Not sure this is the bear flag you want to play on Bitcoin (BTC) with long-term support underneath (using the IBIT chart).

Double bottom breakout in play, but notice some of the unusual long term resistance on the chart that Bitcoin (IBIT) is currently dealing with.

Bitcoin (BTC) confirming that bear flag pattern I've been talking about. Watch for a move into the 70's.

The Bitcoin ETF (IBIT), has had a tremendous run since its inception, but lately, it has started to show some signs of weakness. After hitting a high of $71.82, the stock has pulled back and is now trading around the $57/share mark. This pullback is significant, and it’s happening at a critical technical juncture that

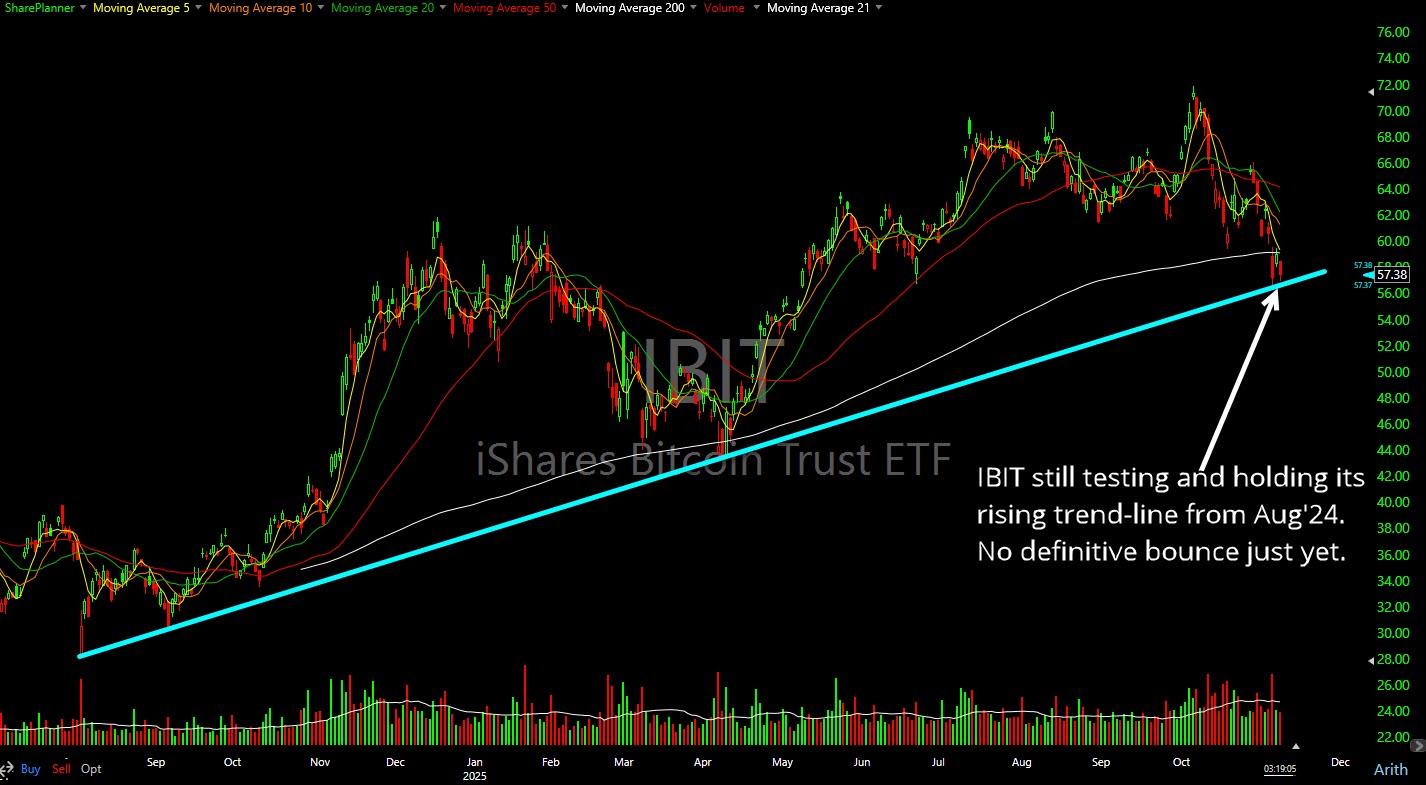

Pullback in the Bitcoin ETF (IBIT) continues to, so far, test and hold the rising trend-line, but yet to get a solid bounce out of it.

Bitcoin (BTC) very close here to a breakdown. If that happens, the next level is the rising trend-line at 96k.

Widening Divergence between Strategy (MSTR) and Bitcoin (BTC)

Episode Overview In today's episode, I talk about the merits of trading just one stock and the potential hazards it poses and why it leaves you looking for "a trade setup" rather than "the trade setup". 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:00] Should You Trade Just One Stock?Ryan opens the

Bitcoin hype finding its way into GameStop (GME) but that momentum may already be fading intraday.

Fear is subtly showing itself in various assets.