Information received since the Federal Open Market Committee met in March suggests that economic growth slowed during the winter months, in part reflecting transitory factors. The pace of job gains moderated, and the unemployment rate remained steady. A range of labor market indicators suggests that underutilization of labor resources was little changed. Growth in household

I’ve lovin’ the look of the SharePlanner Reversal Indicator and how well it is lining up with what we are seeing on the charts right now. On the Daily SPRI the chart is at extremes but that shouldn’t be too much of a problem, as it tends to stay there for weeks at a time

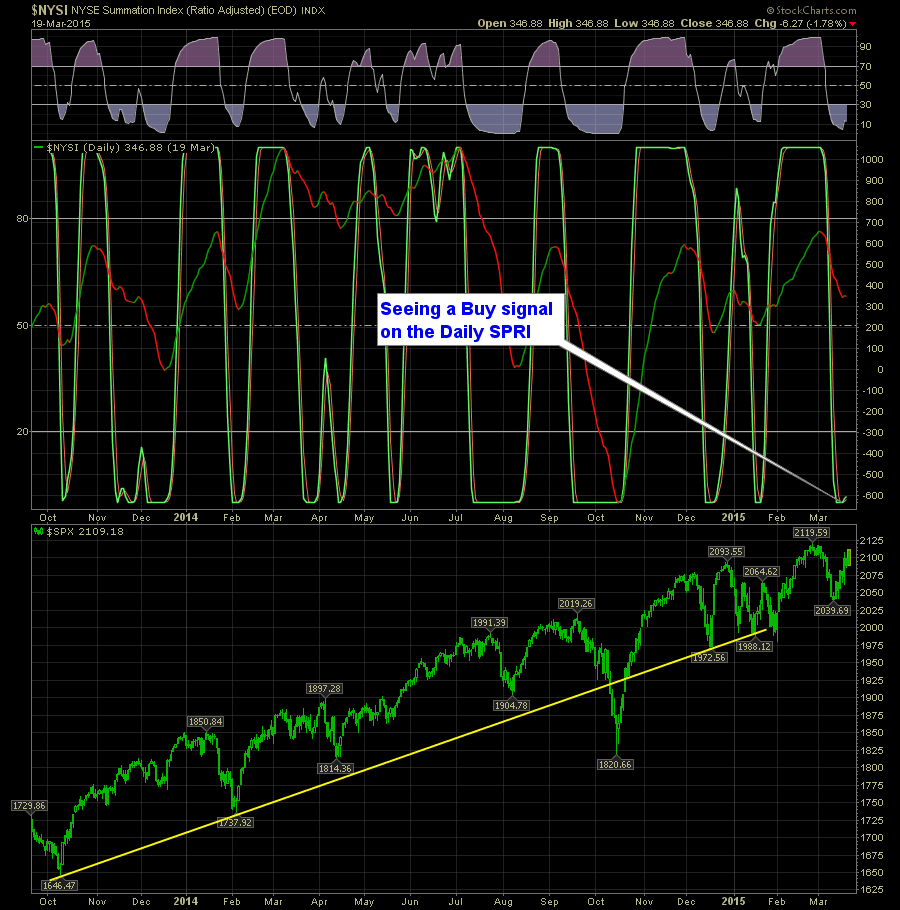

SharePlanner Reversal Indicator is flashing buy signals but it doesn't feel like that quite yet with the price action Daily is already starting to look a bit extended however, it can remain in that realm for a couple of weeks, especially when the Weekly is in the early stages of a bullish reversal. Here's the

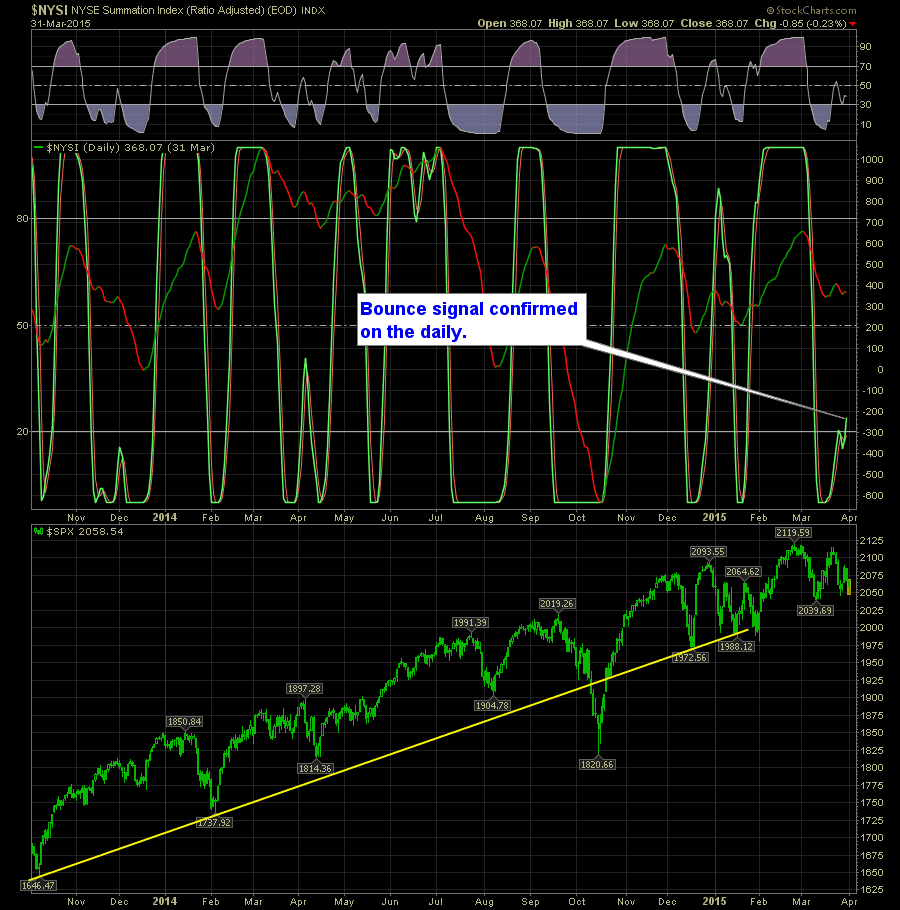

Despite recent bearishness on practically every time frame of SPX, the SharePlanner Reversal Indicator is show some strong bullishness of late. On the daily you already have a confirmation to the upside: Here’s the Daily SPRI:

SharePlanner Reversal Indicator is showing mixed signals which is the first signs that the bears have probably lost their chance at controlling this market. On the Daily SPRI, you have the indicator flashing a bullish signal. Here’s the Daily SPRI:

Information received since the Federal Open Market Committee met in January suggests that economic growth has moderated somewhat. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. A range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; declines

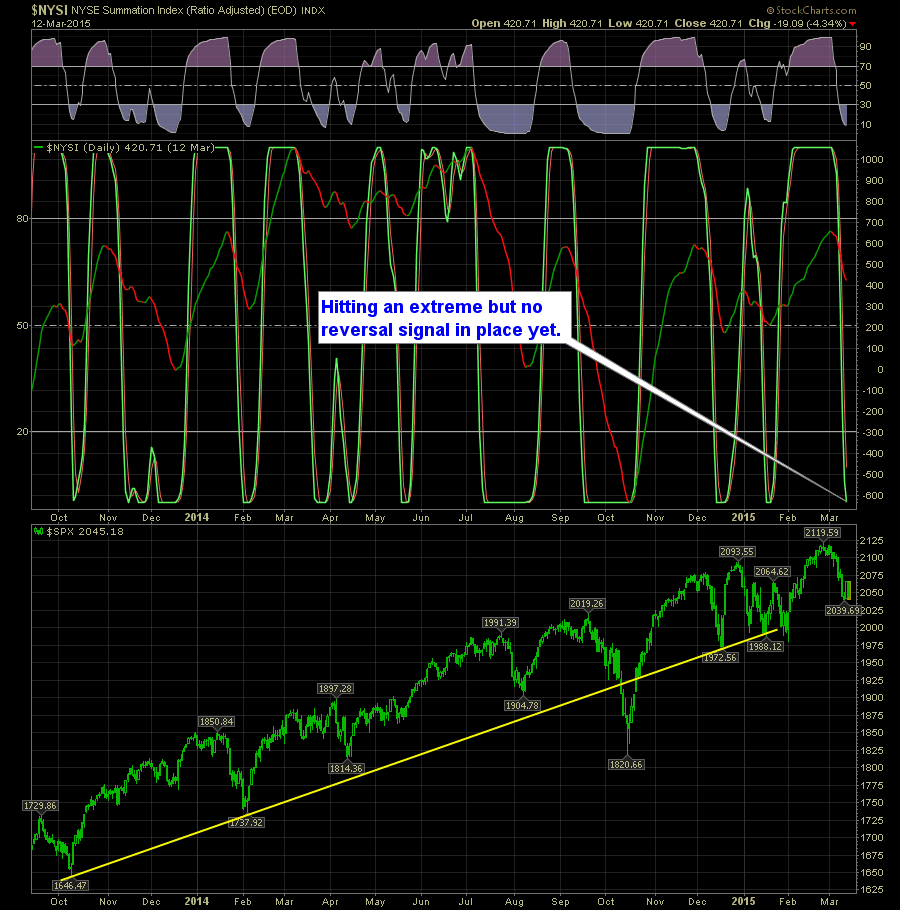

Daily SPRI is hitting extremes, while Weekly SPRI has much more room to drop. On the Daily SharePlanner Reversal Indicator, you have it it hitting the bottom extremes, but what we have seen time and time again, is that SPRI can sit at those extremes for weeks at a time before actually providing a reversal

The SharePlanner Reversal Indicator is flashing simultaneous reversals in the daily and weekly time frames. On the daily, we talked about this happening in the very near future, and with the slight weakness in the market the past two weeks, the bearish reversal finally confirmed. Here’s the Daily SPRI:

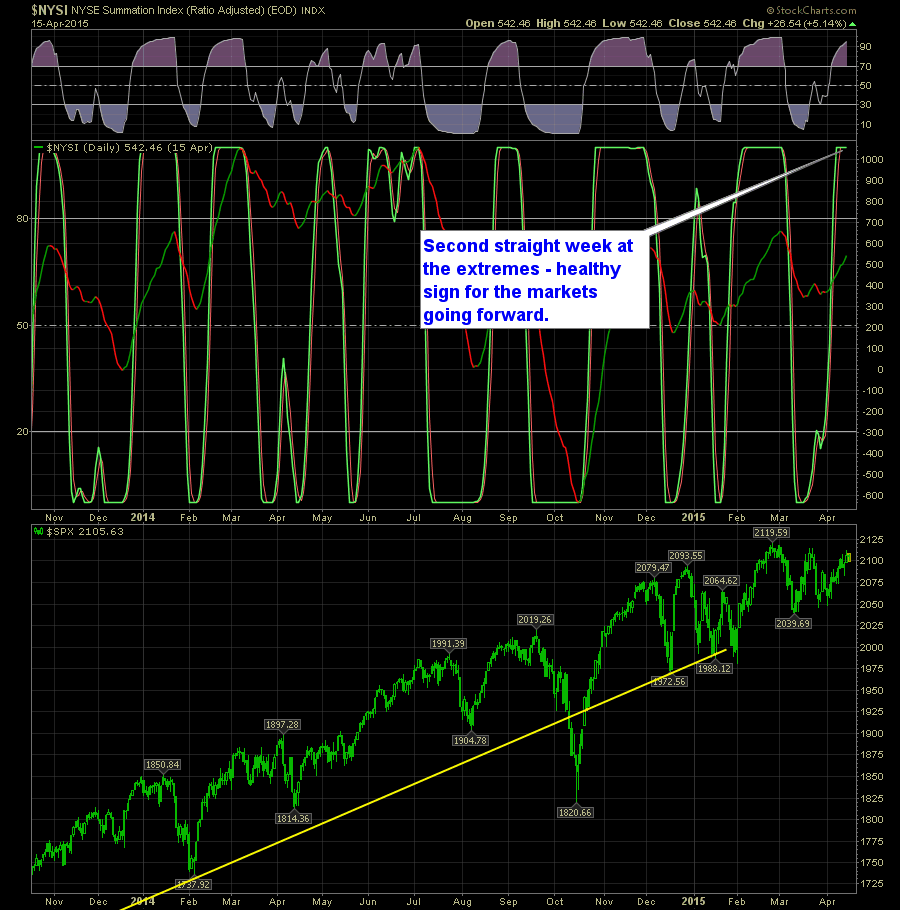

Now is the time that you want to be on guard with this market as the SharePlanner Reversal Indicator on both time frames is sitting on extremes. On the daily, we have the second consecutive week of extreme readings. It won’t take much to get a bearish reversal signal out of it. Here’s the Daily