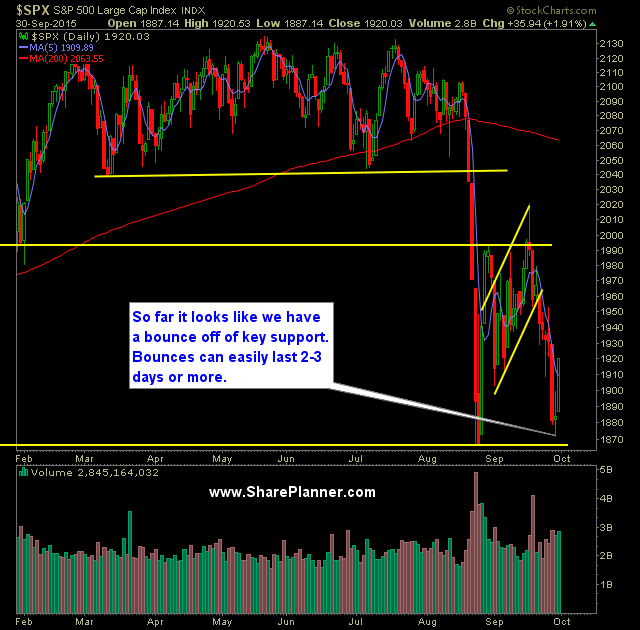

Technical Outlook: One of the best trading days of the year yesterday on what is usually considered a very bearish day historically in the market. Today starts the beginning of fourth quarter – by far the most bullish of all quarters. After trading lower for two straight quarters (a rarity that hasn’t been seen since

SharePlanner Reversal Indicator has not buckled despite recent selling pressures: There is still some more room to climb for the SPRI before it ultimately reverses course. Today’s bounce will help with reaching those extremes, and with us essentially creating a double bottom of sorts on SPX, there is good reason to believe that we

Since 9pm eastern the futures and today's equity markets have been all over the map. We have seen some massive sell-offs followed by some incredible rallies. For now the bears are holding the edge on both the intraday and daily time frames. Heck, look at the weekly and monthly charts and they got that too.

Information received since the Federal Open Market Committee met in July suggests that economic activity is expanding at a moderate pace. Household spending and business fixed investment have been increasing moderately, and the housing sector has improved further; however, net exports have been soft. The labor market continued to improve, with solid job gains and

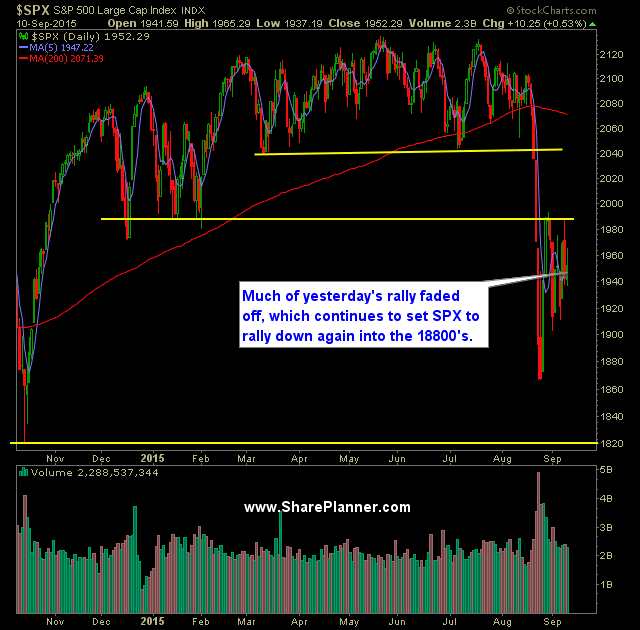

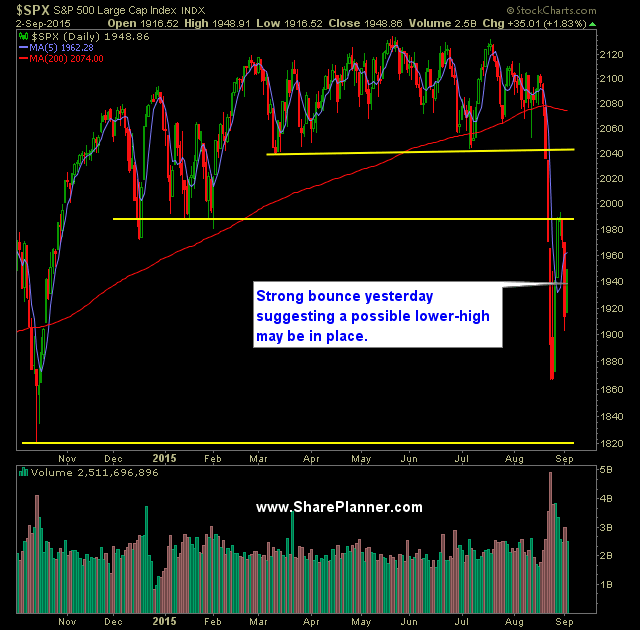

Technical Outlook: Yesterday’s rally saw over half the gains fade before the end of the day. S&P 500 futures have seen continual selling since the european markets opened. Volume yesterday on SPY saw another uptick, that came in slightly above average. VIX pulled back some with a 7.1% decline down to 24.37. SPX

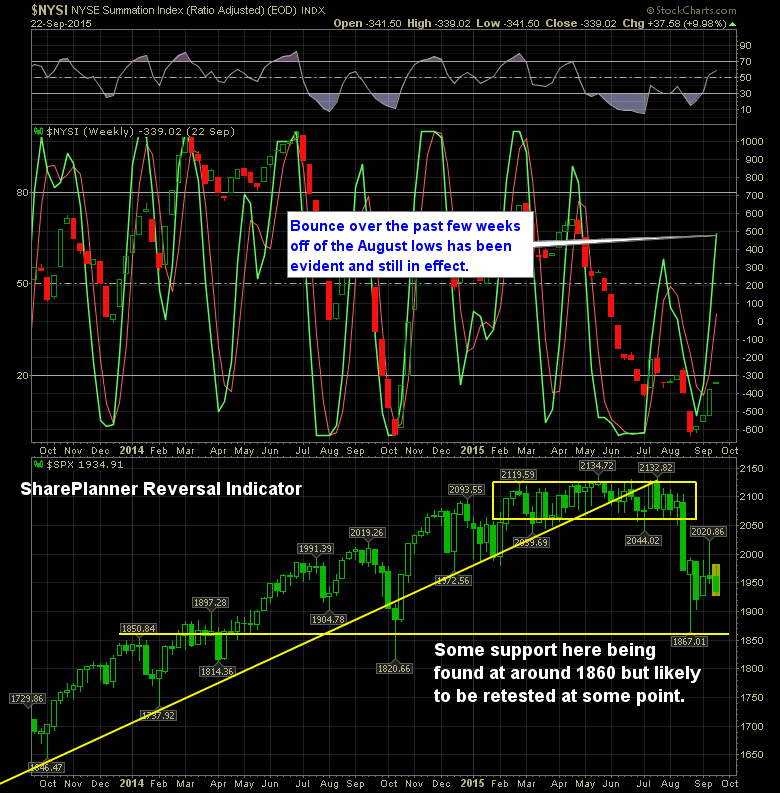

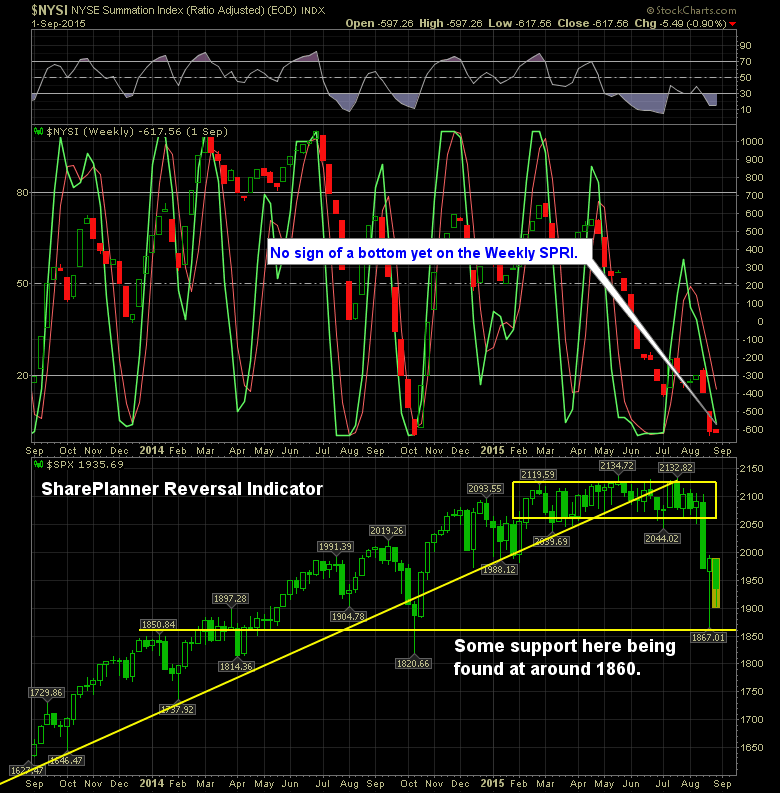

The SharePlanner Reversal Indicator is looking mildly bullish here. There is still one day of trading left in the week, and while most of the time, I wouldn’t give much thought to that, this is a very hostile market environment and what is bullish on the SPRI today could very easily turn bearish tomorrow. So

Technical Outlook: SPX sported a nice rally in the final 45 minutes of trading to pop the market 20 points more into the close. Strong day on the charts. However, SPX needs to get above 1993 to establish a higher-high and and a new uptrend is in place. VIX dropped 17% down to 26.09.

Watching the stock market day-to-day, hour-by-hour, and minute-by-minute will literally make you lose your mind. The rips, the plunges, the overnight gaps, illiquid markets, makes trading a very taxing process. Nonetheless, the trading must go on, and when you look at the weekly SPRI, there still is not confirmation on the weekly time-frame that the market is

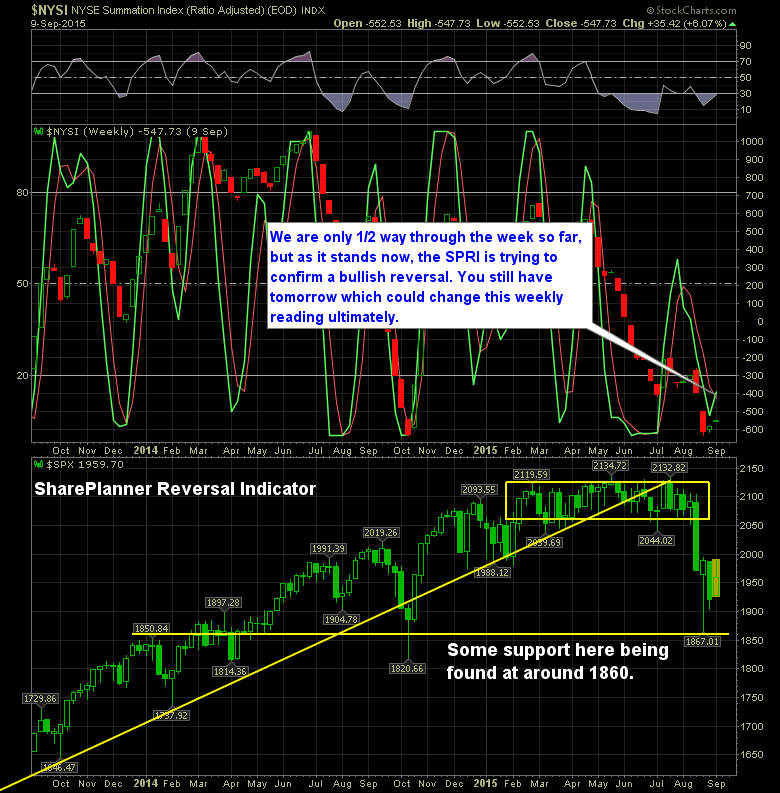

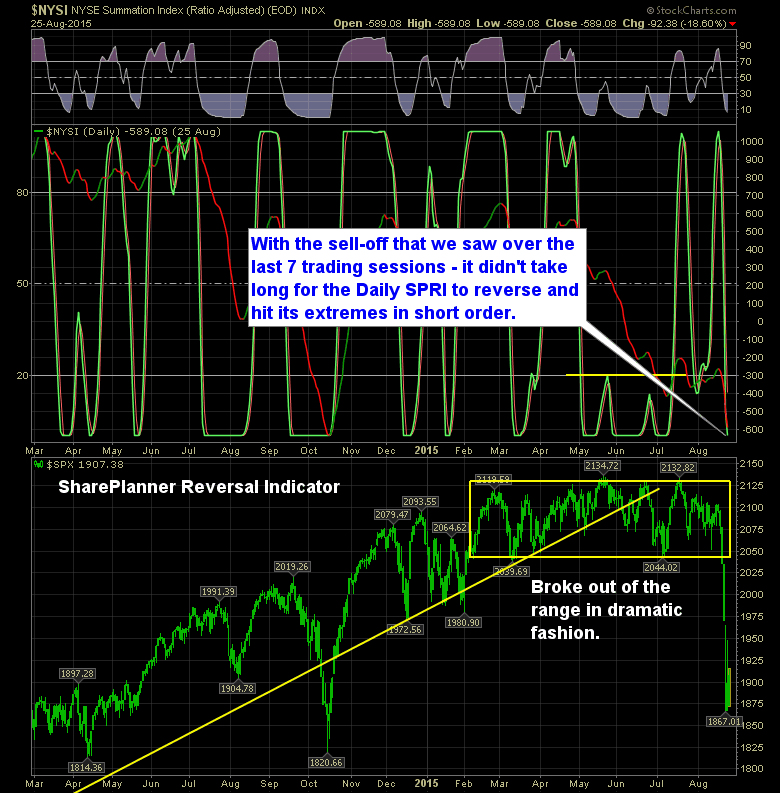

SharePlanner Reversal Indicator showing that a bottom may be in sight. That’s not me saying that a bottom is in place, simply that we are likely closing in on a bottom and that a short-term rally, maybe only a dead-cat bounce, may be nearing. On the Daily, you have covered the full spectrum of

Markets in Turmoil, Black Monday, Stock Market Crash! We have heard all of these expressions and more today. What we saw this morning and the panic selling that took place followed by a rally that probably hasn't never been matched or equaled in any of our life times has everyone scratching their heads right now.