The lack of a strong short-covering bounce from this market is extremely concerning. At this point, I see the best case scenario being a retest of this month’s lows before getting a strong bounce thereafter and worst case scenario is a mix of the 2011 sell-off and 2008. The only way I really see a

Information received since the Federal Open Market Committee met in December suggests that labor market conditions improved further even as economic growth slowed late last year. Household spending and business fixed investment have been increasing at moderate rates in recent months, and the housing sector has improved further; however, net exports have been soft

Tough Resistance for the SPY on the 30 minute chart - watch this in the days ahead.

I came into today 10% long and 10% short, 80% cash. And to be quite honest, I had some massive suspicions about yesterday’s sell-off. It seemed too quick, too amateur, and quite frankly, too easy. I had to take profits in existing positions yesterday because there were some sizable gains that I had made off

China better hope for their sake that this Year-to-Date return represents returns since their last Chinese New Year from last February. But no....nope.... it is not. It is since the beginning of 2016 - like in 26 days and -22.3%. Keep this pace up, and by mid-May, we won't even have to worry about China

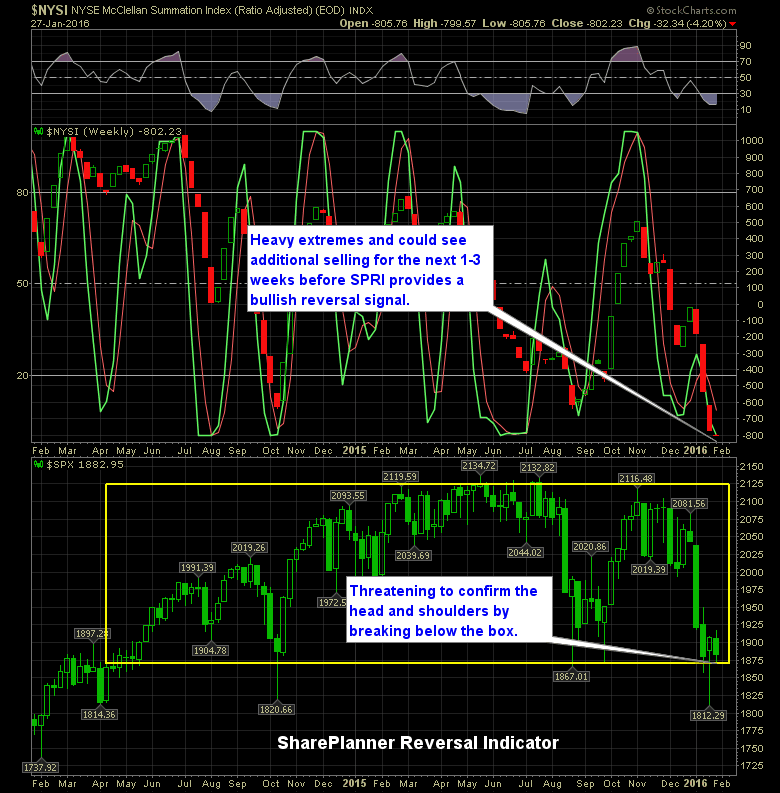

The market is digesting the gains from the previous 2 1/2 days of trading today, but with oil hitting fresh intraday lows today and down 5.3% already, things could get definitely out of hand quickly if the bears take a notion. With that said, this is the pattern on watching on SPX and whether

So far during this lunch hour, the bulls have held on to the bulk of their gains, and their is no doubt that judging by some of the price action that the bears have been trying all morning to fade this gap and what kind of resolve this rally has. And now during the east

Kind of like what we saw at the end of October 2014, where the market attempted to bounce off of the lows of the day, it had a nice bounce but gave up most of the gains by the end of the day. We are seeing similar action today, as SPX continues to loose

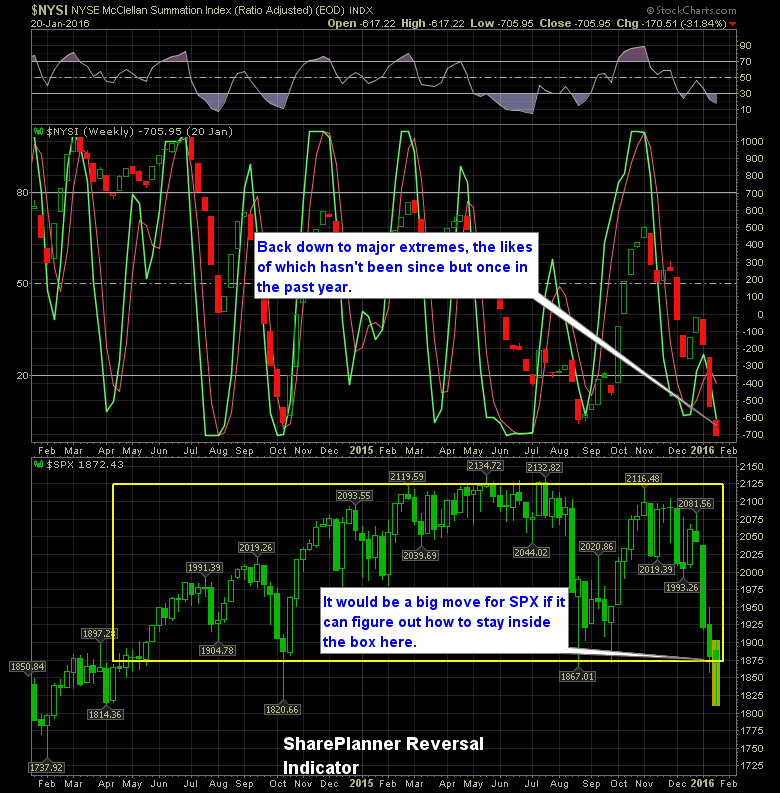

Since the market bottom of March 2009, we have only reached this level of oversoldness just three other times. That’s right, just THREE TIMES. Whether you shorted this market from start of this year or not, this is not the time to start getting bearish. You’ll see from the T2108 (% of stocks trading above

One of my favorite indicators for timing market bounces is the T2108 – it is the percentage of stocks trading above their 40-day moving average. I’ve already done a post on it this week, but I wanted to do another using a long-term view of where we were on it this morning when the market