SharePlanner Reversal Indicator back in line on both time frames. Last week you had early reversals on both time frames going in opposite directions – a phenomenon that I couldn’t recall ever seeing. Well it looks like it will be a short-term move as the daily is still striding towards the upper extremes. Here’s the

SharePlanner Reversal Indicator still showing mixed signals on multiple time frames. I hate it on the rare occasions that this happens, but I think it is a testament to the current market conditions, where inside of an already tight trading range, you have a two month long triangle pattern that is narrowing the range even

This is one of the few indicators that I follow a great deal. This isn’t a tell-all indicator that knows exactly the direction the market will take, instead it is a tool that gauges the temperature of the market to see how well it is doing under the surface. Kind of like taking the temperature

I am not a huge fan of this week's readings. Granted the weekly chart only shows two day's worth of action for this week's price action and the remaining three days worth could alter the current path that it is currently on. But nonetheless, the sudden and unexpected bearishness is something worth noting. You don't

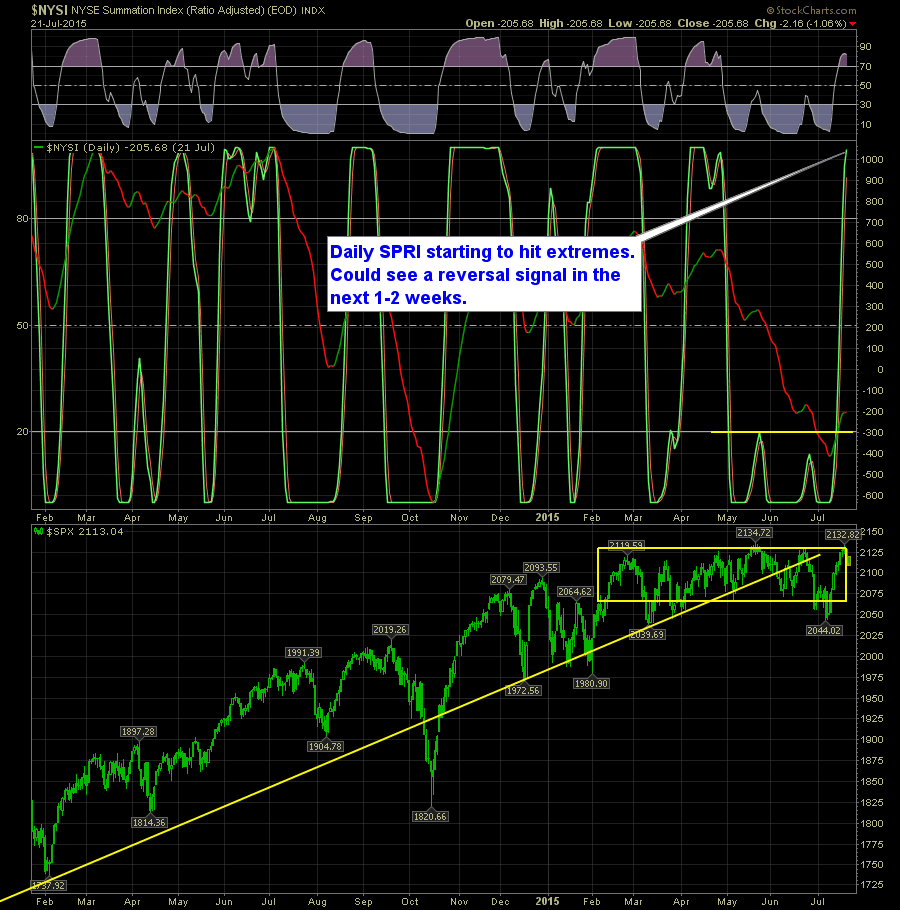

Mixed signals in the SharePlanner Reversal Indicator for now. On the Daily SPRI you have a downward turn that has taken place since the last reading was published. This isn’t all that surprising considering the day-to-day movements play a much greater influence on the daily time frame. The reading, in fact, is already nearing extremes.

Information received since the Federal Open Market Committee met in June indicates that economic activity has been expanding moderately in recent months. Growth in household spending has been moderate and the housing sector has shown additional improvement; however, business fixed investment and net exports stayed soft. The labor market continued to improve, with solid job

The VIX has been one of my biggest concerns over the past 48 hours. No doubt that the market has been rallying hard and fast over the past six trading sessions. My big concern though at this point is the Volatility Index (VIX). Over the past year, the lower 12’s, high 11’s have been

The SharePlanner Reversal Indicator is onto something here. On the SPRI you have matching reversals on both the daily and weekly time frame. A few weeks ago, I mentioned that the SPRI needed to break out of the base of the past few months and today it is doing exactly that. Here is the Daily

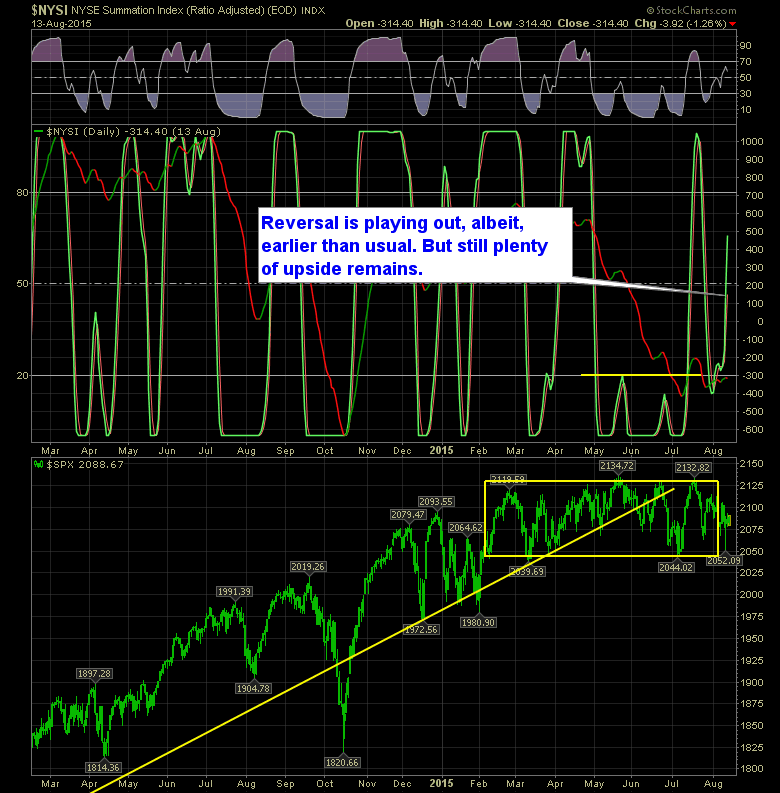

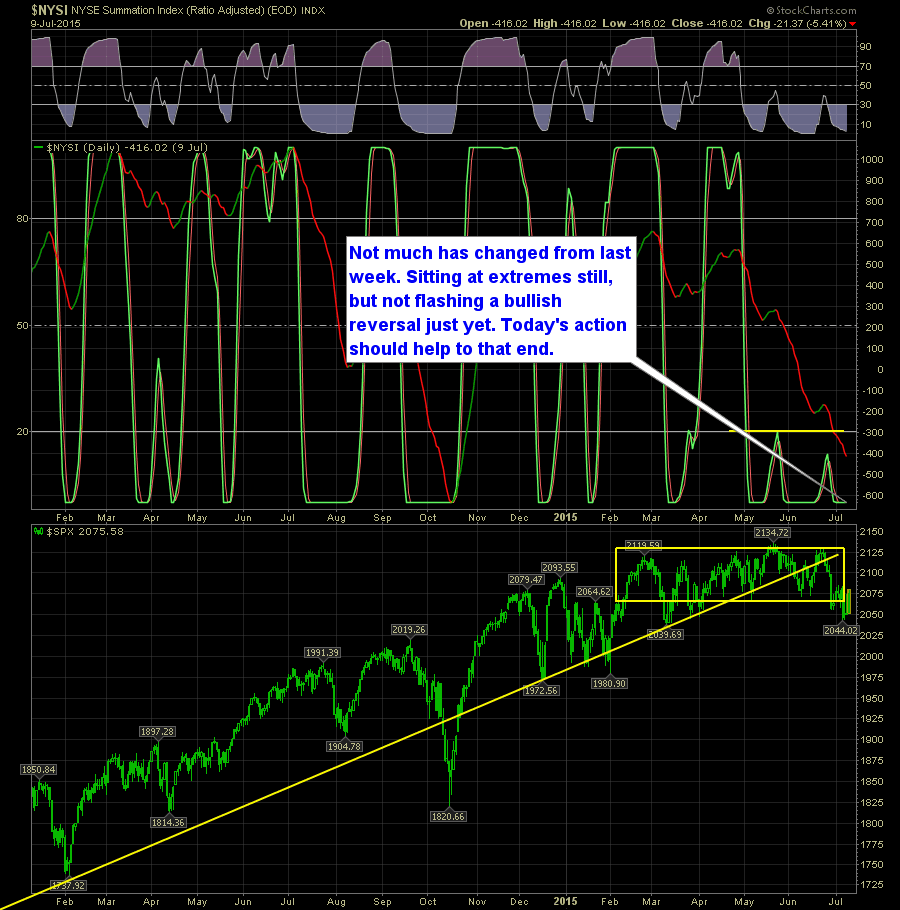

SharePlanner Reversal Indicator sits at extremes waiting for a bullish reversal. That hasn’t happened yet, but it could any day now. On the daily reversal you have had two previous attempts to get a rally confirmed and moving but could not push above and out of the base. Now it is basing for a third