Information received since the Federal Open Market Committee met in October suggests that economic activity has been expanding at a moderate pace. Household spending and business fixed investment have been increasing at solid rates in recent months, and the housing sector has improved further; however, net exports have been soft. A range of recent labor

I’ll be so glad when after today, the Fed has raised rates and we can all move on from this long drawn out discussion/hysteria of when the Fed will finally hike the interest rates. I’m pretty sure we can track this discussion all the way back to when Bernanke was chairman, which is just absolutely

I’m using the 30 minute chart because it is the easiest to see, but this Bullish Island reversal pattern is valid from the daily chart all the way down to the 1 minute chart. This is a bullish pattern that doesn’t develop often, but when it does, often markets the bottom to a recent sell-off,

The five minute chart, going back to the end of Friday has itself a nice inverse head and shoulders pattern that could be marking the bottom to this heavy sell-off and forming a nice opportunity to add some long positions at. It confirmed in afternoon trading today. Very promising…

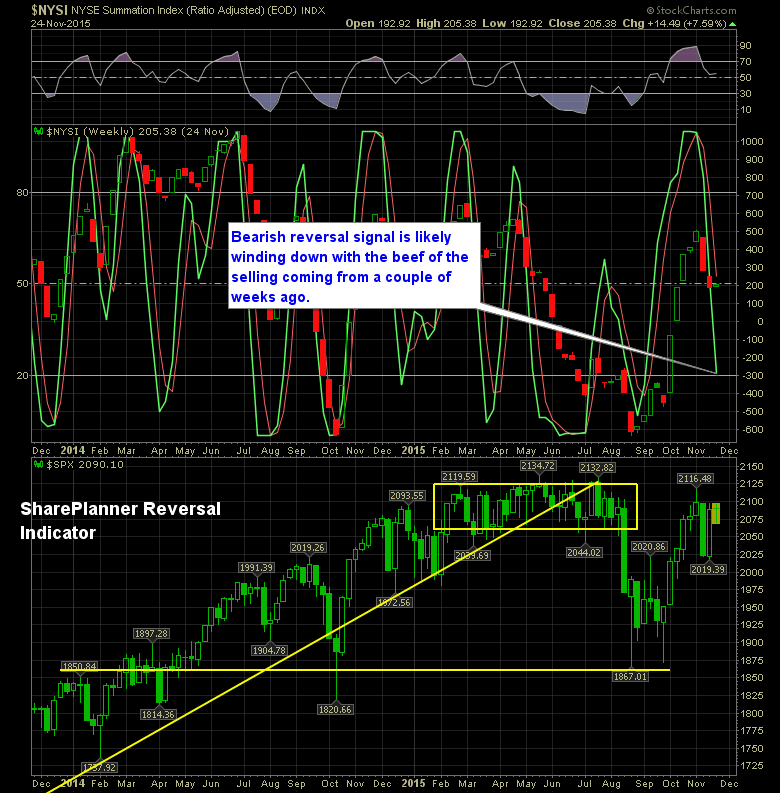

Okay, please excuse the subtle reference to the upcoming Star Wars movie that will be released next week. However, the SharePlanner Reversal Indicator is, despite a treacherous market, exhibiting some surprising behaviors that suggests a bottom to all of the selling of the past two weeks will be coming to an end and the SPRI

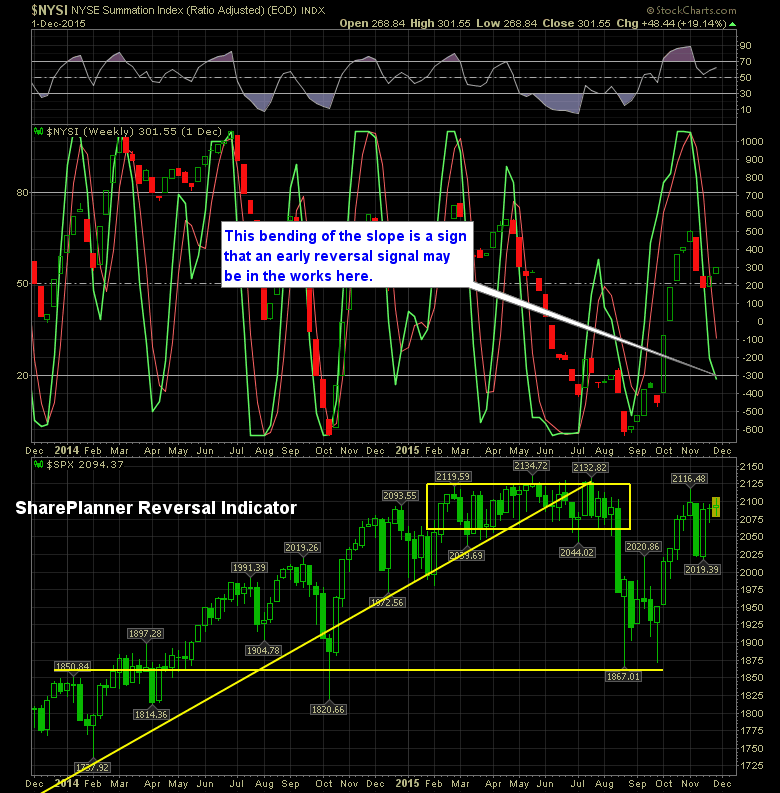

While the SharePlanner Reversal Indicator still suggests weakness, the reading itself is weakening. As a result, the potential for an early reversal is very strong here. Once the slope starts to bend some, it increases the odds of an early reversal signal in the opposite direction either this week or the week to come. With

With the Rally off following the recent attempt to push the market back lower again, the bulls are on the cusp of establishing a new higher-high off of the September lows and negating any renewed hope the bears might have had from a couple of weeks ago when the market sold off for seven out

The S&P for all of its wackiness in 2015 has a very bullish pattern emerging for traders to possibly look forward to… if it can confirm. And if it does confirm, you have the potential for a very promising start to 2016 as the pattern plays itself out. The pattern is an inverse head and

Stocks are trying to rally today, and so far there have been no terrorists threats or attacks and the market seems to be liking it so far. But don’t fret, in only a matter of minutes from the time I post this article the Fed will be releasing their minutes from the October meeting, and

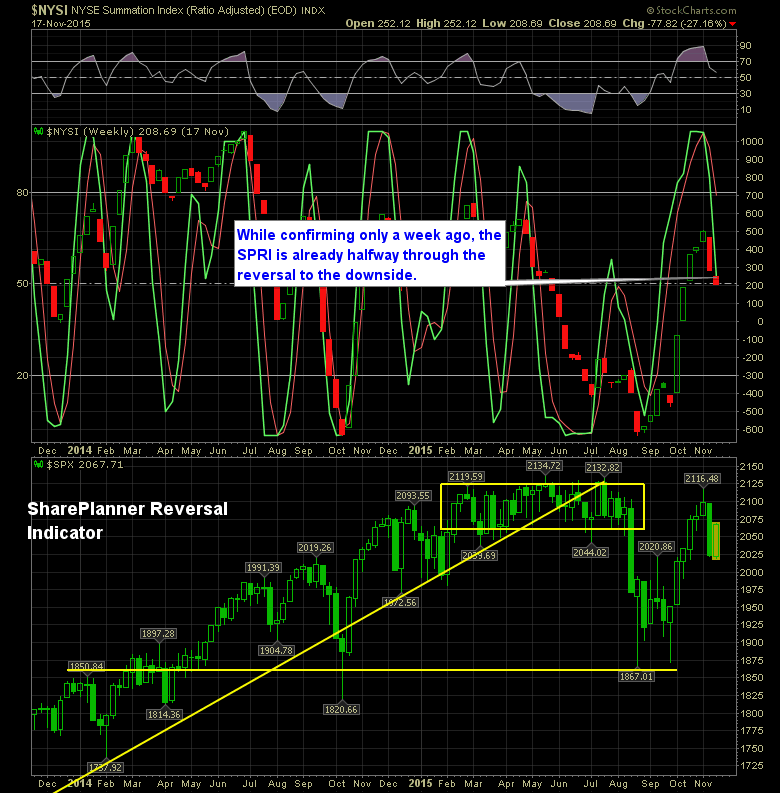

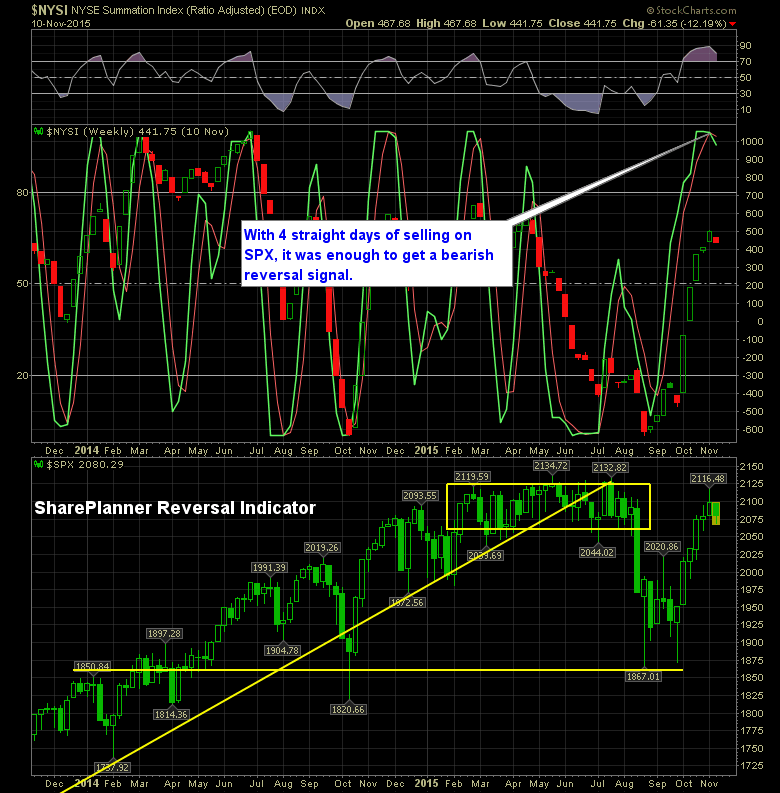

The SharePlanner Reversal Indicator is flashing some red and giving us the bearish reversal signal. This is where being careful in the context of the current market conditions is extremely important. If the market chooses to break down here, you have to be quick to close out the positions. I always post the SPRI