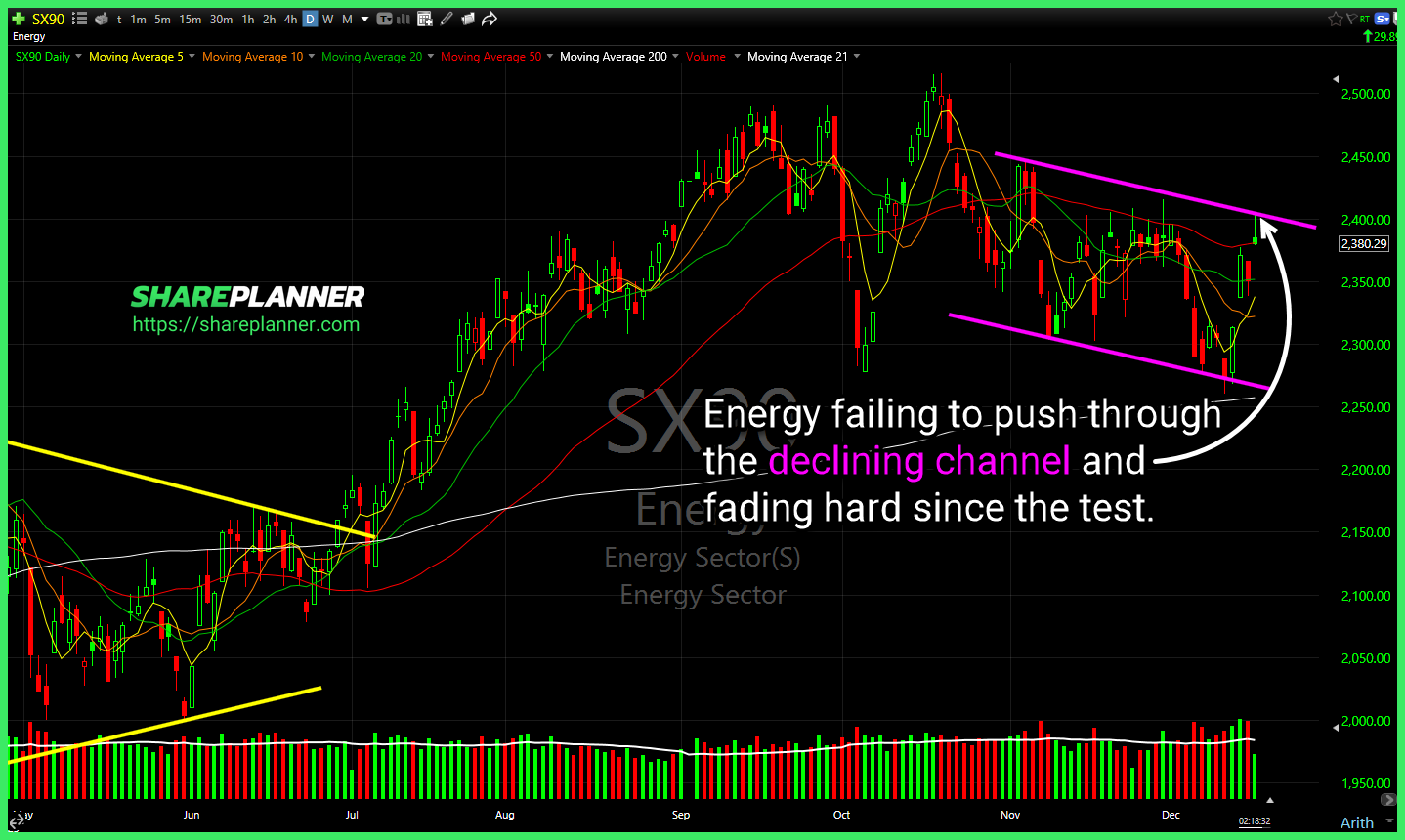

Energy sector failing to push through the declining channel. $XLE $GPCR these days there's no limits to what the bulls won't go to, to buy the dip. This time off of a -50% push lower & bounce off the rising trend-line. Gap and crap on $NIO following the gap higher. Watch to see here whether

Head and shoulders nearing a confirmation on $DKNG What changed in from 11 straight weeks of declines for $BA where nobody wanted the stock to 7 straight weeks of dramatic price increases and a 50% rally where no one can get enough of this stock? $COST: A perfect example of FOMO taking over a stock