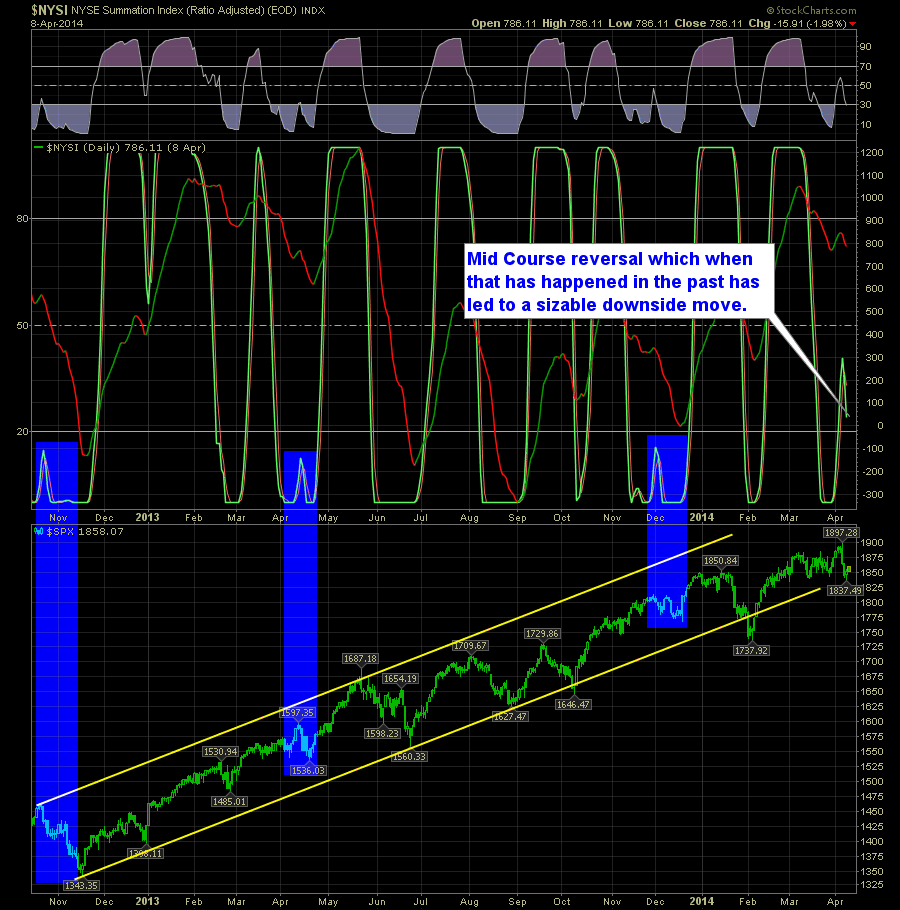

The SharePlanner Daily Reversal Indicator flashed a reversal signal to the downside in conjunction with yesterday’s sell-off. The Daily SPRI was already reaching overbought territory, but with yesterday’s weakness, it confirmed a short-term reversal should be in order for stocks. Here’s the Daily SPRI:

Information received since the Federal Open Market Committee met in March indicates that growth in economic activity has picked up recently, after having slowed sharply during the winter in part because of adverse weather conditions. Labor market indicators were mixed but on balance showed further improvement. The unemployment rate, however, remains elevated. Household spending appears

On the verge of mixed signals of the SharePlanner Reversal Indicators and the best advice I can give is to wait for some price confirmation one way or the other. On the Daily SPRI you have the indicator racing towards extremes where an eventual bearish reversal occurs. Here’s the Daily SPRI:

The reversals on both the daily and the weekly SharePlanner Reversal Indicators are looking great for additional price movement higher. However, we have been range bound on the S&P 500 for two months now and if we are going to put any faith in this reversal price needs to break out of this consolidation pattern.

Bullish signs are creeping in again on the SharePlanner Reversal Indicator and they are aligning nicely on the weekly and daily time frames. Here’s the Daily SPRI:

We are seeing some follow through today on the indices, but to be honest, it looks weak to me. That may change by the end of the day, but all the previous bounces following hard sell-offs has resulted in sizable ‘snap-backs’. In two days we have only moved 12 points. Unless we rally hard in

Here’s my market analysis to cap off the week:

The latest rendition of the SharePlanner Reversal Indicator: On the daily side of things, we have hit extremes but no reversal to the upside as of yet. Very little downside movement so far out of SPX since we got the downside reversal signal. In fact the best thing the bears have going for it

Information received since the Federal Open Market Committee met in January indicates that growth in economic activity slowed during the winter months, in part reflecting adverse weather conditions. Labor market indicators were mixed but on balance showed further improvement. The unemployment rate, however, remains elevated. Household spending and business fixed investment continued to advance, while

It is another one of those blasted Fed days where you are left sitting on your hands not making any moves in the market until the annointed Fed Chairman delivers her blessing or curse on the market. While we wait, let's take a look at the SharePlanner Reversal Indicator and see what it has to