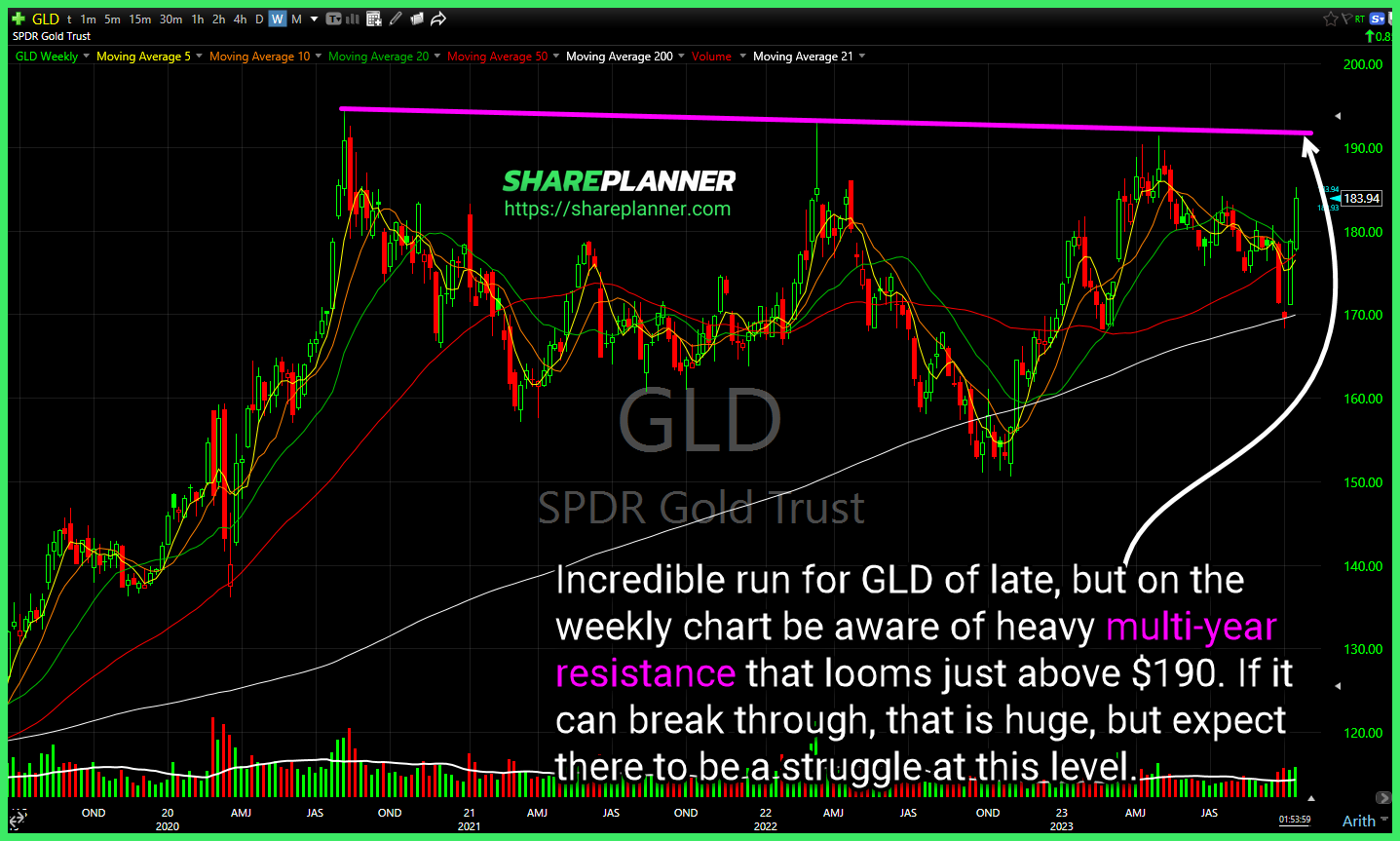

Incredible run for $GLD of late, but on the weekly chart be aware of heavy multi-year resistance that looms just above $190. If it can break through, that is huge, but expect there to be a struggle at this level. Just when you think $PYPL can't go any lower, it breaks another important support level,

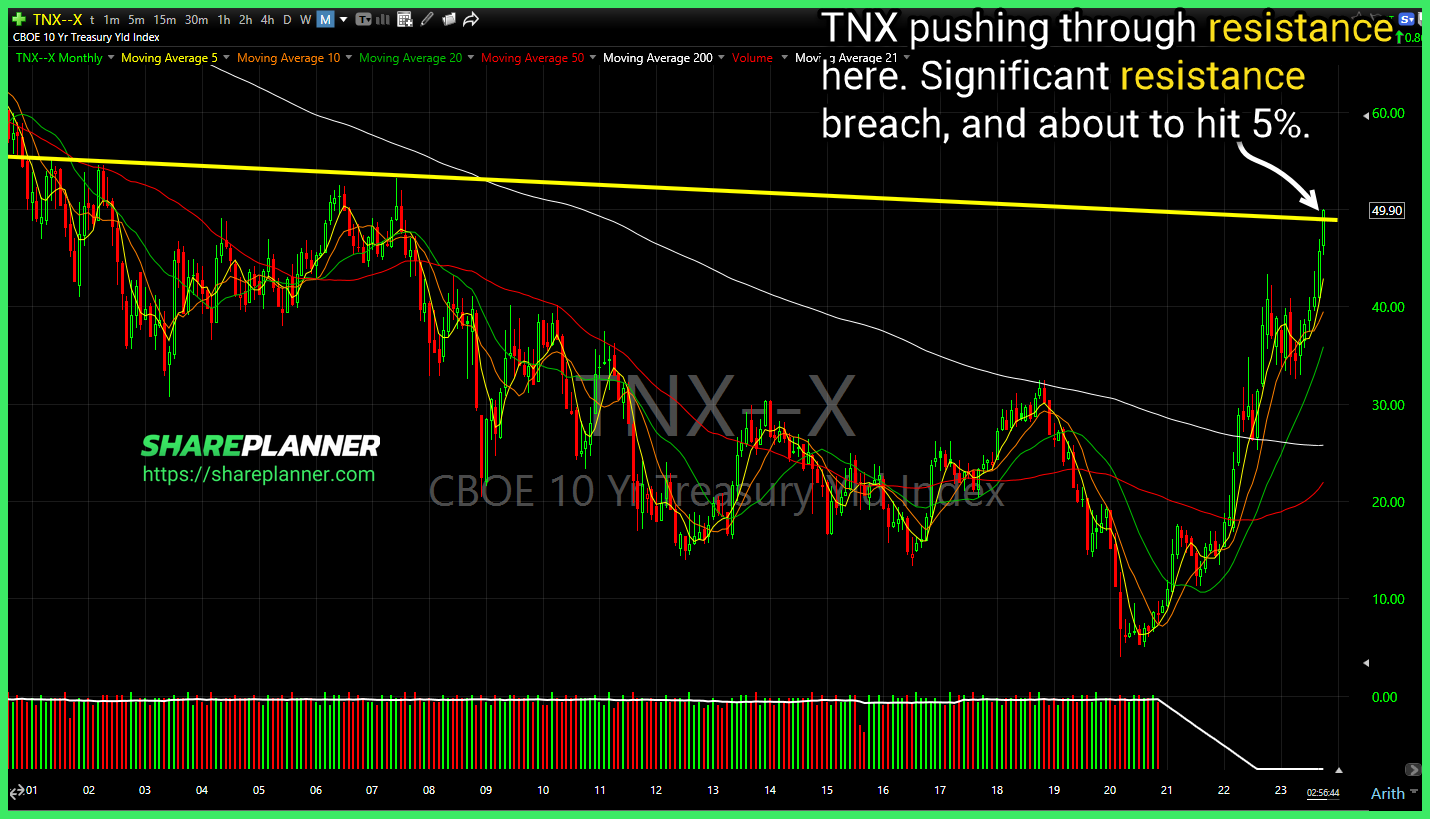

CBOE 10-year Treasury Yield Index (TNX) pushing through resistance here. Significant resistance breach, and about to hit 5%. SoFi Technologies (SOFI) Price breaking back below major support levels. A significant market sell-off could take SOFI back below $5. Triangle pattern in Healthcare Sector (XLV) nearing a break to the downside. Bounce play if

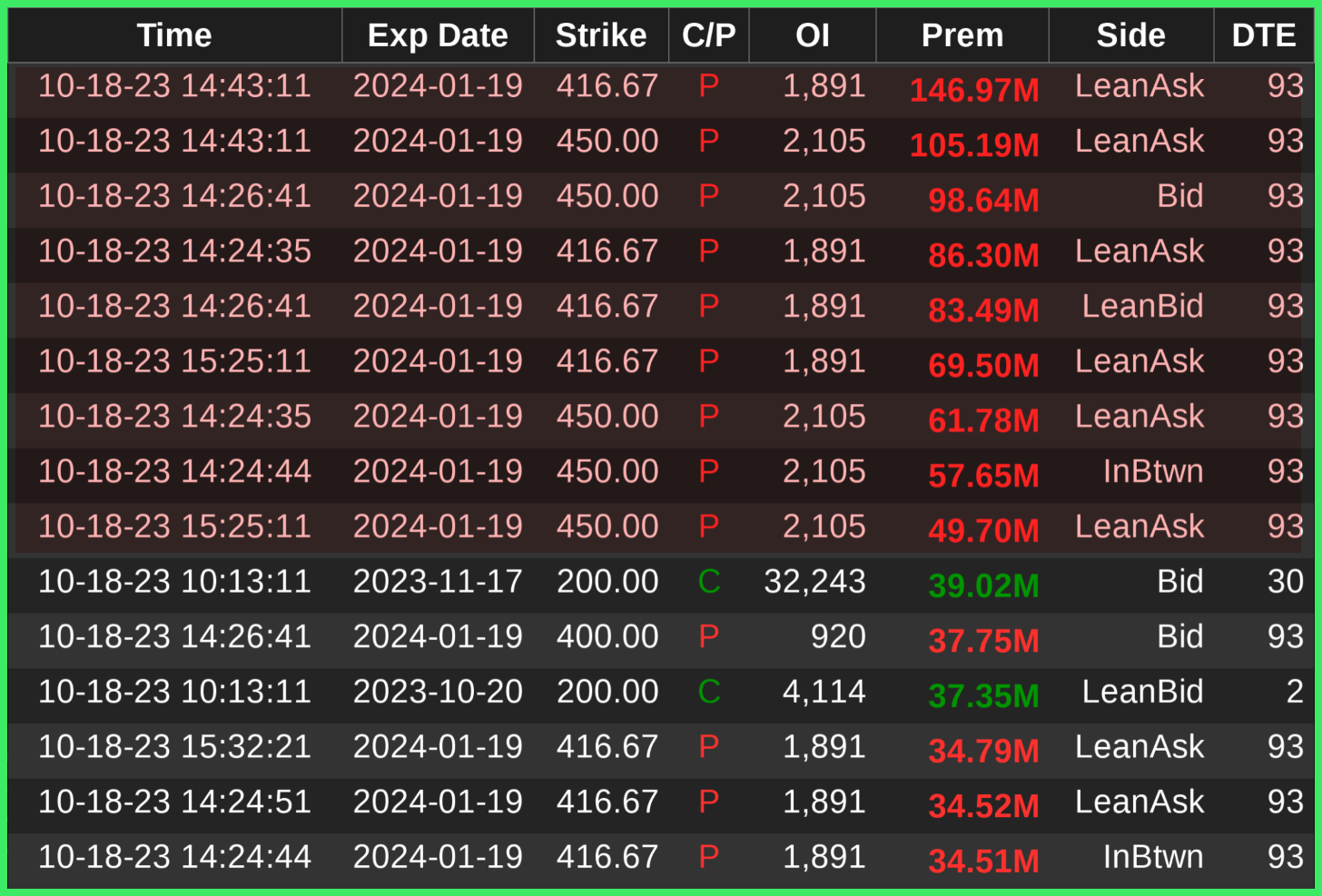

That is a ton of put buying going on with $TSLA today. Still not a reason for me to play earnings though. Rising trend-line on $TSLA beginning to break down ahead of the its earnings report. $CBRL 25 year support level holding up so far and allowing for a bounce to materialize. Key moment for

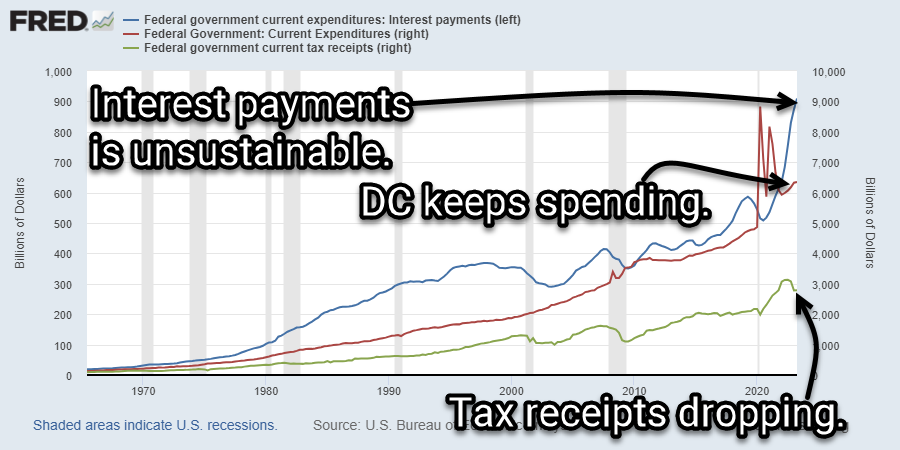

This is why the interest rates going up is so bad for the economy, and almost inevitable it breaks something in the system....Declining tax revenue, parabolic interest payments, and spending that has yet to cool down. $STUDY Declining channel seeing an upside break for $BAC following its earnings. $27-30 will still be a difficult price

Volatility Index (VIX) Bears 11 times in a row continue to reject any movement above this threshold. Riot Platforms (RIOT) with tight consolidation and continues to get rejected on the breakout attempts. Heavy resistance at the 200-day moving average as well. Strong potential for a downside break. US 10 year treasury yield (TNX) Another jump

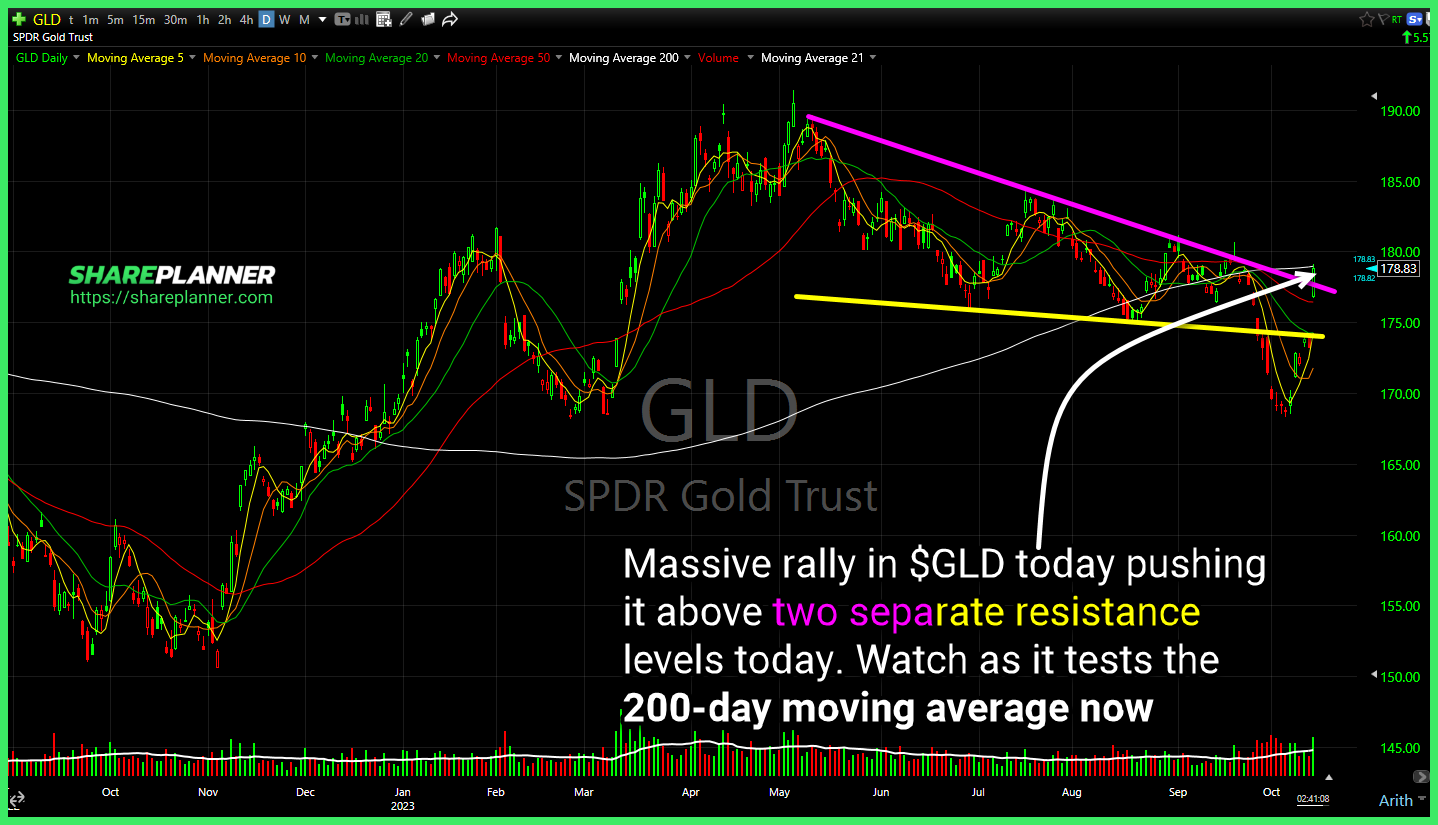

Massive rally in $GLD today pushing it above two separate resistance levels today. Watch as it tests the 200-day moving average now $VIX with a break back above major resistance. Key is to hold that level into the close. Rising resistance could prove important next week. A new layer of resistance is forming for $JPM

$GLD getting some push back here at the resistance from the broken descending triangle $XLE Watching for a pullback to the rising trend-line here. $IWM broke the rising trend-line today, and looking at another test of major price level support. Below that, watch for October '22 lows retest. $TPST Couldn't have seen that one coming...

$TPST might be one of the biggest one-day pump and dumps I've ever seen. You can expect plenty of bag holders to come out of that as they pile into the stock at absurd levels. Earnings for $DAL tomorrow will make or break this test of the rising trend-line and help determine direction going forward.

$GME with multiple layers of resistance from the declining trend-line to the price level resistance. Good chance of a rejection here. Base breakout for $XLY today. $JOBY breaking the declining trend-line. Next target is $6.87 then $7.60

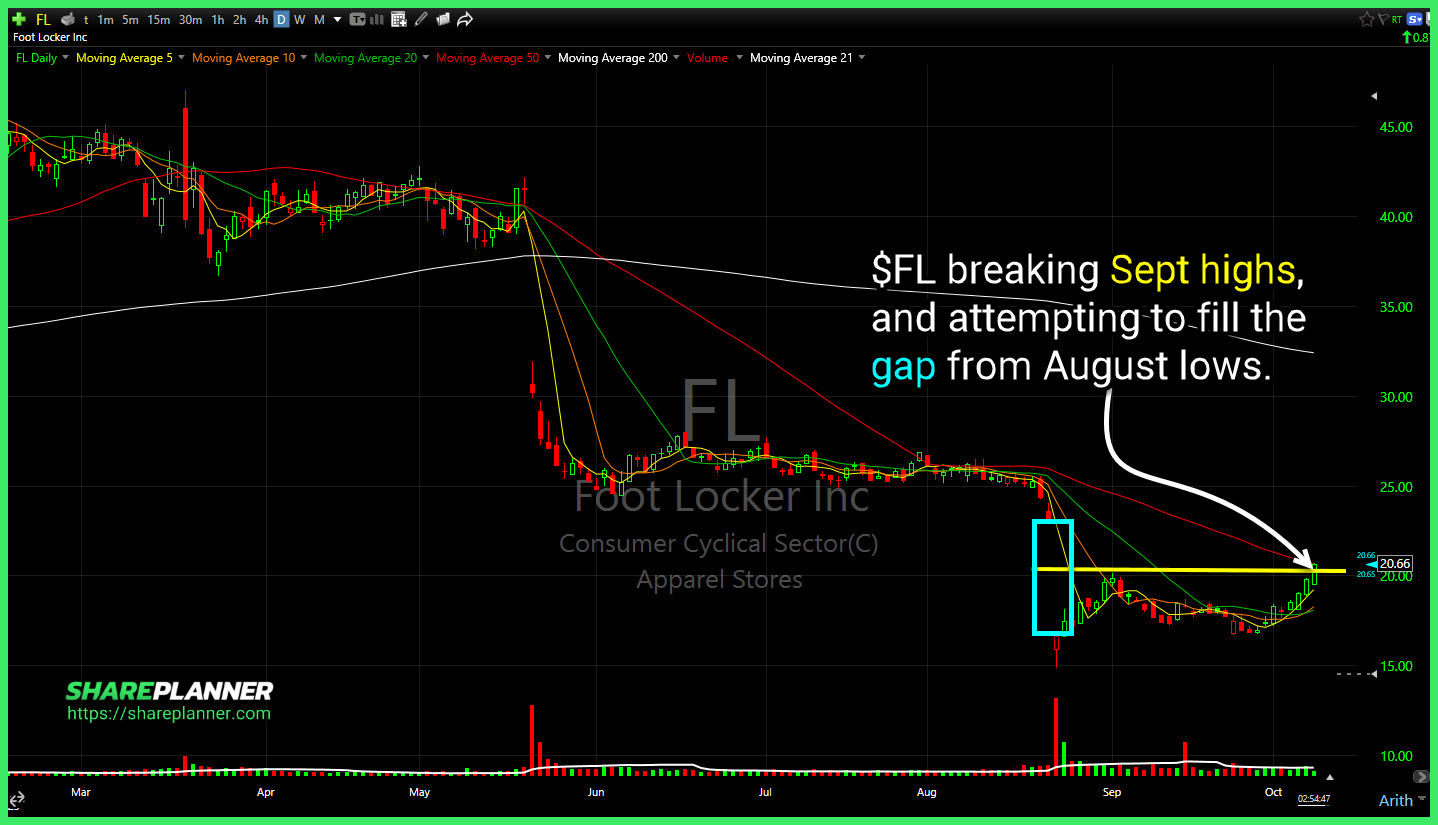

$FL breaking Sept highs, and attempting to fill the gap from August lows. Hard fade in $VIX today, with the lower-channel band getting tested again. A break to the downside would likely signify more upside for equities. $LMT declining resistance and price level resistance overhead to watch. If US gets involved, or provides aide, likely