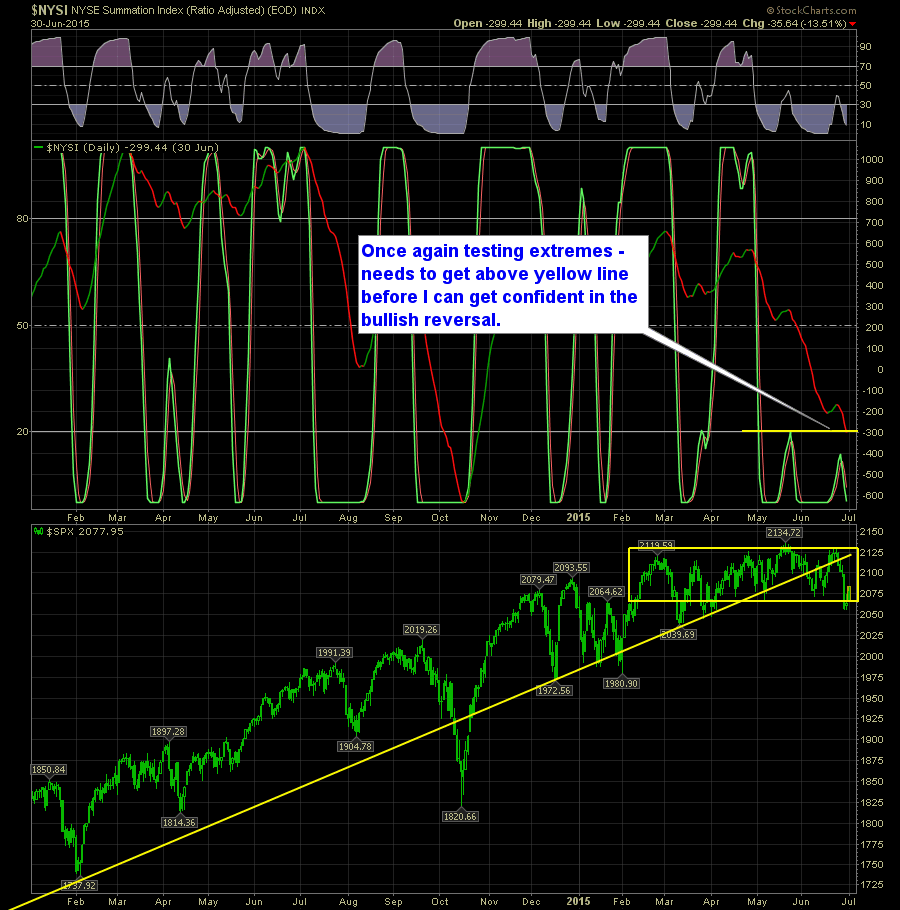

Last week I mentioned concerns that the bottoms that were being formed on the SharePlanner Reversal Indicator could not be trusted. Those bottoms were creating a very sloppy bullish reversal pattern but on the Daily SPRI, there was already one failure to launch, as a result I’ve provided a clear resistance level that needs to

For quite some time now, the VIX has been nearly unbearable to watch – stuck in a range that had it between 12 and 15. Anytime the lower 12’s were tested, you could be sure the market would have a quick 1-2% sell-off and any time the downtrend off of the October highs was

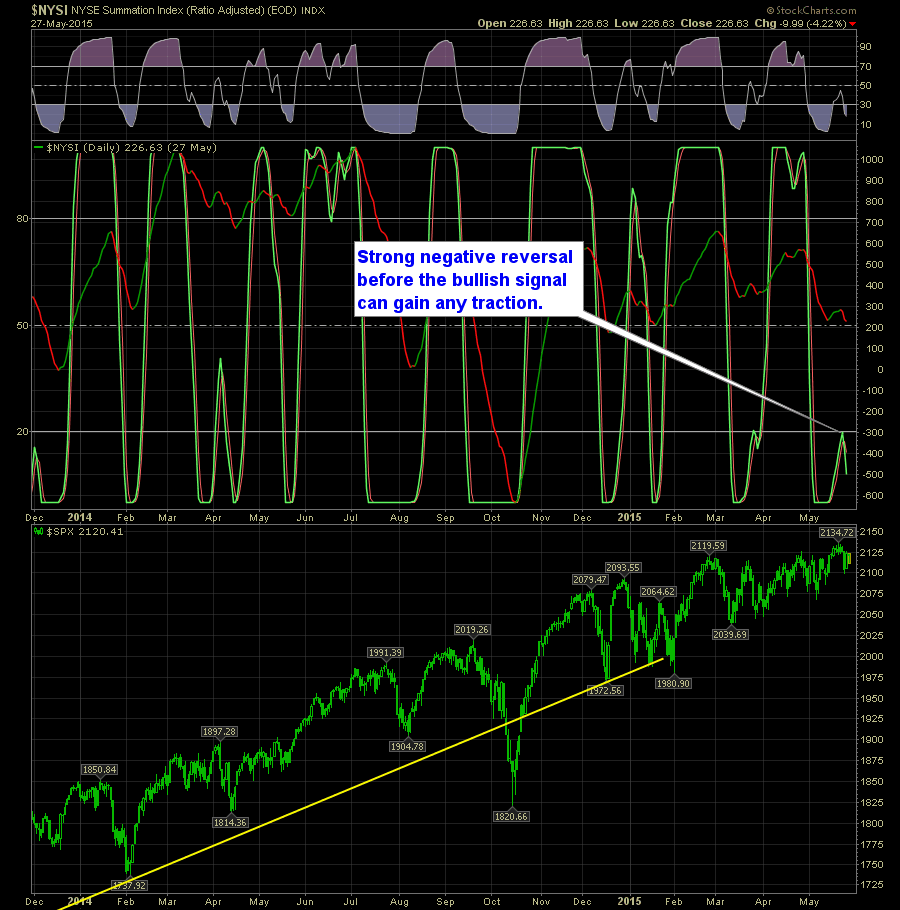

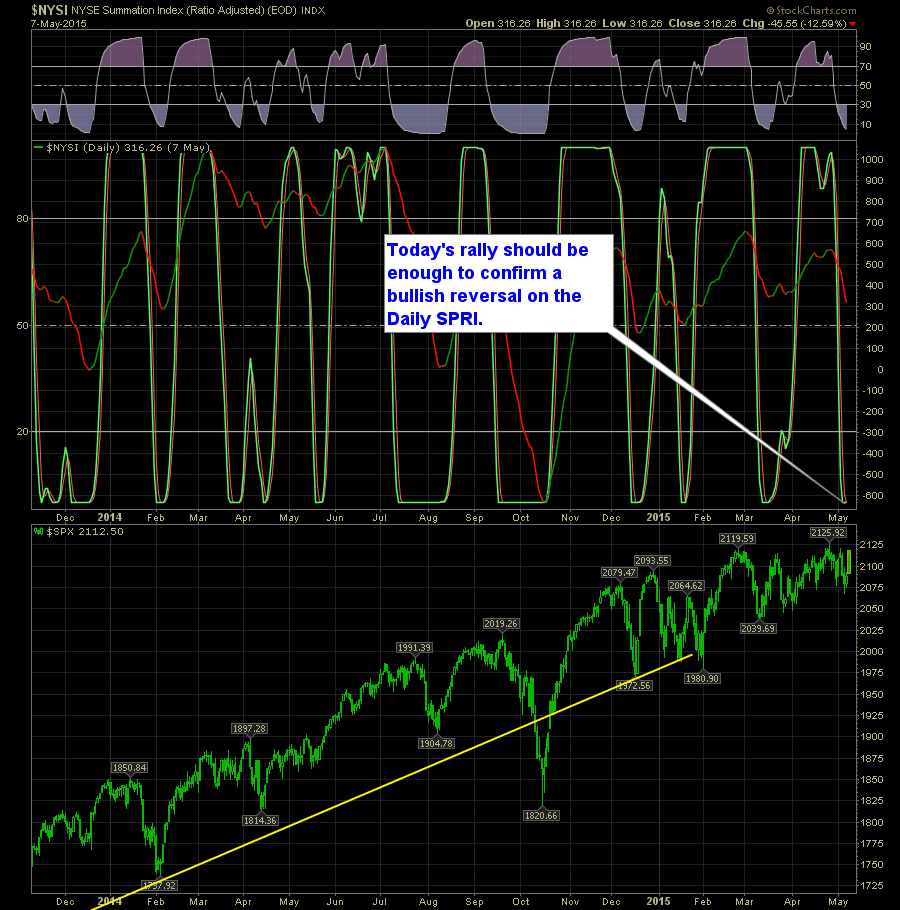

SharePlanner Reversal Indicator is flashing "Bullish Reversal" on both time frames. On the daily, you have a fantastic looking reversal underway, however, we have seen of late, where it doesn't take much for a false reversal to take place. So the daily needs to see rapid expansion out of the bottom area of the chart

Information received since the Federal Open Market Committee met in April suggests that economic activity has been expanding moderately after having changed little during the first quarter. The pace of job gains picked up while the unemployment rate remained steady. On balance, a range of labor market indicators suggests that underutilization of labor resources diminished

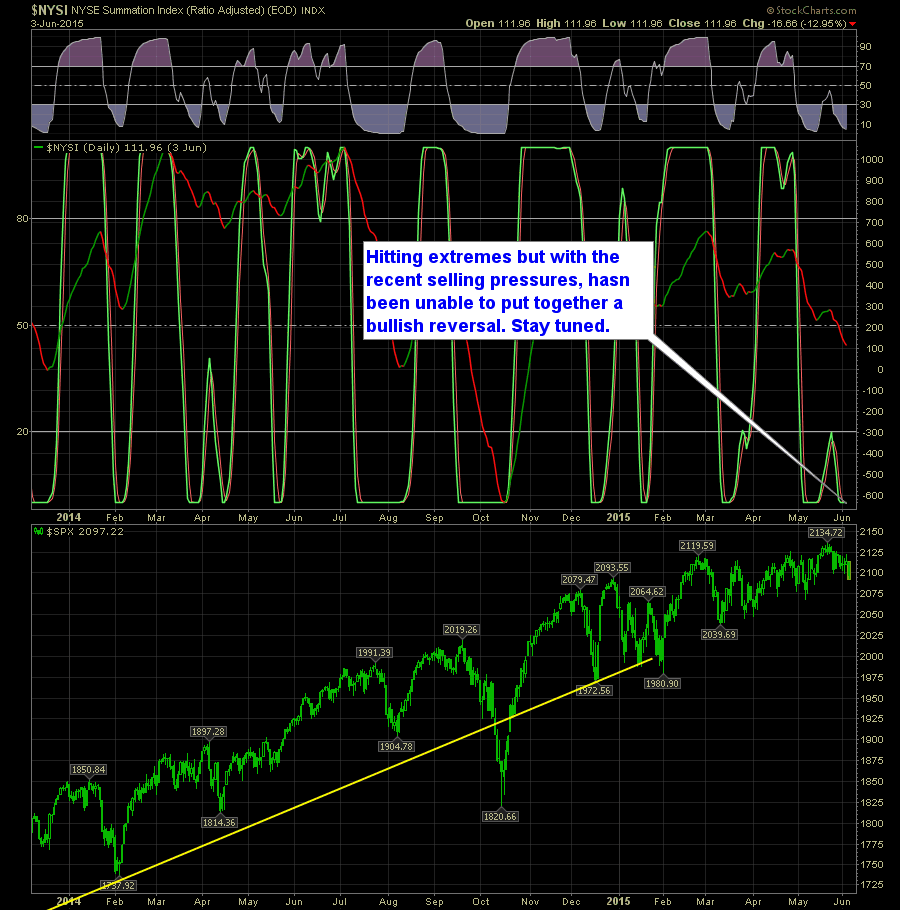

The SharePlanner Reversal Indicator is at extremes but not ready for any bullish reversals just yet. On the Daily SPRI you have a flat line reading that suggests any kind of bullishness will be enough to provide an upside reversal on the indicator. Here’s the Daily SPRI:

SharePlanner Reversal Indicator has been waiting to flash the bullish reversal for quite some time now but like the market as a whole it just sits idle…for now at least. On the daily chart you have the potential for a bullish confirmation on even a minor rally. However, every time the market tries to rally,

SharePlanner Reversal Indicator still leaning bearish. The daily last week attempted a reversal that seemed to have had some legs to go on, but with some of the weakness that has been seen so far this week, the Daily SPRI was quickly influenced and reversed back to the downside. Here’s the Daily SPRI:

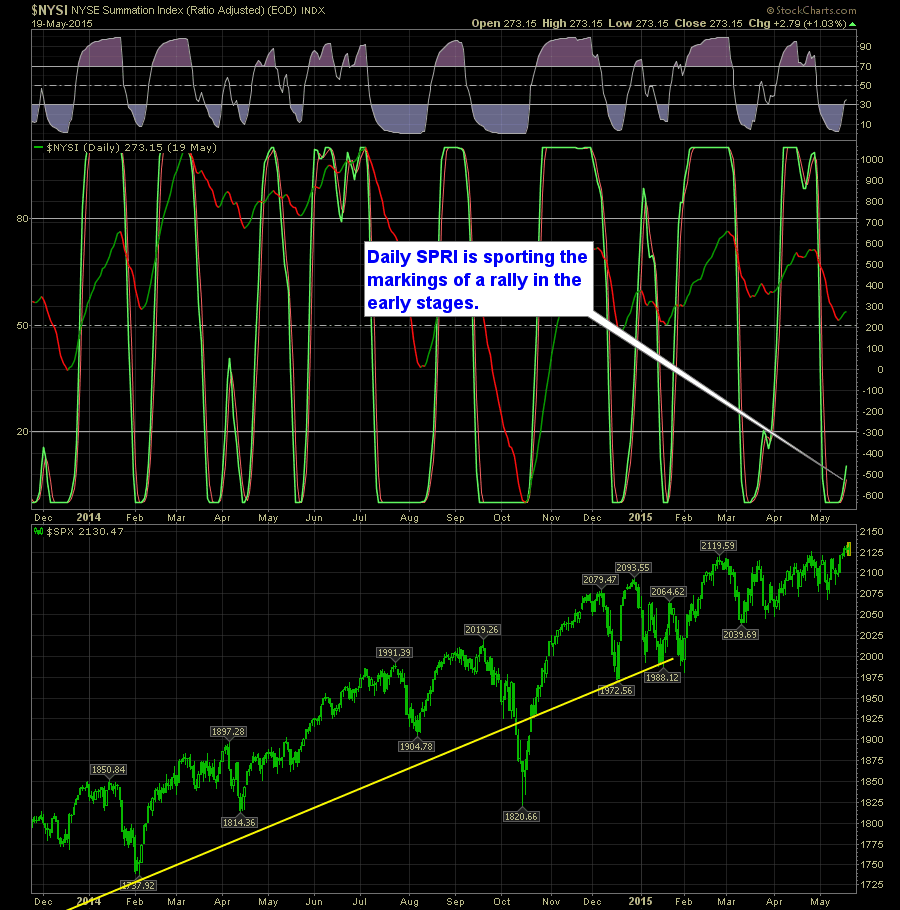

The SharePlanner Reversal Indicator on the daily time frame is showing a reversal that is just getting underway to the upside. Here’s the Daily SPRI:

SharePlanner Reversal indicator is showing mixed signals right now. On the daily you have a clear bottom in place and with today’s rally, will likely show a confirmed bullish reversal. Here’s the Daily SPRI:

The SharePlanner Reversal Indicator isn’t looking to hot these days for the bulls. I’m not necessarily saying that the uptrend is over (if you want to call it an ‘uptrend’). Nonetheless, based on price action that I’ve seen this week and coupled with the sluggish behavior my indicator is exhibiting, I’d say less is more