Are we loving this market yet? Whether you are long or you are short, your nerves are fried. I’ve been both during the down turn, and both sides of the trade have their moments of difficultly and frustration. But now that the market has dramatically sold off, where do we currently stand in this market?

By no means are things improving for this market. There is plenty to be concerned with but no one headline that has yet to really drive fear into the heart of investors. You have Ebola worries, ISIS terrors, European banking concerns, rising dollar, POMO drying up, and politicians in DC that concern themselves more with the golf

It seems to me that anytime there are multiple days of selling in a row, that traders en masse proclaim that the market has reached a top – or better yet, they give you a ten reasons why you should believe the market has topped. But let’s look at what’s really going on in this

Information received since the Federal Open Market Committee met in July suggests that economic activity is expanding at a moderate pace. On balance, labor market conditions improved somewhat further; however, the unemployment rate is little changed and a range of labor market indicators suggests that there remains significant underutilization of labor resources. Household spending

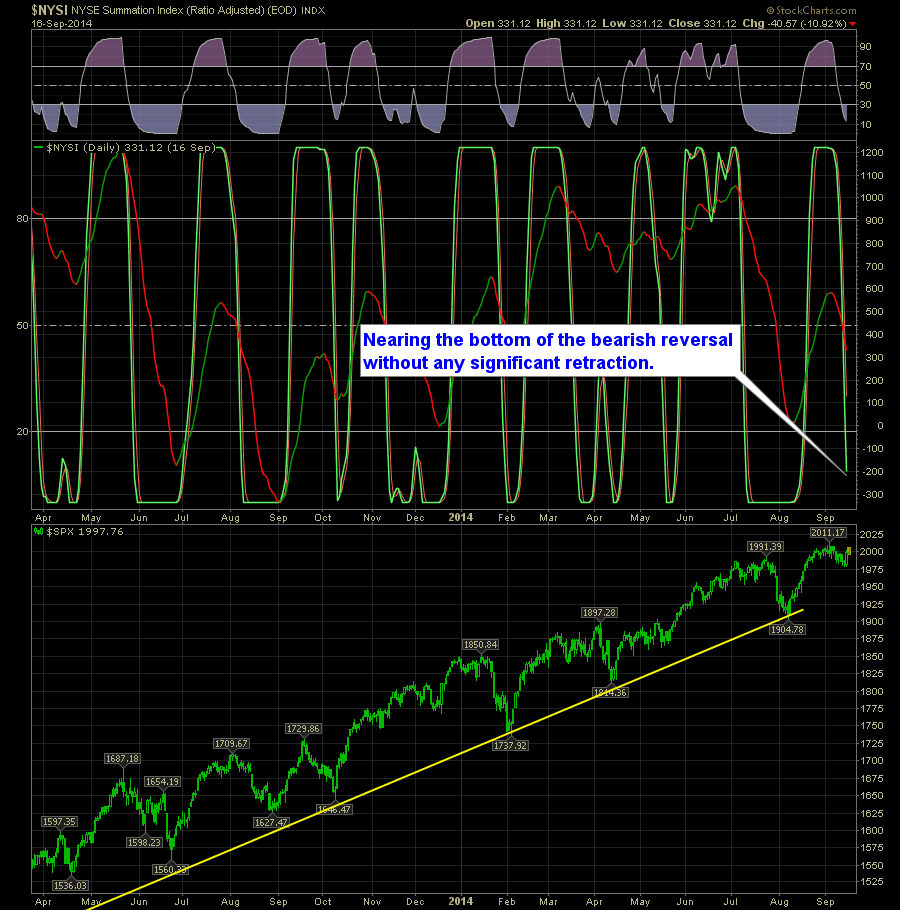

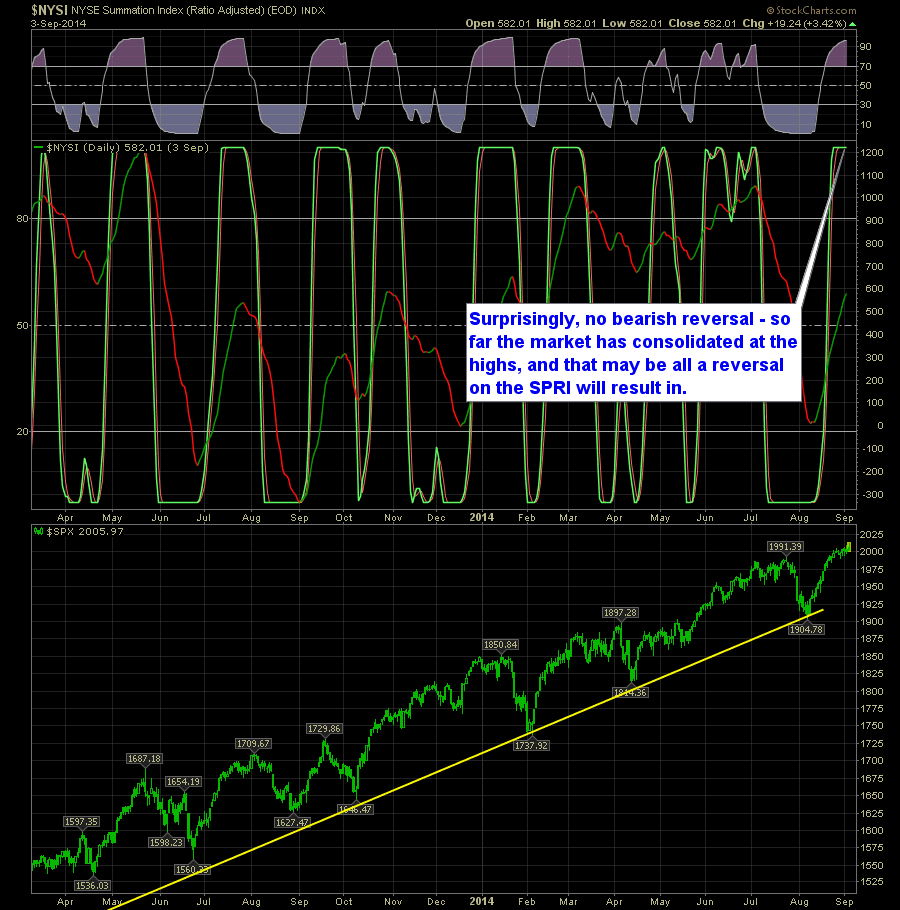

SharePlanner Reversal Indicator with different view points. For years now I have been following the SPRI on a near daily basis and I’ve pretty much seen every signal that it can give off, particularly when trying to make sense of what the daily and weekly SPRI charts are trying to tell me simultaneously. On the

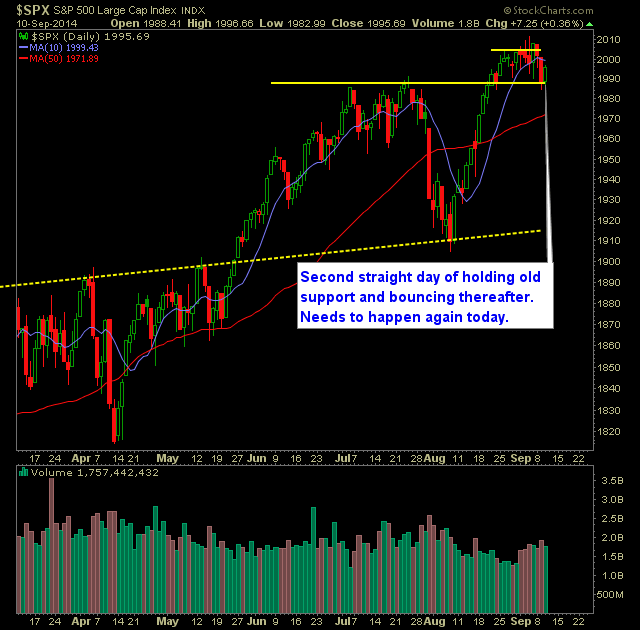

Pre-market update: Asian markets traded 0.3% higher. European markets are trading 0.7% lower. US futures are trading 0.4% lower ahead of the market open. Economic reports due out (all times are eastern): Jobless Claims (8:30), Quarterly Services Survey (10), EIA Natural Gas Report (10:30), Treasury Budget (2) Technical Outlook (SPX): SPX tested support at 1887 yet

I’m not willing to go out on a limb and say that the bull rally is dead and long live the bears just yet. In fact I haven’t even brought myself to short a stock yet this month. And I won’t until the price action starts to confirm as much and while yesterday we saw

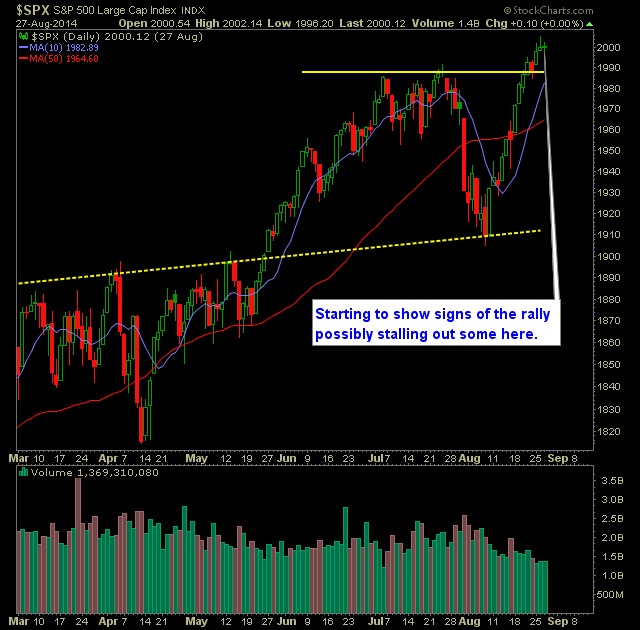

Exhaustion isn’t necessarily a bad thing for the markets to experience It just means that the current trajectory of the markets can be sustained. In fact it can easily be said that what we have seen over the last seven trading sessions has been a form of exhaustion in and of itself. The theory of

Pre-market update: Asian markets traded 0.1% lower. European markets are trading flat. US futures are trading 0.2% higher ahead of the market open. Economic reports due out (all times are eastern): Personal Income and Outlays (8:30), Chicago PMI (9:45), Consumer Sentiment (9:55) Technical Outlook (SPX): SPX had strong sell-off initially yesterday, but the dip-buyers came in

Pre-market update: Asian markets traded 0.5% lower. European markets are trading 0.7% lower. US futures are trading 0.4% lower ahead of the market open. Economic reports due out (all times are eastern): GDP (8:30), Jobless Claims (8:30), Corporate Profits (8:30), Pending Home Sales Index (10), EIA Natural Gas Report (10:30), Kansas City Fed Manufacturing Index (11)