TSLA clean break of declining resistance with old-trend-line resistance now looming, has previously struggled to push through in the past. Triangle pattern starting to break here, but just underneath it is testing the rising trend-line off of the March lows. Make or break moment for LLY. RIVN keep an eye this morning on a test

$GLD attempting to put in a new higher-low, following FOMC. $SLV bouncing off of the rising trend-line, suggesting it doesn't believe inflation is over. $PFE breaking through some major support dating back to 2015 this morning.

FOMC Statement Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

Costco Wholesale (COST) reports earnings on the 14th and people are chasing this 44 P/E stock right higher still. Total lunacy! As Luckin Coffee (LKNCY) continues to sell-off look for a pullback & buy opportunity at the lower channel band here. Major support looms for Oracle (ORCL) to be tested at $98. Could

Nice base forming on $NIO daily. Watch for the breakout above resistance. $GS currently testing the declining trend-line & on the verge of pushing through here. Financials are higher risk plays with FOMC on Wednesday.

$CRSP attempting to hold the declining trend-line following a massive sell-off today. Watch for a potential bounce here. $SOFI pushing through the declining channel to the upside. Little resistance until $9.15. $MS attempting to breakout of overhead resistance. Has already broke through the declining trend-line.

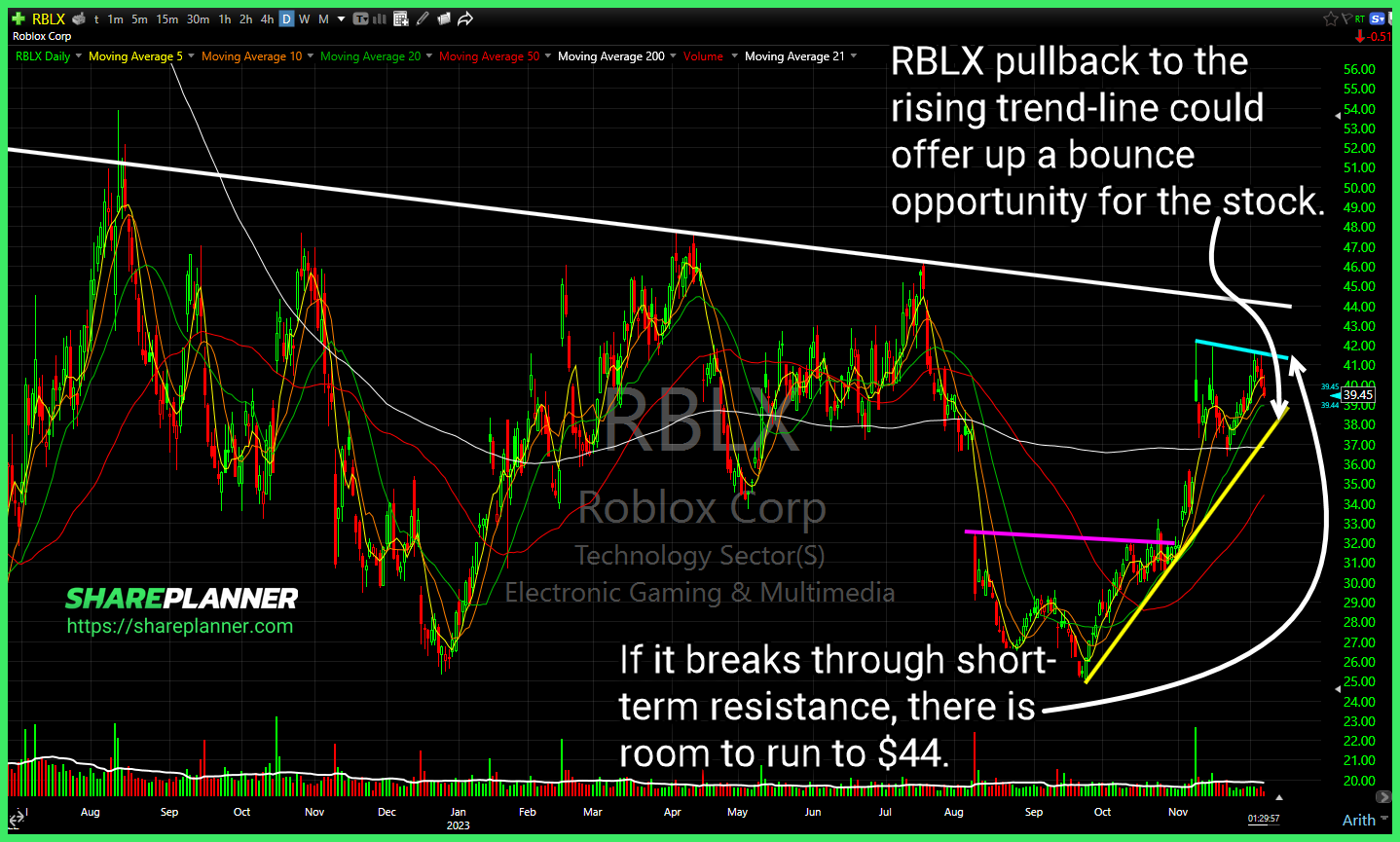

Roblox (RBLX) pullback to the rising trend-line could offer up a bounce opportunity for the stock. Darling Ingredients (Dar) breaking out of its base with room to run to $51 before encountering much resistance. Chewy (CHWY) Hard bounce off of support following a large gap lower this morning. Some support attempting to be found for

10 year yield is now testing a major long-term rising trend-line, after selling off almost two months $TNX Similar pattern continues to emerge on $PYPL, and each time it has resolved itself to lower prices here. Huge red flag if that trend-line breaks down again

Fiverr International (FVRR) declining trend-line getting retested on the pullback. Worth waiting first to see if it will bounce or not before trying to get long on it. Otherwise it may end up pulling back to the original breakout level. Snap (SNAP) finally pushing through long-term resistance. High risk for a head fake due to

$MARA on a gap higher like this, gotta take some profit off the table in order to reduce risk. 5-day moving average would be my key on the trade. A close or hard move below and I would exit the trade. This resistance has been strong against price when it comes to $SLV. Fourth straight