Stock market winning streak hits the 7th straight day! And this stock market winning streak comes after a 4 day sell-off, and just just a couple of weeks later, the market have finished off an 8 day winning streak. It kind of feels like this market is beholden to nothing but streaks these days and

Another low volume day for the market with anticipated 50bps rate cut from FOMC on Wednesday Even with the expectations now of a 50 basis point rate cut on Wednesday, the trading environment today was entirely boring and uneventful. It’s the quiet period for Fed speakers right now, so you’re not going to get any

The S&P 500 is back to testing all-time highs yet again! It was just two weeks ago the market was doing the same thing it did today – run it higher right into the close and testing all-time highs but not breaking through. The following shortened week, it sold off four straight days, but this

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee’s 2 percent inflation objective.

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

How to Spot Bull Flag Patterns for Profitable Trading Are you looking to improve your profitability and swing trading results by learning how to spot and trade bull flag patterns? Bull flag patterns are one of the most reliable and profitable chart patterns for swing traders. For me personally, it is my favorite continuation pattern.

The Trade Desk (TTD) on the weekly chart, it's possible that a double top is starting to form. I don't see a clear edge at all on the daily for a long play. Also in play is ultimately a return to its long-term trend-line. Atlassian (TEAM) retesting the rising trend-line again, but doing so without

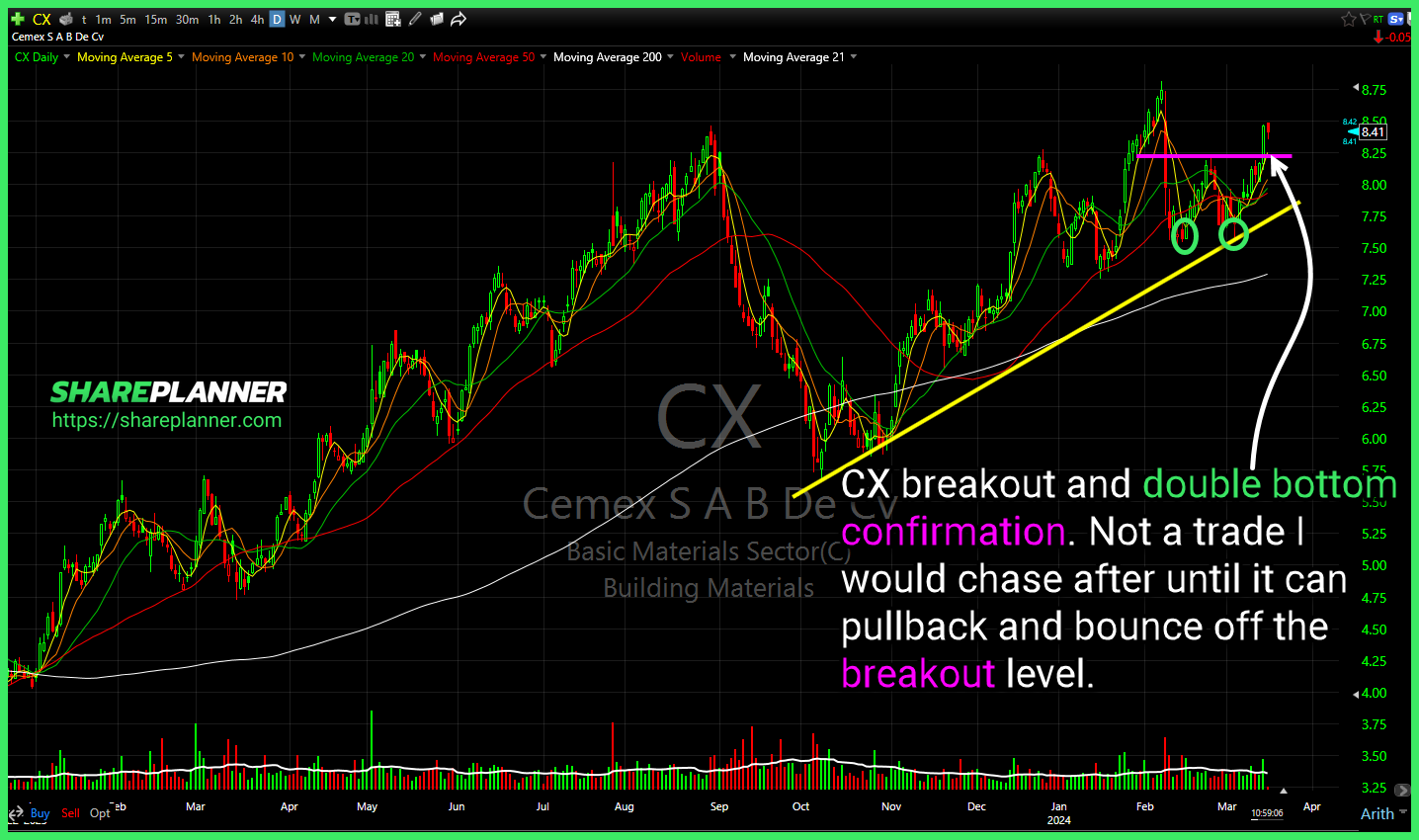

Cemex (CX) breakout and double bottom confirmation. Not a trade I would chase after until it can pullback and bounce off the breakout level. Microsoft (MSFT) with a pullback to the breakout level. Extreme volume at the open though is concerning that it will be able to hold. Could see a pullback to the rising

Little in the way of support for Affirm (AFRM) on the weekly until it comes back down to where it originally broke out at (27.50), which is also in line with the 200-day MA on the daily. Compelling bounce play here in Apple (AAPL) if it weren't for the declining resistance just above. Better to