Information received since the Federal Open Market Committee met in October suggests that economic activity is expanding at a moderate pace. Labor market conditions improved further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending

The one takeaway with the SharePlanner Reversal Indicator this week is that both the Daily SPRI and the Weekly SPRI are telegraphing the same exact message: More downside to come. Here’s the Daily SPRI:

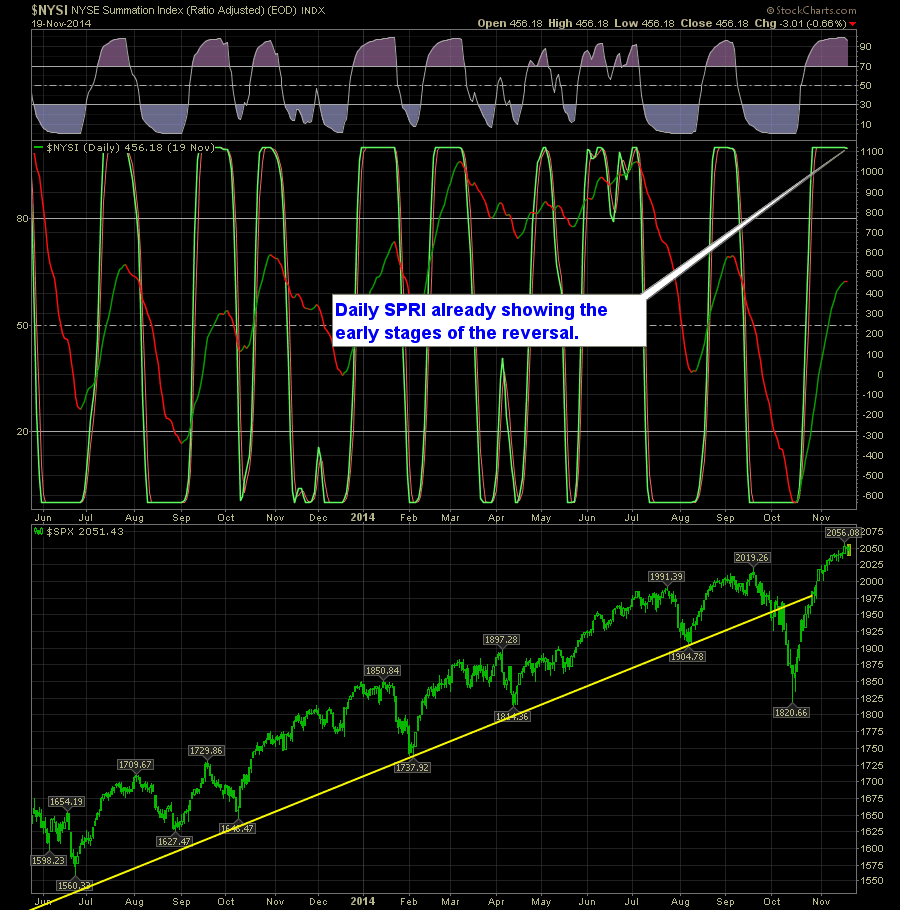

SharePlanner Reversal Indicator signaling this market will slow down some. On the daily chart, the SPRI is already flashing a bearish reversal signal. However, as we have seen so far from the S&P 500 in December, it appears as if the reversal signal will be more about the market slowing down and consolidating then it

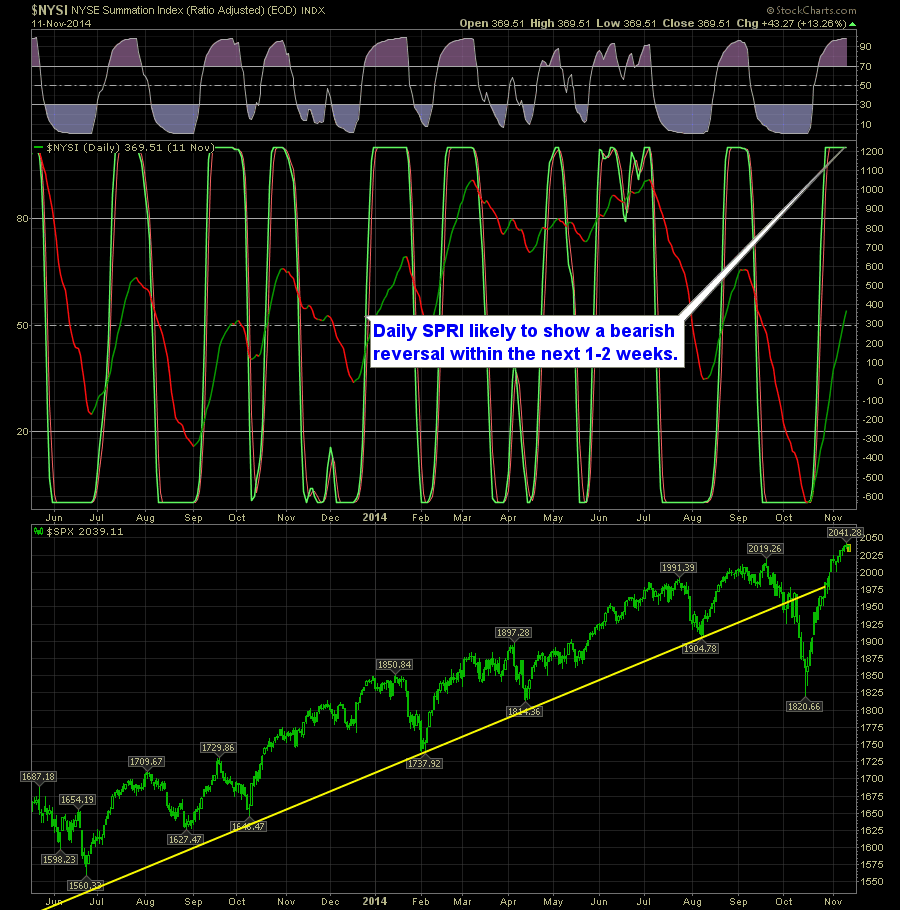

SharePlanner Reversal Indicator is still not showing any signs of weakening. Based on its tendencies of past years, the likelihood it finally flashes that reversal signal in the coming week is very real. Here’s the Daily SPRI:

SharePlanner Reversal Indicator is hitting high levels of altitude lately. In times past, a bearish reversal would have usually led to respectable pullback in the broader market, but since the Fed took a heavy hand in the market since 2008, the bearish reversal signals can mean one of two things: Either a sell-off is coming

The SharePlanner Reversal Indicator is getting a bit extreme. And when it gets this way, it can lead to a period of choppiness, or worse, a sell-off. At this point, I am more inclined to believe it will lead us to a period of choppiness or consolidation and not a sell-off. Seasonally we are in

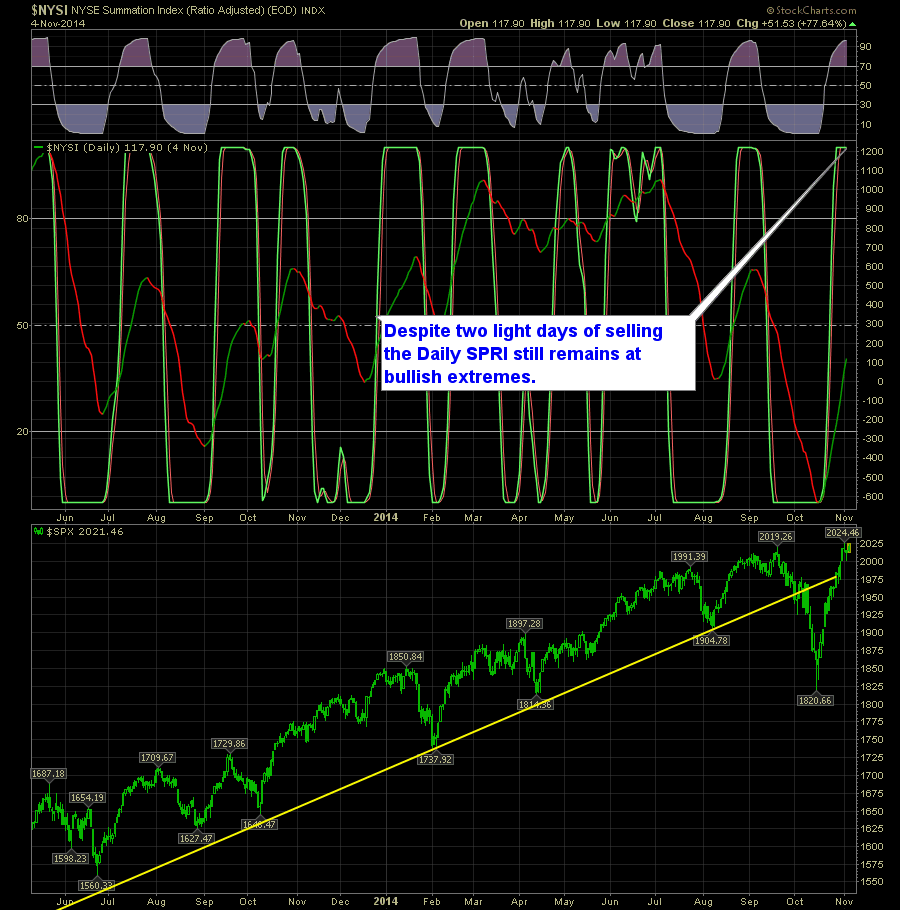

The market seems to be taking a breather here to start the month of November. On the Daily SharePlanner Reversal Indicator, you have a reading that is in the extreme bullish area, however, this reading can still last for weeks at a time. Here’s the Daily SPRI:

For immediate release Information received since the Federal Open Market Committee met in September suggests that economic activity is expanding at a moderate pace. Labor market conditions improved somewhat further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources is

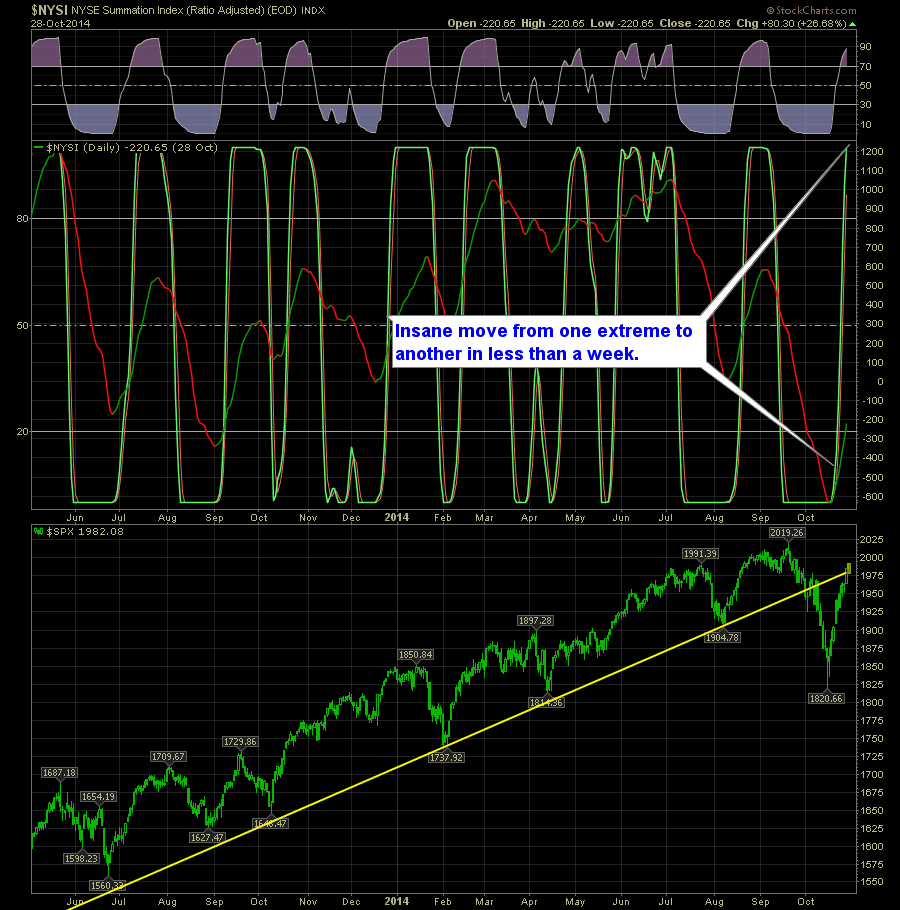

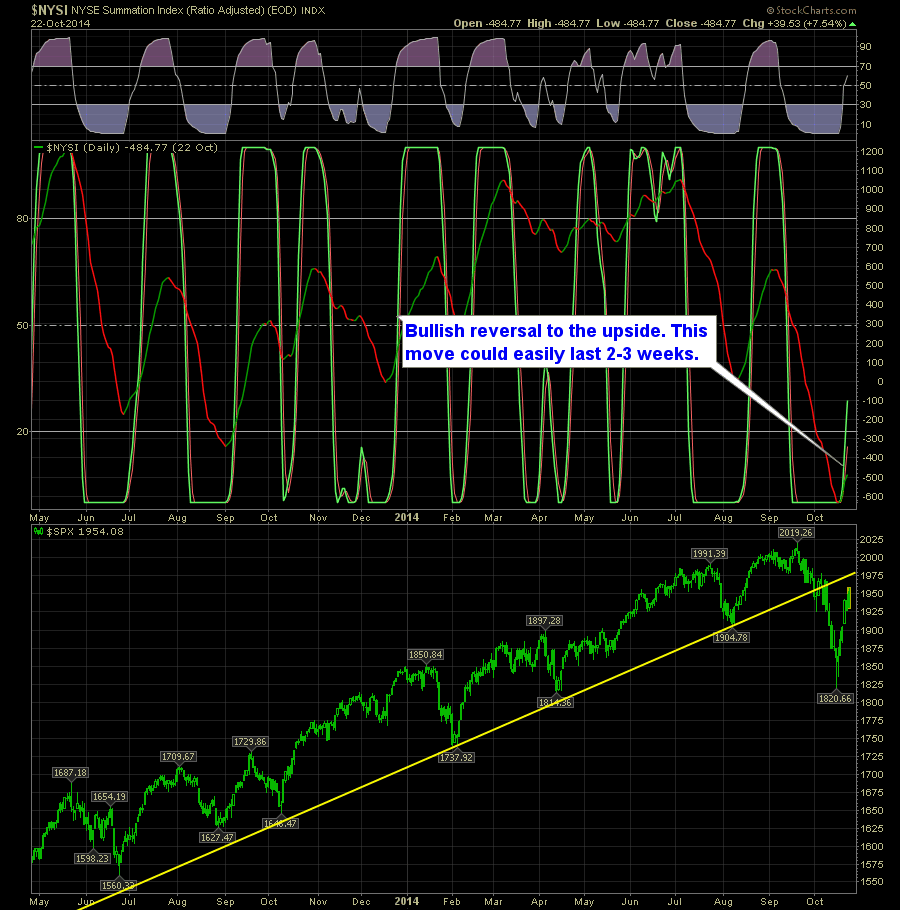

The Daily SPRI has been on a tear of late going from one extreme to the bullish extreme in less than a week. But that is understandable considering the fact that SPX has rallied about 165 points since the lows on 10/15. But now we have the Fed’s FOMC statement coming out in less

The market is all over the place - just think, last week SPX was on the cusp of possibly dipping below 1800's and into the 1700's. In fact, many thought that it would. But here we are now in the latter parts of October and SPX currently sits at 1954. That is a HUGE reversal