Technical Outlook:

- One of the best trading days of the year yesterday on what is usually considered a very bearish day historically in the market.

- Today starts the beginning of fourth quarter – by far the most bullish of all quarters.

- After trading lower for two straight quarters (a rarity that hasn’t been seen since 2011), I wouldn’t be surprised to see quarter four turn out to be very bullish for the market.

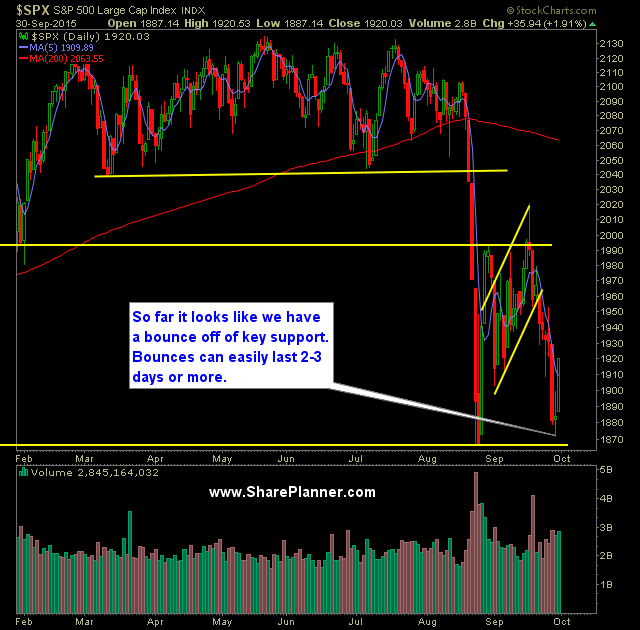

- The big key for the market will be getting back above and closing above the 1997 level. Then there is a confirmed double bottom in place.

- SPY volume saw a nominal uptick in strength and was overall average for the day.

- VIX dropped 8.7% down to 24.5.

- 30 minute chart of SPX sports a similar double bottom pattern to the daily chart.

- SPX managed to reclaim the 5-day moving average yesterday – something it hasn’t been able to do since the FOMC sell-off.

- I expect the bounce to continue strong in the days ahead.

- The Fed has never raised interest rates at a point where the market was trading lower on the year.

- The large gaps in the market, the record number of stock buybacks, and ETFs that are constantly accumulating/dumping large chunks of stocks, and most importantly the high frequency trading, shows just how illiquid this market has become in recent years. These entities are the most responsible for the massive market swings that stocks incur each day.

My Trades:

- Added one new long position to the portfolio yesterday.

- Did not close out any swing-trades yesterday.

- 10% Long / 90% Cash

- Will look to play the market bounce today.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.