I'm always trying to make for your use as much of my personal research as possible that I do everyday in order to successfully trade the stock market. With that said, I have revamped and relaunched my morning newsletter that I send out every day. And it is huge. I guarantee you, nobody puts this

It looks liked today, initially at least, that the market would be roaring to the upside and while it is still up a substantial amount, it hasn’t held on much to the gains except for what it started the day with. So really there hasn’t been any action out of the market today, and the

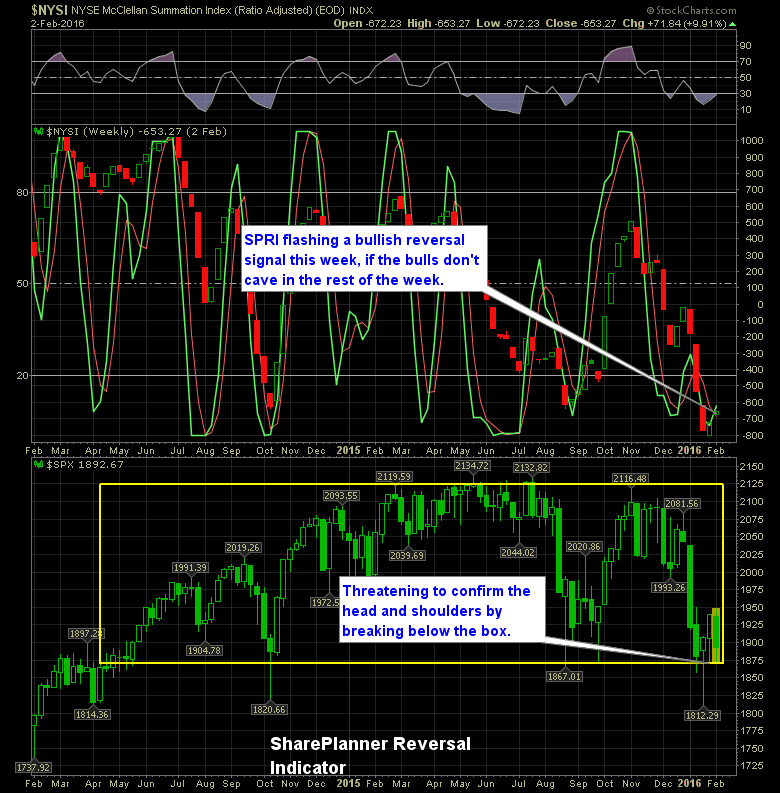

This is the bad for the bulls, and I mean really bad! Unless you have been living in a cave for the past year, you’ll see that a quick glimpse of the S&P 500 weekly chart shows a massive head and shoulders pattern that has formed over the past two years of trading. Today the

Barring a huge final hour rally in the market the S&P 500 will confirm the bear flag that I pointed out this morning in the daily trading-plan. Here’s the confirmation:

Not a ton of clues about what the market wants to do following yesterday’s mind-blowing afternoon rally. We were down, then up, then down again, and now we are trying to decide between whether SPX wants to stay down or jump start another afternoon rally. It is really a mess out there, and reminds

So far the indicator is taking the price action of the past two trading sessions into account and some strong bullishness from last week, to suggest that this market may have a short-term bottom in place. That can change if conditions continue to deteriorate throughout the remainder of the week though. If that happens, there

It was a bit uglier not too long ago, but oil is trying to make a run off of the lows here. Lets see what they can do once Europe starts trading.

As you long know, T2108 is one of my favorite indicators. And that is saying something, considering that I really don’t much like indicators. But the T2108 is a great way of measuring the collective behavior and state of stocks across the board.

Technical Outlook: SPX continued yesterday in its current 5-day trading range. The market is not providing clear direction here and being light until it shows otherwise is absolutely key here. I still think that there is a retest of the month’s lows in the near futures, at which point I think that is where you

I can still remember it like it was yesterday, I was a little boy, just five years of age, going out to the playground to see the Space Shuttle Challenger rocket into outer space. Growing up in a small town called Titusville wasn’t what you’d call glamorous or exciting. In fact the Titusville of 30