$MARA cup and handle pattern forming but still needs to push through and close above the 200-day moving average first. $PLTR attempting to break through a long-term resistance level as well as confirm a multi-year cup and handle pattern. Next stop would be upper-$20's. Since Tuesday, $QQQ has been all consolidation - going sideways since

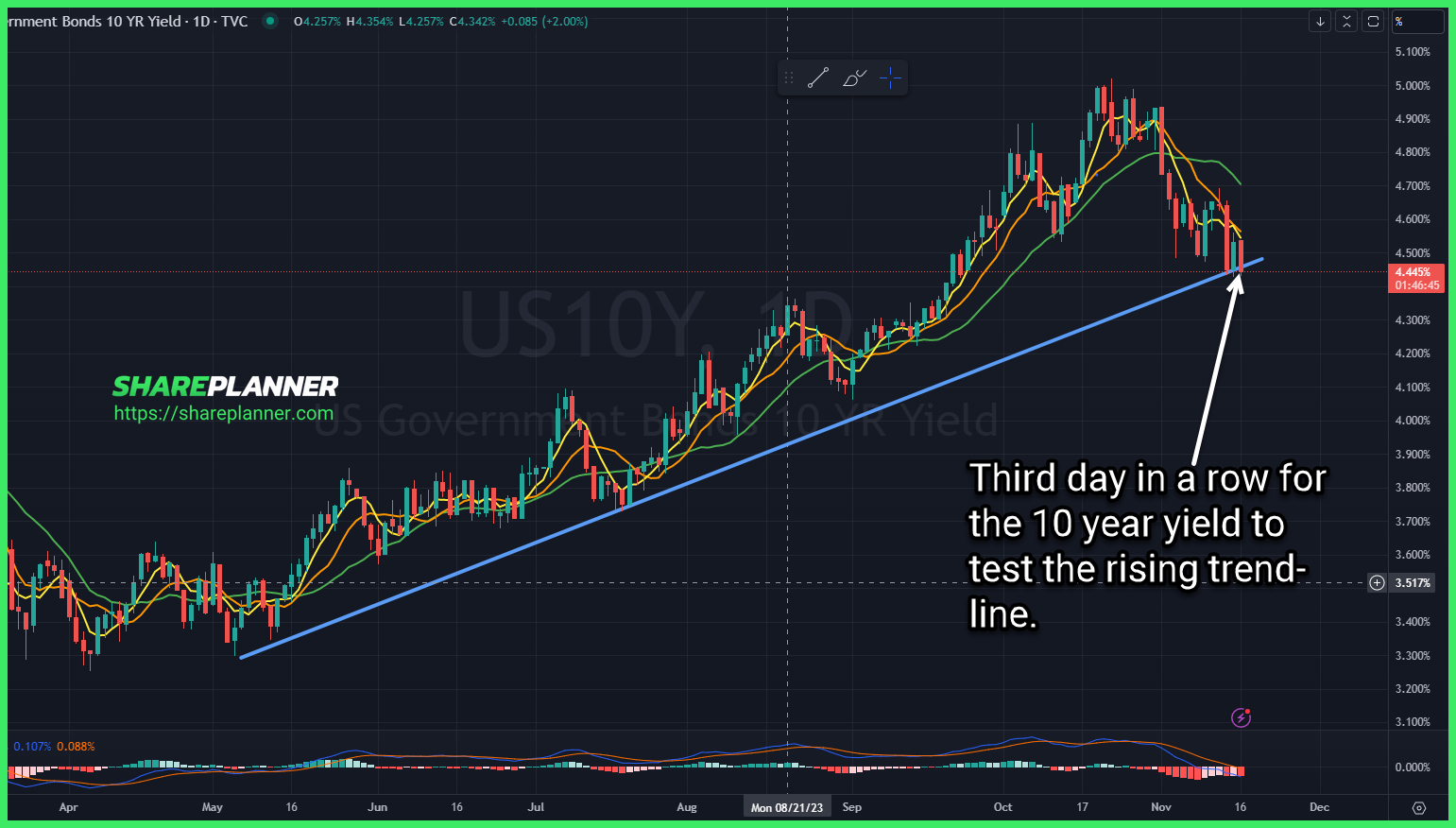

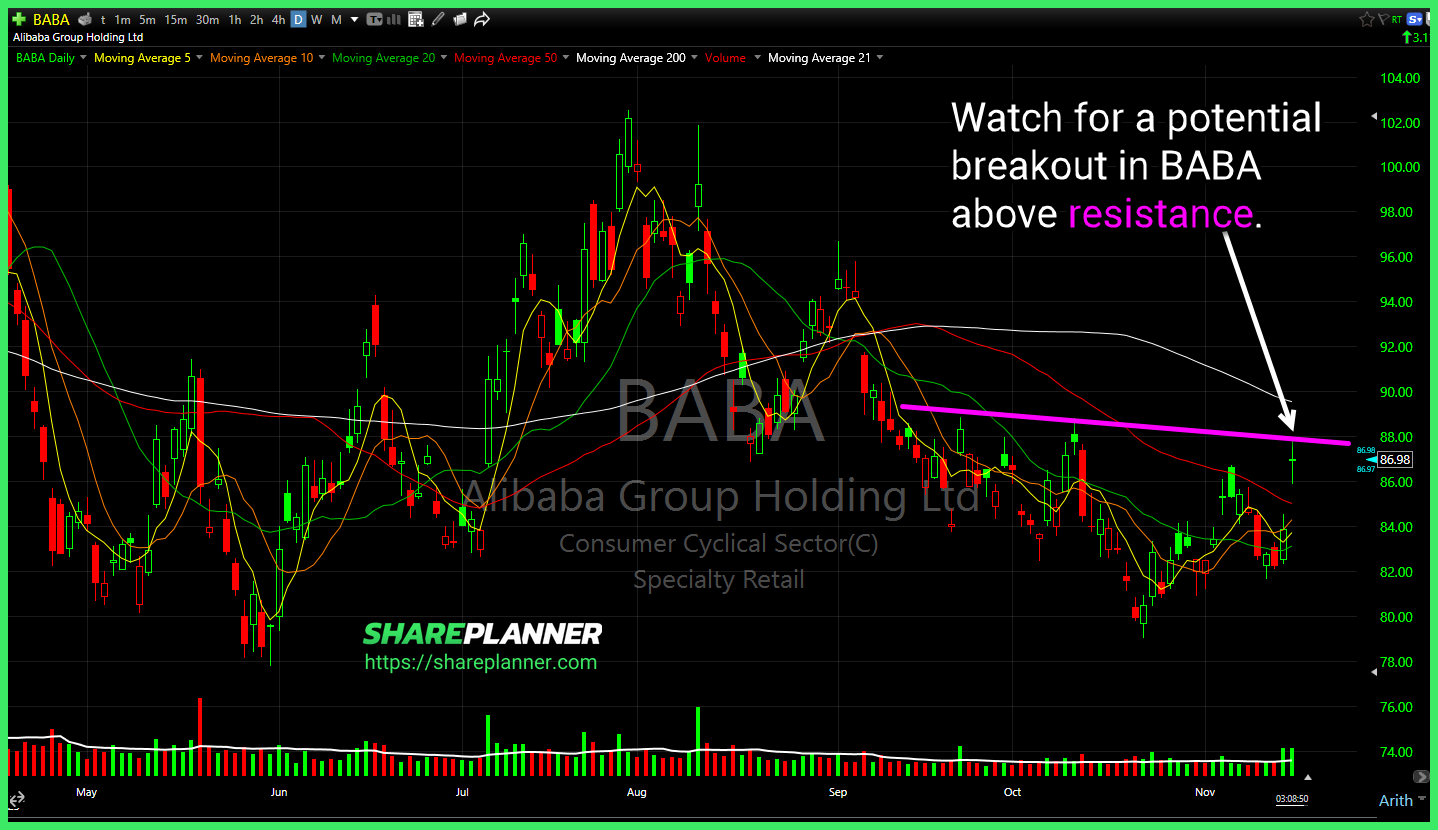

Third day in a row for the 10 year yield (TNX) to test the rising trend-line. Tesla (TSLA) Analysis Alibaba Group (BABA) testing support following a massive earning sell-off. This is a key area to hold going forward. Ugly reversal following yesterday's developing basing pattern.

Watch for a potential breakout in Alibaba Group (BABA) above resistance Vertex Pharmaceuticals (VRTX) testing lower-trend-line. Best to wait for evidence of a bounce instead of assuming gone will take place.

$SMCI nearing a triangle breakout. $IWM declining trend-line getting tested here, with a massive gap underneath.

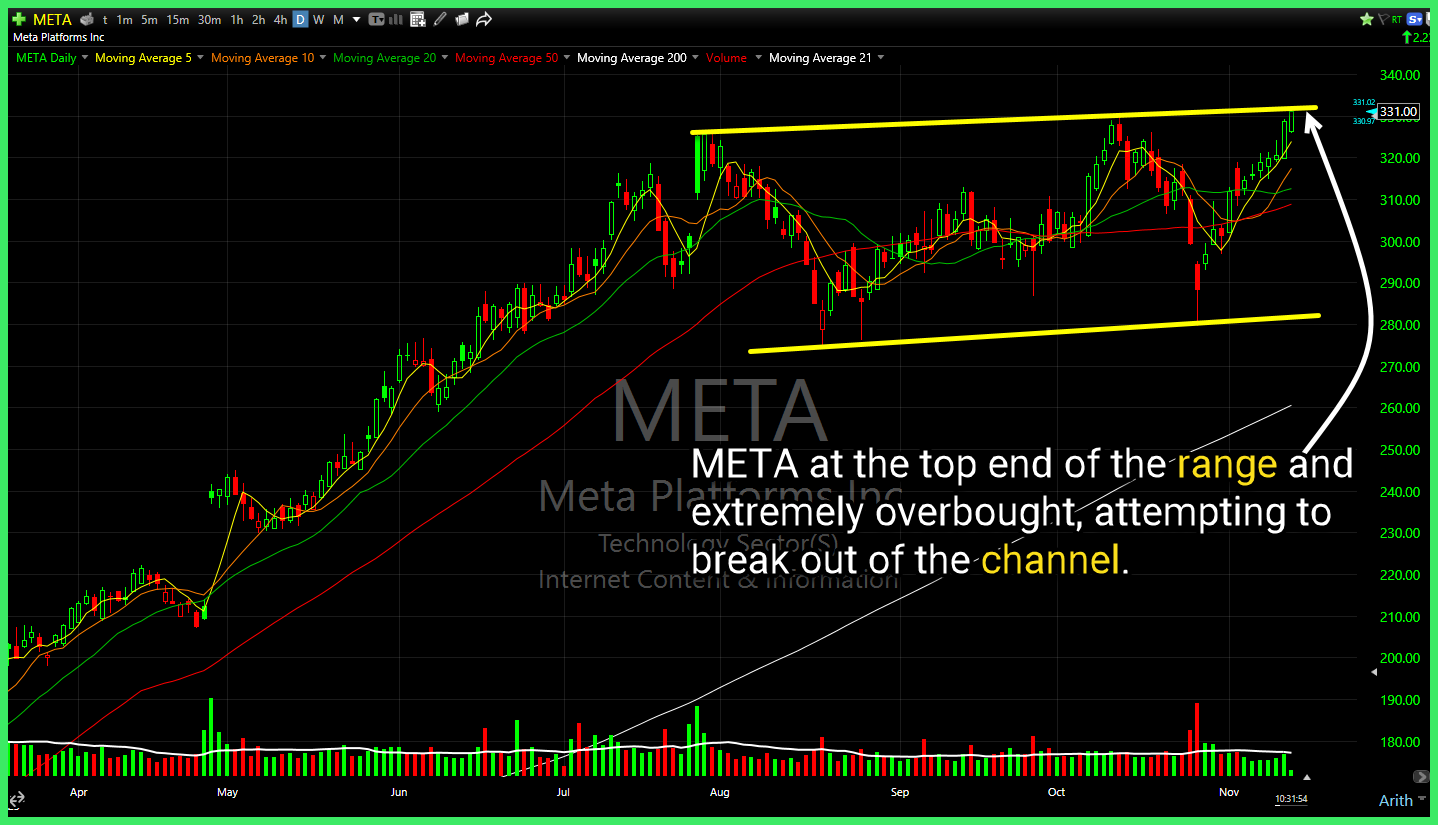

$META at the top end of the range and extremely overbought, attempting to break out of the channel. $MDT working on a potential base. A breakout would occur just underneath $74. Some resistance overhead to be aware of though, and earnings scheduled for 11/21.

$SOFI attempting to bounce off of declining support but still faces overhead resistance. $PLTR breaking out of a declining resistance $AIG may be forming a wedge pattern to play the breakout on, but resistance overhead remains a problem.

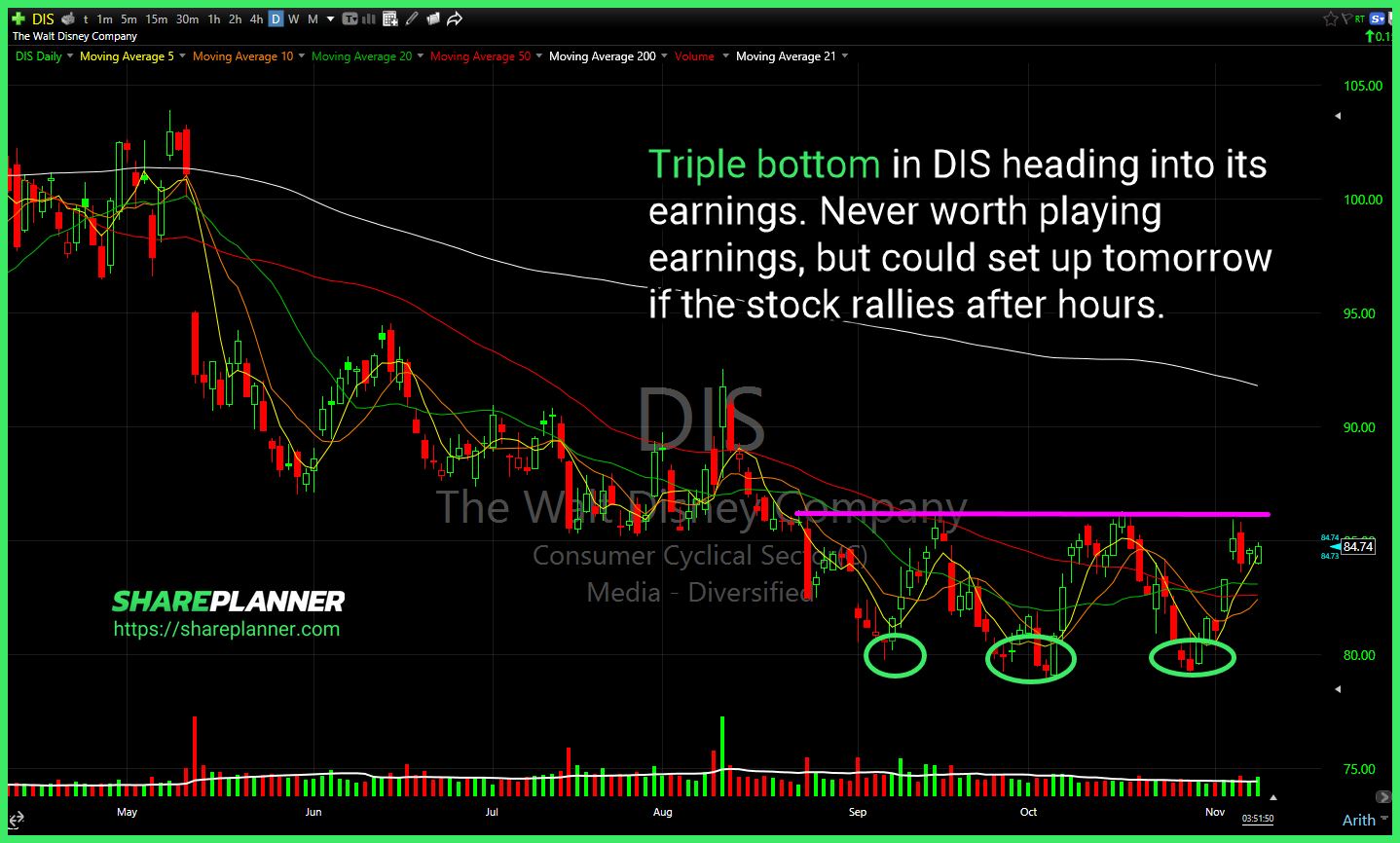

$AMC remains absolute dog-water, being down 92% since December. Bulls are going to want to hold on to hold on to this key support level, or more turmoil should be expected. $GME declining trend-line off of the June highs remains well intact and continues to reject price on every test. $DIS currently sitting at heavy

Triple bottom in $DIS heading into its earnings. Never worth playing earnings, but could set up tomorrow if the stock rallies after hours. $NVDA breaking the declining trend-line here, rallying 19.3% in 7 days. Playing a breakout with that steep of a rally prior to, doesn't create an ideal reward/risk ratio. $DLTR cup and handle

$COST back to testing major resistance. Previous attempts led to sharp rejections. $SMH right there on the upper channel band trying to break through here. $CELH with a heavy sell-off today. Watch these two key support levels.

Chevron (CVX)Analysis 1) Short-term support broken, setting up for a retest of long-term trend-line. 2) Declining trend-line above creating lower-highs. 3) Short-term trend-line also broken. First Solar (FSLR) declining channel remains perfectly intact and seeing a hard rejection off the upper channel band today. Apple (AAPL) starting the week by pressing up against declining resistance.