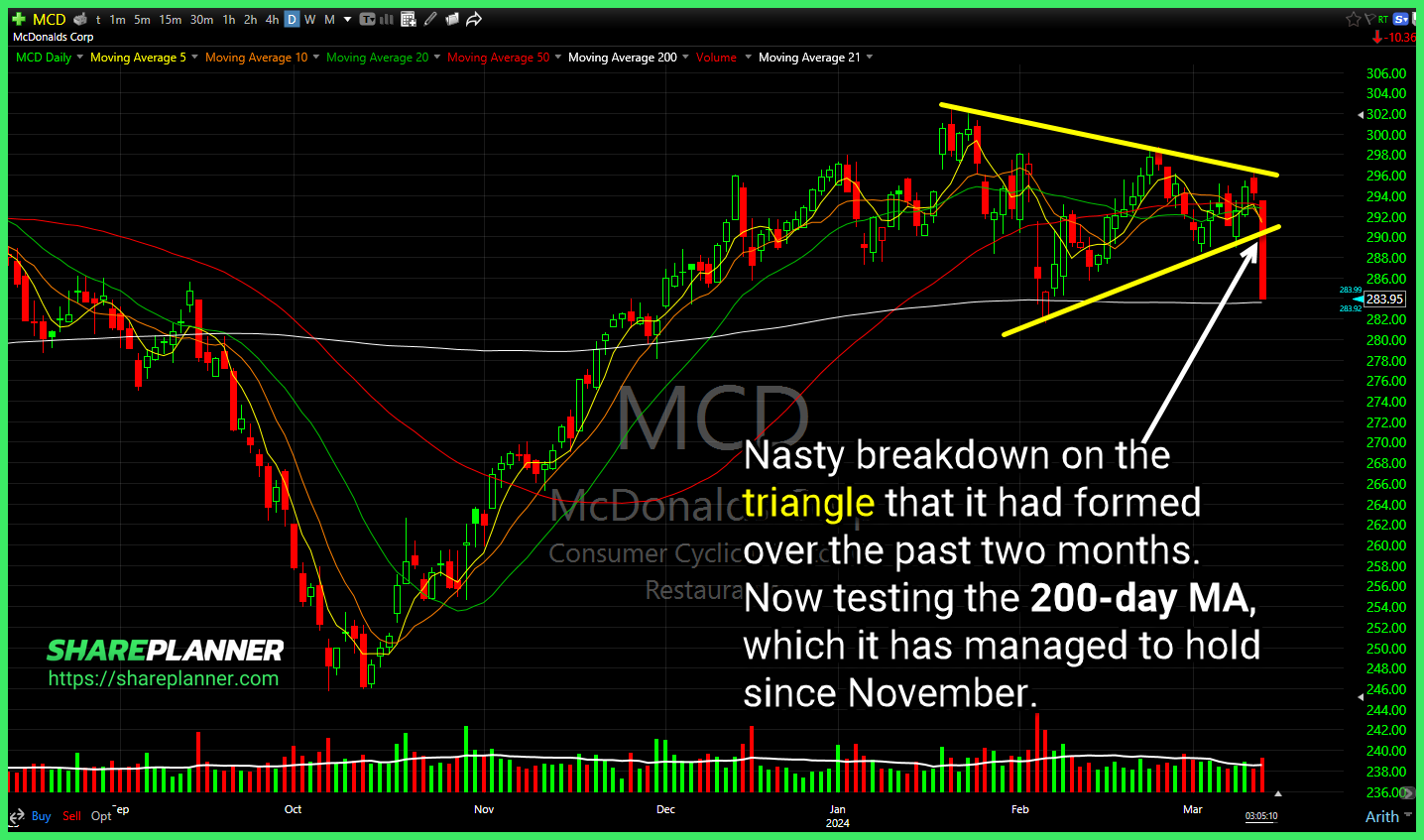

Nasty breakdown on McDonalds (MCD) with the triangle that it had formed over the past two months. Now testing the 200-day MA, which it has managed to hold since November. SoFi Technologies (SOFI) wedge break following a breach of the rising trend-line looks at a potential move back down to its lower channel band.

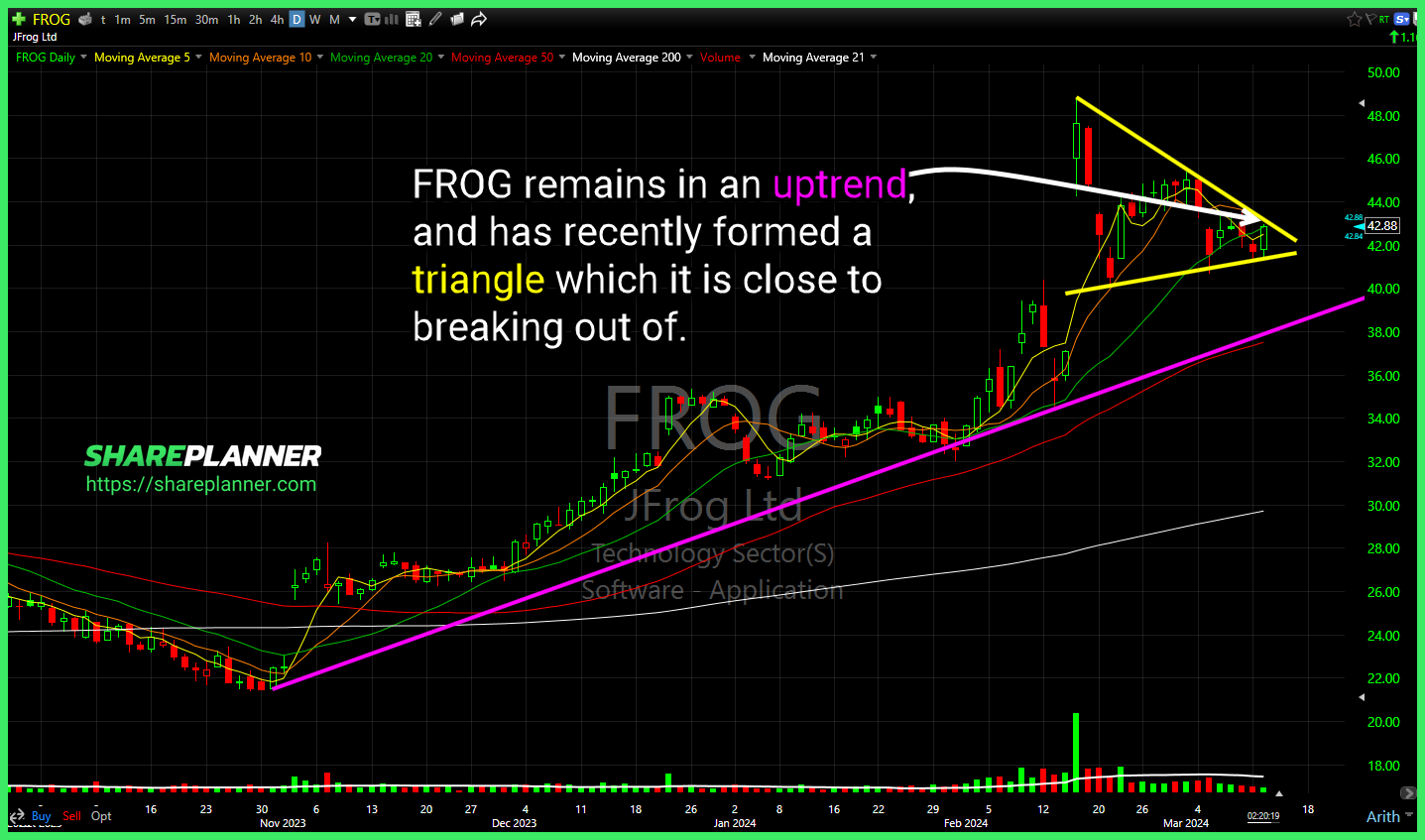

JFrog (FROG) remains in an uptrend, and has recently formed a triangle which it is close to breaking out of. FTAI Aviation (FTAI) strong bounce off of the rising trend-line. Rising channel on Boeing (BA) a broken yesterday, and strong continuation to the downside today. Huge headline risk as well, No reason to even go

Microsoft (MSFT) holding the rising trend-line here, but not quite getting much in the way of a bounce so far. Semiconductor ETF (SMH) attempting to find some support here on this pullback. Boeing (BA) breaking below the lower channel band that goes back to October '22

Lululemon Athletica (LULU) declining channel despite strong run higher. Needs to push through the $468 level to change stock's trajectory. Sunrun (RUN) attempting to breakout of the triangle. However, heavy price level resistance is pushing back on the stock here, and could see a break lower instead. Jacobs Solutions (J) ascending triangle pattern setting up

T-Mobile (TMUS) breaking out of a bull flag yesterday, with follow-through today. Strong volume as well. MedPace (MEDP) ascending triangle breakout, right after the opening bell. ZipRecruiter (ZIP) head and shoulders confirmed, continuation triangle pattern forming with a break to the downside today. Palantir Technologies (PLTR) holding the channel breakout from last month, and now

Possible that $FSLR breaks out of that base here. Very volatile and wild stock for swing trading at times. . $SPY attempting to set the stage for an end of day rally with this inverse head and shoulders forming. $CMC solid bounce off of the trend-line, with potential room to run up to resistance at

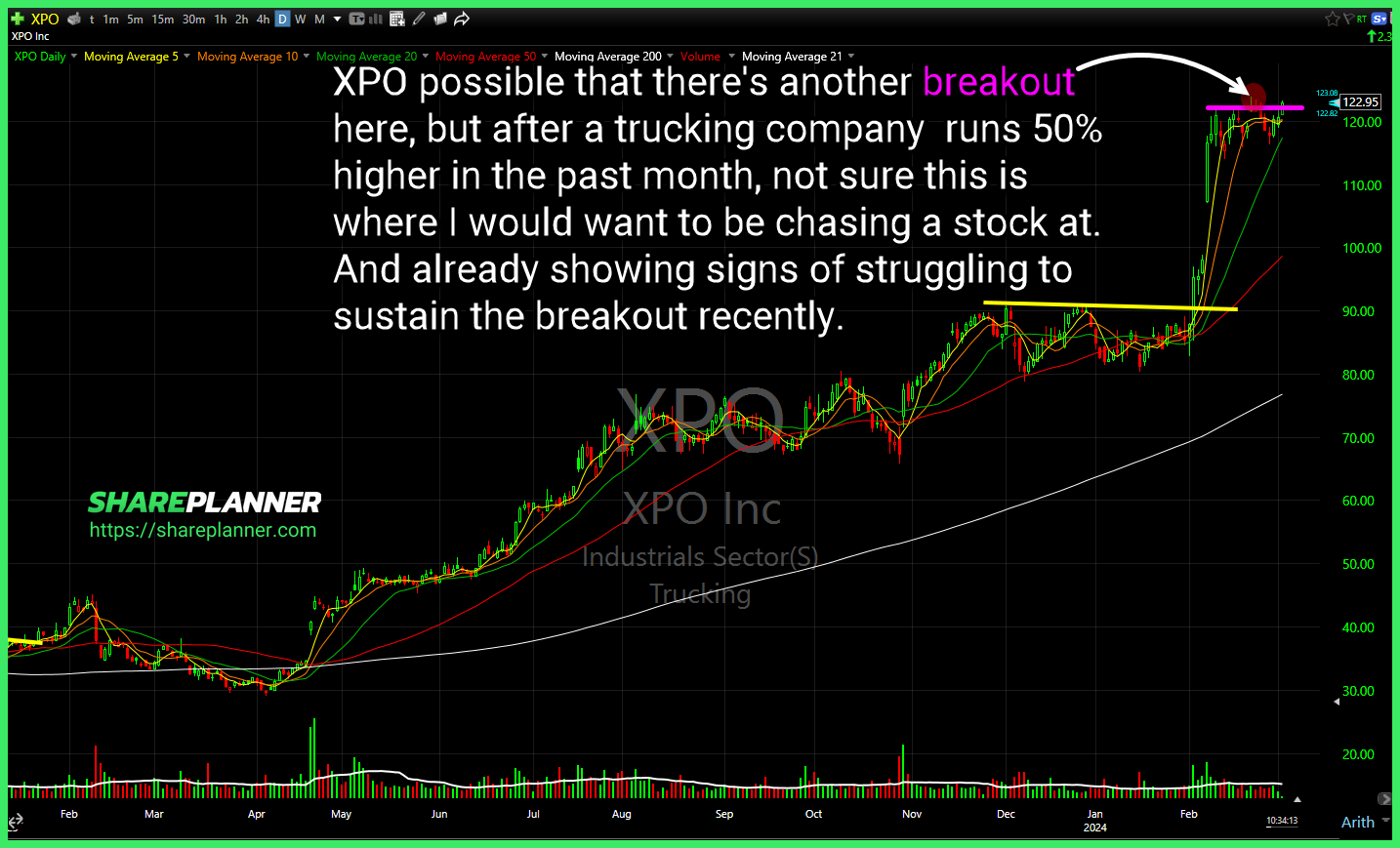

XPO (XPO) possible that there's another breakout here, but after a trucking company runs 50% higher in the past month, not sure this is where I would want to be chasing a stock at. And already showing signs of struggling to sustain the breakout recently. Major break in resistance on Friday for SPDR Gold ETF

Nasdaq 100 (QQQ) 30 min chart will zero chill in it. Another breakout attempt unfolding on Russell 2000 (IWM) today. A solid push through resistance so far. If US Global Jets ETF (JETS) breaks out of the continuation triangle, then it has to immediately contend with long-term declining resistance. A no-go for me. Heavy resistance

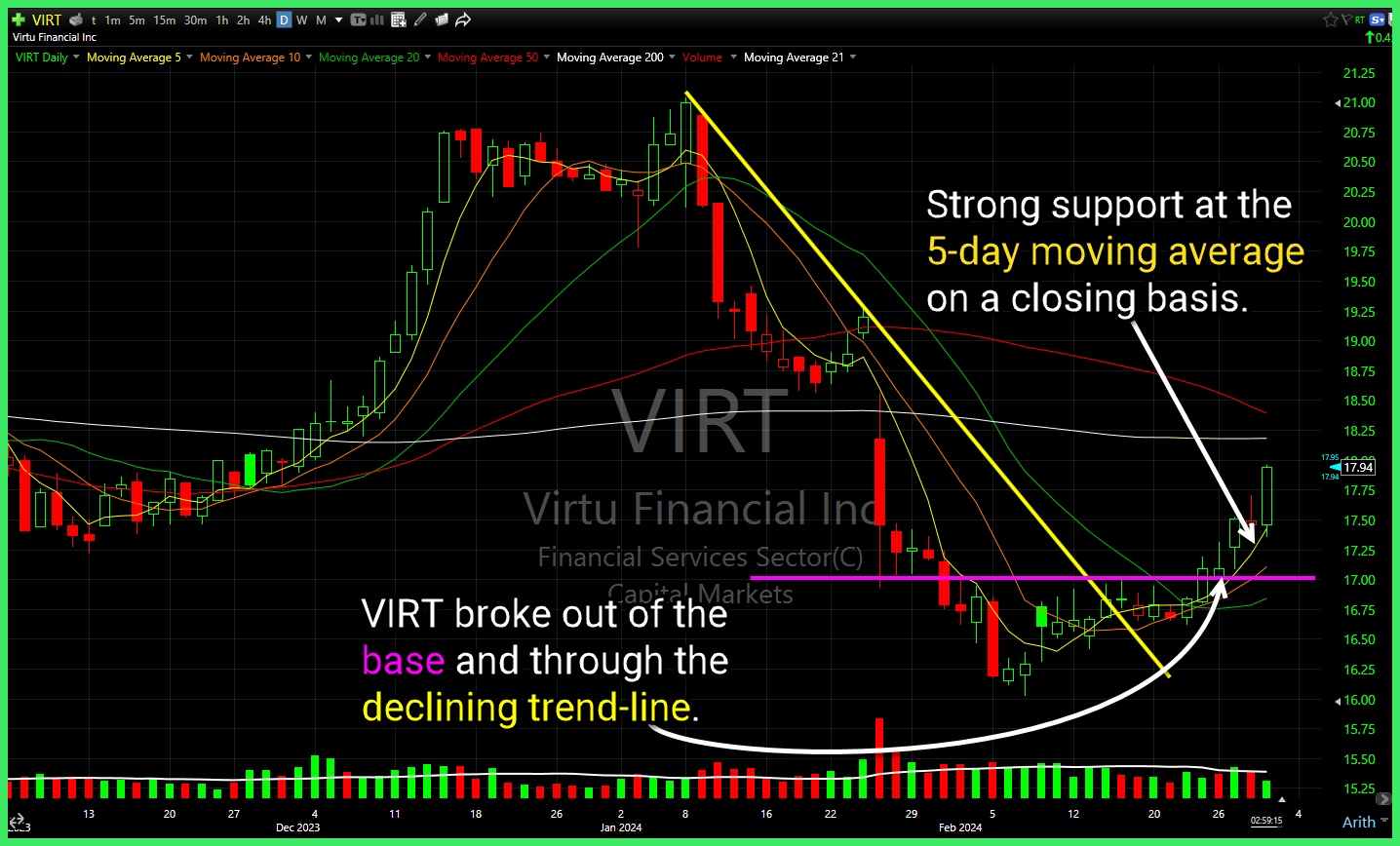

$VIRT broke out of the base and through the declining trend-line. . $IWM gapped above resistance today, and has since pulled back for a retest. Watching here to see whether that level holds, or if it starts to fade and close the gap from this morning. Bull flag in $WYNN attempting to breakout. Rising trend-line