$SHOP trading inside a megaphone, but very little else to comment on, not even crazy about what could be a bullish wedge that is forming. Chart is a complete mess, and half expect it to move back to $71 to test support. . $XLV pulling back to the rising trend-line from the October lows. Potential

Alibaba Group (BABA) inverse head and shoulders yet to confirm, and heavy declining resistance above. Previous bases similar to the current one never quite materialized with a breakout - something to keep in mind. Keep an eye on this bearish inverse cup & handle pattern on PDD (PDD). Not confirmed yet, but a break below

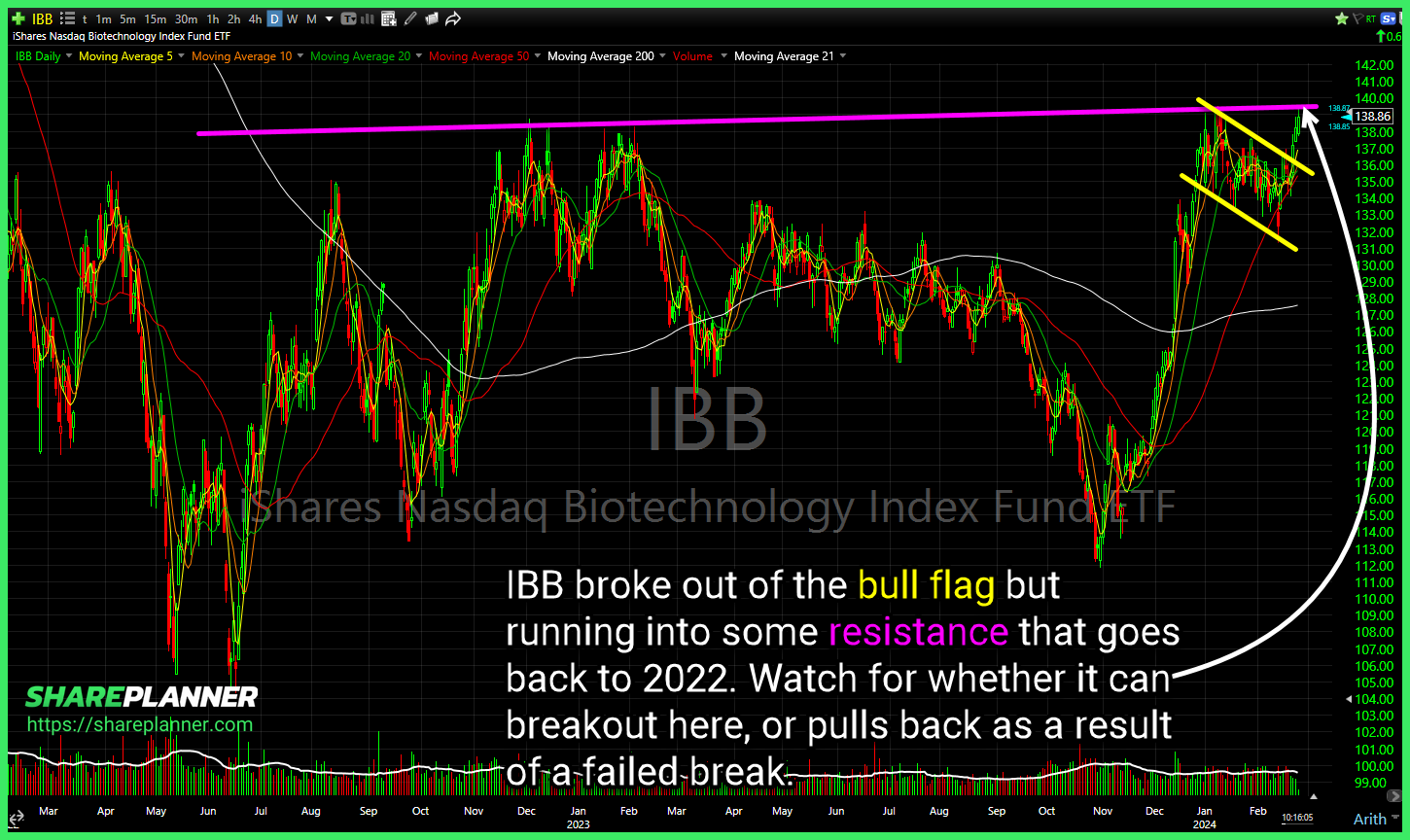

$IBB broke out of the bull flag but running into some resistance that goes back to 2022. Watch for whether it can breakout here, or pulls back as a result of a failed break. . $IBIT bull flag breakout here, representing a continuation of the current trend-line off of the January lows.

$FHI bouncing off of the lower channel band, but short-term declining resistance needs to see a break before considering a long position. . $VSCO bull flag pattern nearing a breakout to the upside. A break below declining support would invalidate the setup. $SMH has a complicated history with bollinger bands and here the reward gets

Tesla (TSLA) pullback and bounce off of the base breakout level. Airbnb (ABNB) wedge pattern formed that could provide some short-term resistance for ABNB, which trades inside of a much bigger channel pattern. Dollar General (DG) pulling back to breakout support. So far holding it. Will need a hard bounce here to keep the setup

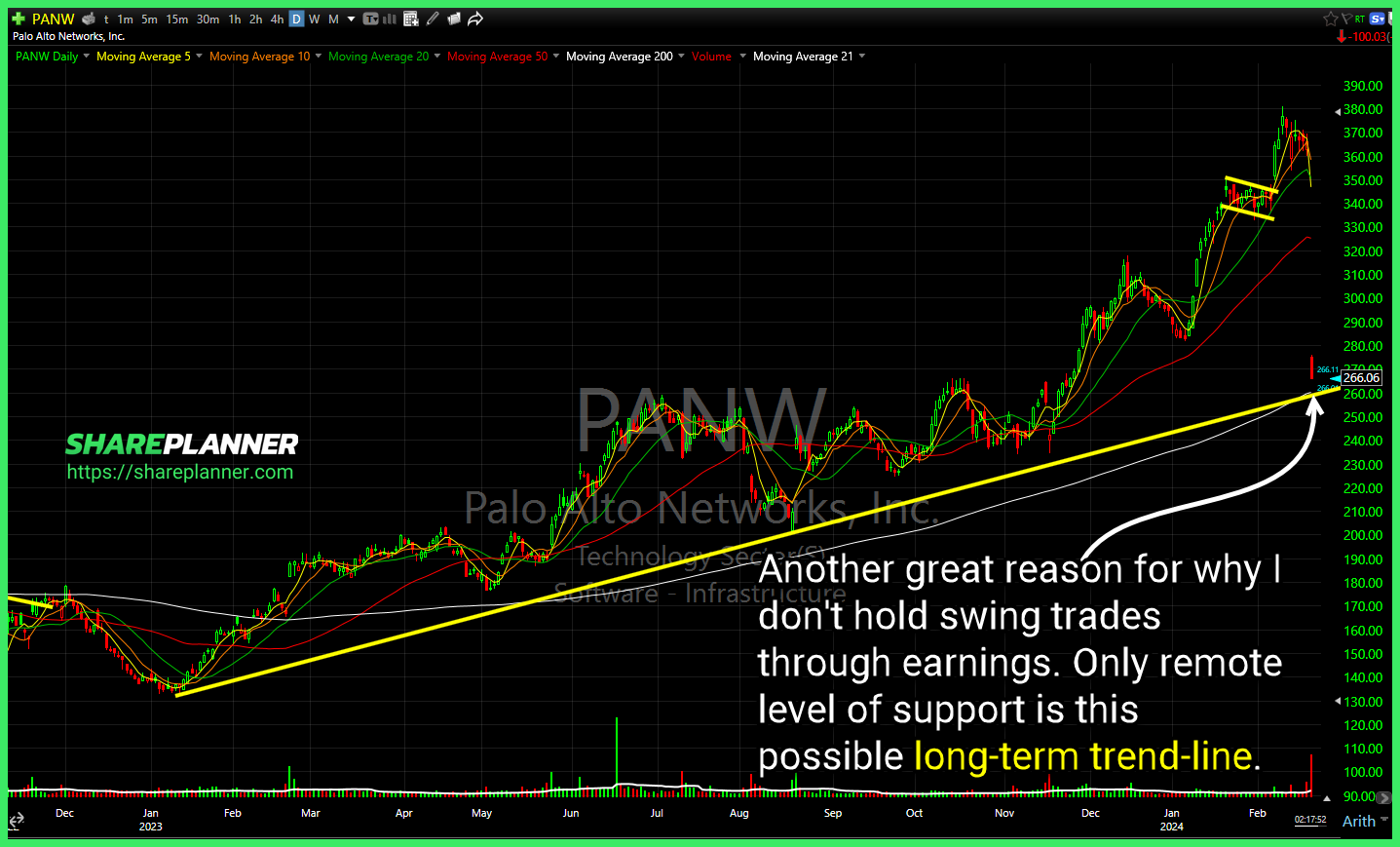

PANW - Another great reason for why I don't hold swing trades through earnings. Only remote level of support is this possible long-term trend-line. AAPL managed to hold the trend-line into the close yesterday, and now attempting to bounce off of it today. Possible it sees some push back from the 200-day MA

Mastercard (MA) pulling back here to the rising trend-line. Watch for whether it can hold & bounce. . Alphabet (GOOGL) buying the dip off the rising trend-line today.

$NFE with a break in the declining trend-line while holding support underneath. . $SMCI with a massive bearish engulfing candle so far today. $HOOD broke through the upper channel band.

Tesla (TSLA) inverse head and shoulders most prominently seen on intraday charts and now trading in the gap from 1/25 Airbnb (ABNB) with solid short-term rising support underneath, but you want to pay close attention to the resistance above that it isn't part of a bearish wedge that is forming. History often rhymes Super Micro

Careful with Robinhood Markets (HOOD) right here as it is testing some significant resistance from 2022 with the upper channel band. Sherwin-Williams (SHW) attempting to push its way out of an ascending triangle. Significant support at the 50-day moving average. Coinbase Global (COIN) not a trade I would chase here, but certainly remains