The SharePlanner Reversal Indicator is not nearly as uber-bullish as it had been the past few weeks. But it is still bullish. On the daily though you are at extremes that suggests some kind of pullback or at the very least, consolidation of some kind is likely here. Here’s the Daily SPRI:

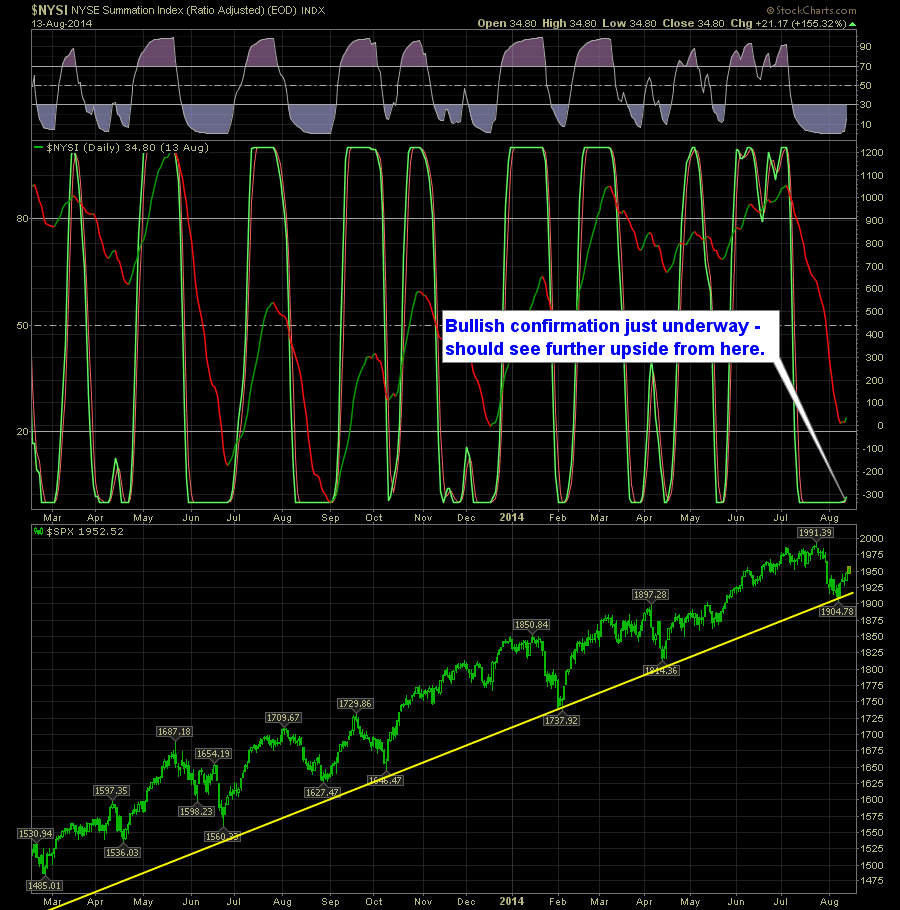

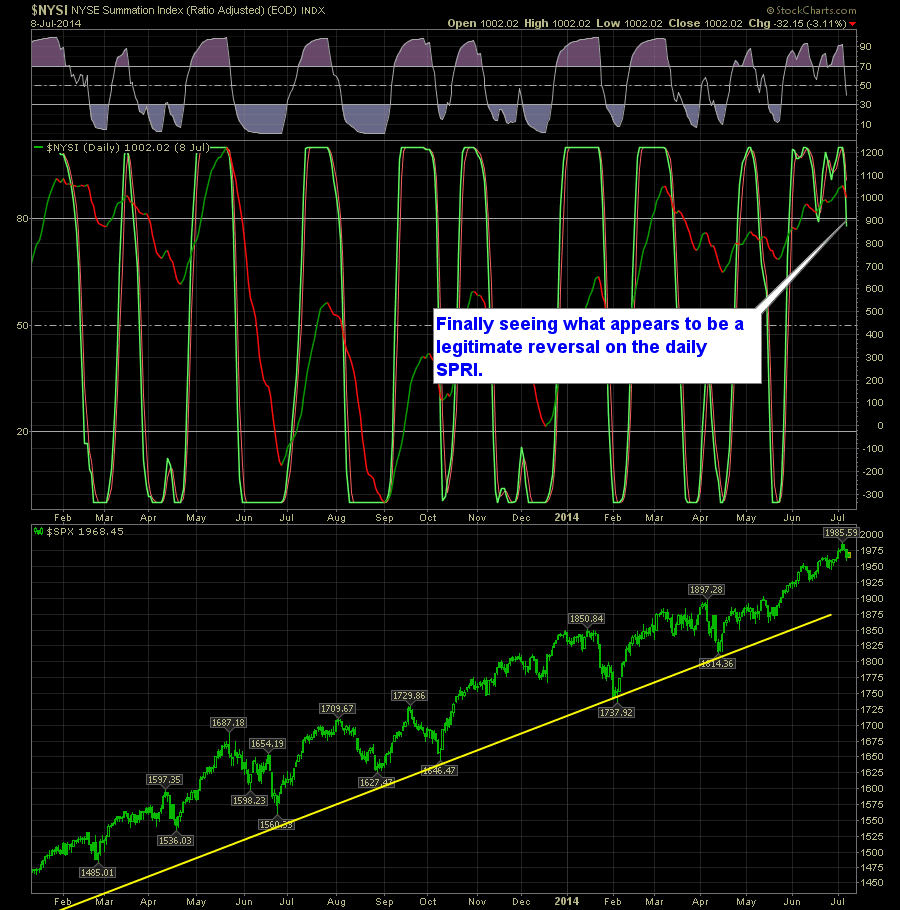

Last week’s update of the SharePlanner Reversal Indicator stated that a significant bounce was bound to happen and it did. And still the reversal looks like it is in the early stages on both time frames. Here’s the Daily SPRI:

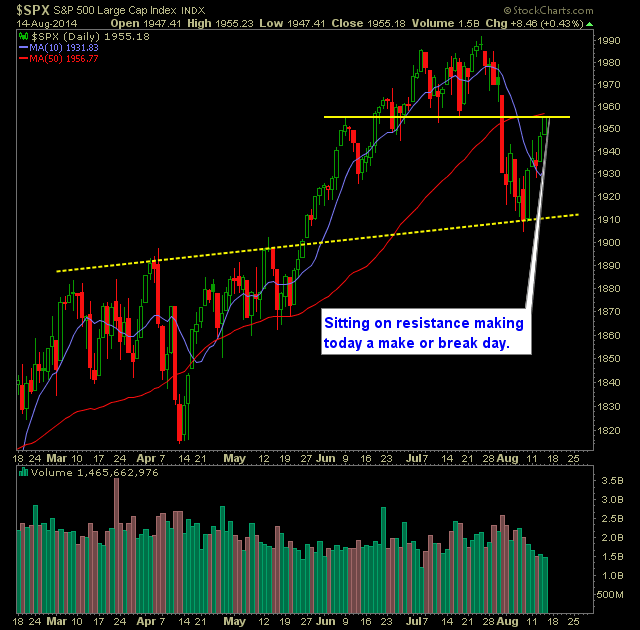

Pre-market update: Asian markets traded 0.2% higher. European markets are trading 0.9% higher. US futures are trading 0.2% higher ahead of the market open. Economic reports due out (all times are eastern): PPI-FD (8:30), Empire State Manufacturing (8:30), Treasury International Capital (9), Industrial Production (9:15), Consumer Sentiment (9:55), E-Commerce Retail Sales (10) Technical Outlook (

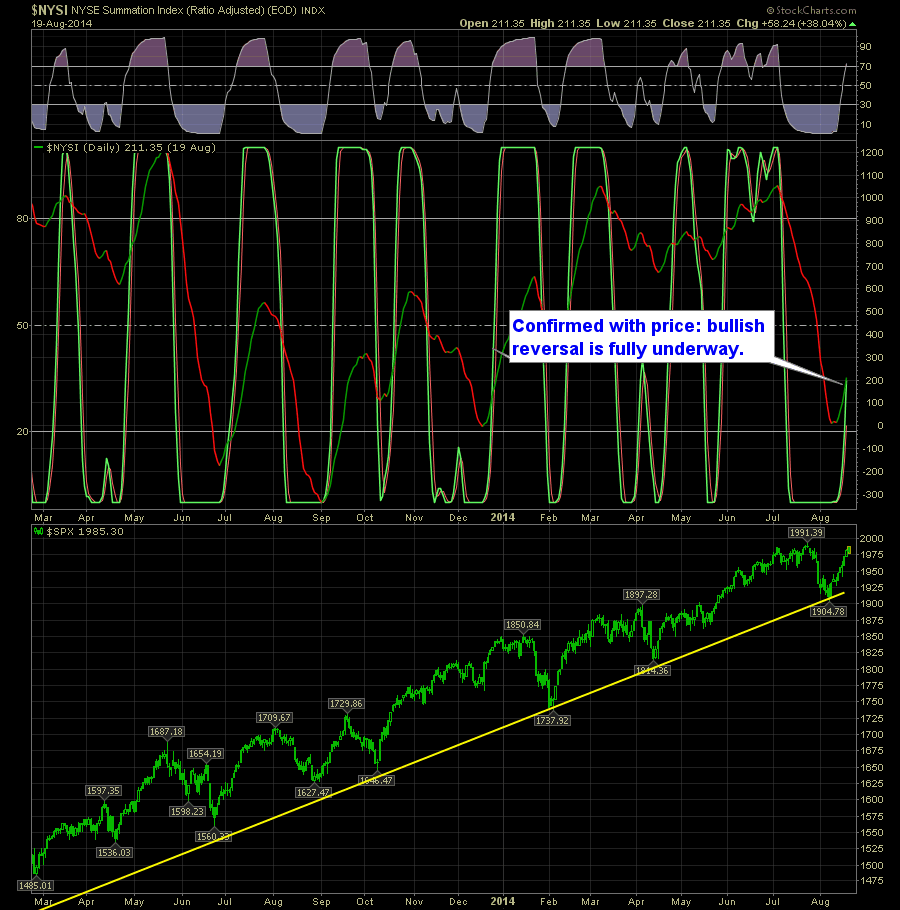

Very rarely do you get a simultaneous confirmation as perfect as what we are currently seeing on the daily and the weekly of the SharePlanner Reversal Indicator. On the daily, after a long bottoming process we just got the bullish reversal in the past day indicating that now is the time you want to be

Obviously traders are expecting the worse from the market at this point in time. And that may very well come to fruition, but you have to be willing to work within the confines of this market and what it is willing to offer. While the short setups are enticing at these levels, they don’t come without a

Information received since the Federal Open Market Committee met in June indicates that growth in economic activity rebounded in the second quarter. Labor market conditions improved, with the unemployment rate declining further. However, a range of labor market indicators suggests that there remains significant underutilization of labor resources. Household spending appears to be rising

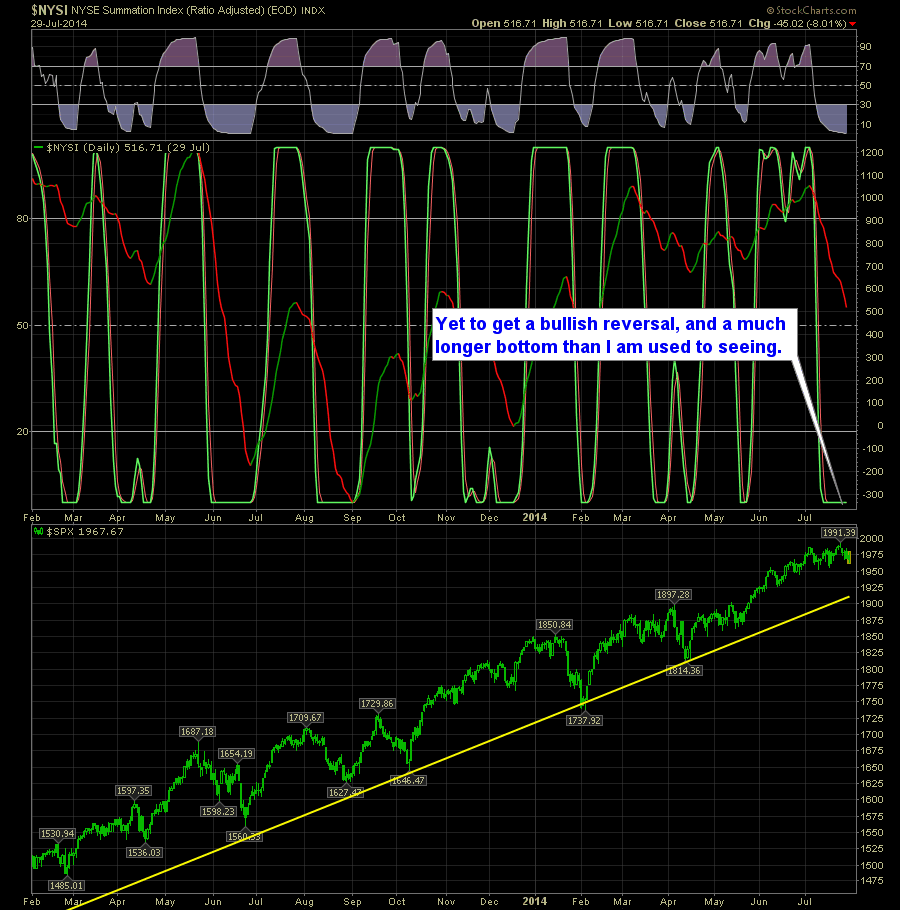

Not much has changed since the last SharePlanner Reversal Indicator – but the signals have just gotten that more obvious. On the daily you have a legitimate bottom in place and the first signs of strength this market exhibits will confirm that the bottom is in place and lead to a nice rally to the

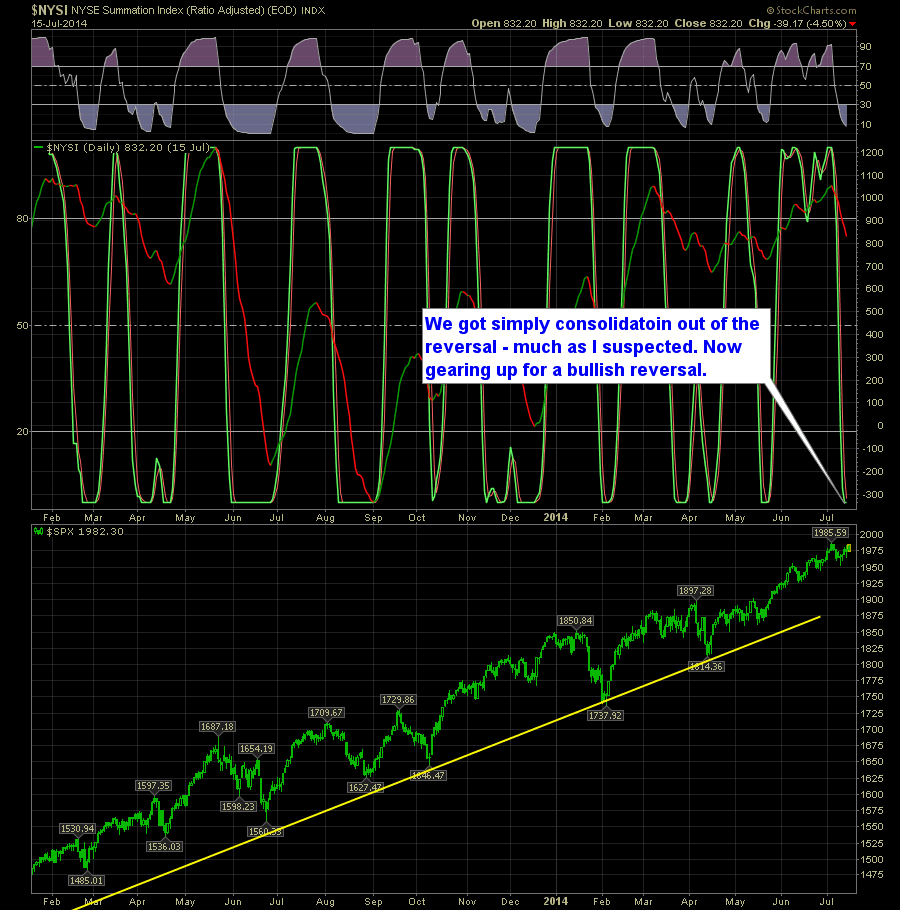

The SharePlanner Reversal Indicator is once again lining up on both time frames. The bears, much like we’ve seen over the past year with bearish reversals, have simply seen mere consolidation intertwined with a few volatile moments. But now we are getting close to a double bullish reversal where both the weekly and the daily

As previously mentioned in the last update of the SharePlanner Reversal Indicator, I said that I wouldn’t be surprised if we saw an extended period of consolidation instead of a full blown bearish reversal like the charts suggested. Well a week later, and the daily indicator has bottomed out which means the bears missed out

It has been since late February that we saw a legitimate bearish signal on the SharePlanner Reversal Indicator – while it didn’t usher in a huge wave of selling, it did nonetheless lead to nearly 3 months of consolidation, which in a market that has trended higher for the last five years, it isn’t all