It is like the toddler who is pitching a fit and won't go to bed but can't manage to keep his eyes open either. That is what we are dealing with in this market - it won't allow itself to sell-off but can't find the momentum either to push price higher and ultimately through all-time

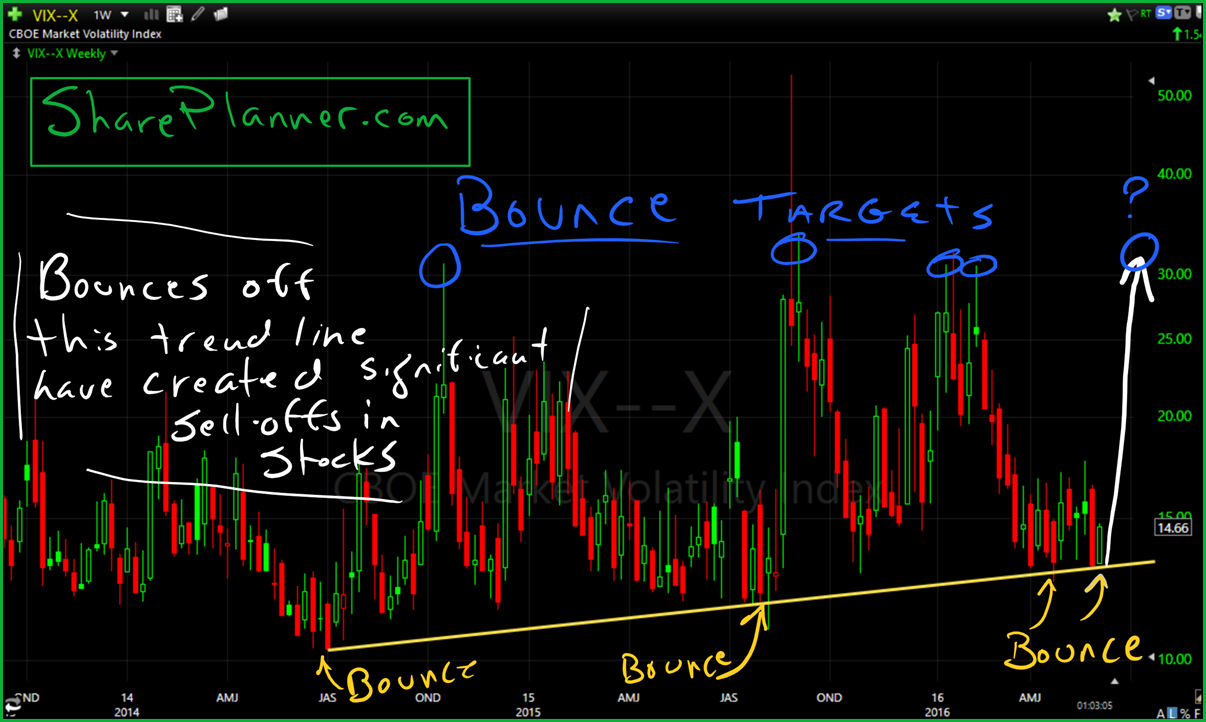

The Volatility Index (VIX) is giving me pause today. I came into today thinking I would buy the dip if we were to sell off some, but seeing the VIX index up today nearly 12% on the day is definitely not fitting the mold of what we should be seeing with the S&P 500 down

Coming up on the midnight hour and the futures are relatively quiet and flat. You have Yellen speaking tomorrow, so there’s no doubt that will have an effect on the market for better or worse. My guess is the market remains relatively flat heading into the long weekend. If we are to see any selling

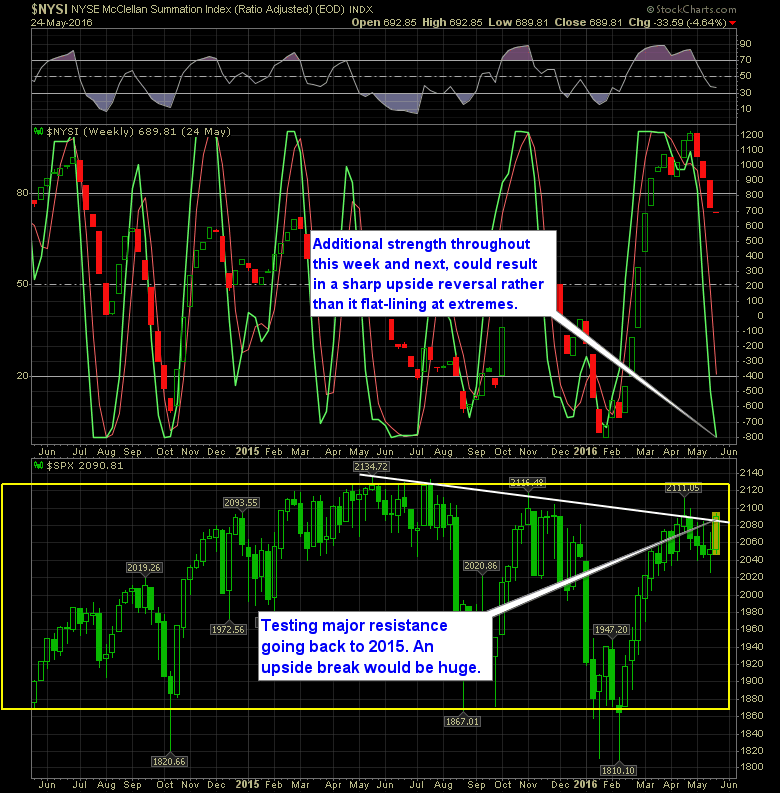

So far we’ve run hard right out of the gate this morning and since then we’ve essentially traded sideways showing little desire to push higher. But we’ve seen a lot of that so far this year and in year’s past. It isn’t uncommon. The question is how much more room does this market have to

Yes the previous reversal on the SharePlanner Reversal Indicator, which was a bearish one, did come to fruition, but it was one of the weakest three week pullbacks I have ever seen. The market barely gave up any ground, and over the course of the past three days, the bulls have managed to recover basically

If you’ve been following this market over the last two trading sessions there are probably a millions things that you can think of that would be more productive than watching the current state of price action. Watching grass grow Watching paint dry Watching Jim Cramer – No wait, no….I don’t wish Jim Cramer on anybody.

I’m not into calling market tops and I’m not trying to do that with this post. What I am trying to do is to bring some concerning developments to light. We all know just how hard it has been for SPX to trade within the 2040-2138 range. For almost two years it has destroyed price

One of the members of the SharePlanner Splash Zone brought this chart to my attention recently and it is quite honestly frightening. Since 2001 this has only happened two other times and it coincided with the Tech Bubble bursting in 2000-2001 and with the Subprime Mortgage crisis of 2008. Now we are in a Central

Of course there should be about 15 more dead cat bounce attempts between now and the close, but I have to say, I am pleasantly surprised that the bears have the price action down below 2039. That is where it should be, but my expectations were diminishing rapidly over the past week for that ever

The last two days of trading has been quite a head-scratcher. Yesterday we sold off on news that there would be an increased chance of further rate hikes this year, today, prior to the FOMC Minutes being released we rallied on the same news, banks in particular. Following the FOMC Minutes that priced in a