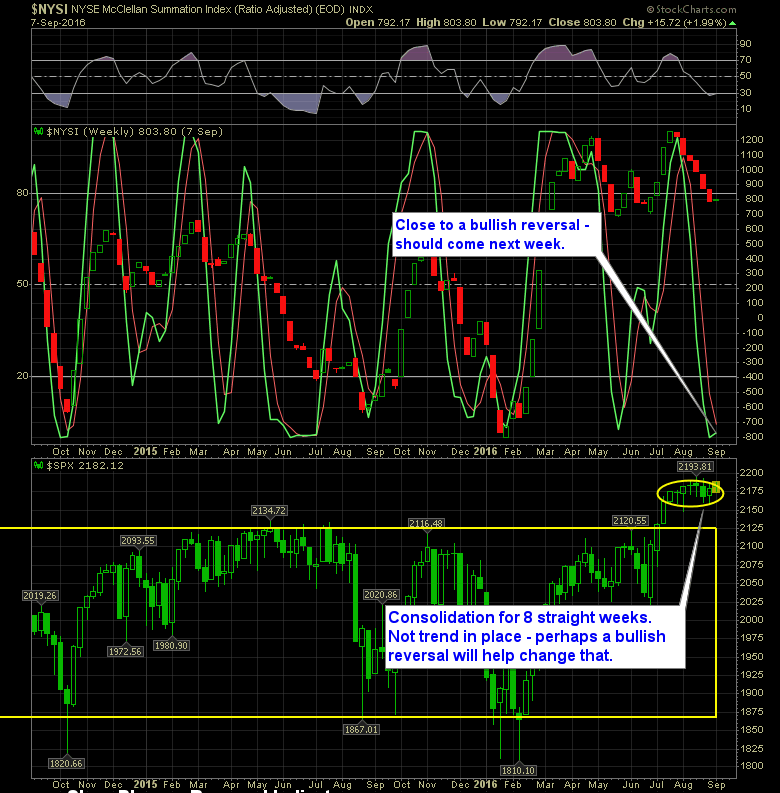

Seeing a sharp bounce at the extremes on the SharePlanner Reversal Indicator. That is a bit surprising to me, because with the market range-bound for the past two months and showing no signs of wanting to break it, I would have guessed it would have stayed at the extremes for 2-3 more weeks, barring a major breakout. ![]()

But that isn’t the case today, as you can see below, it is actually on the verge of confirming the bullish reversal. The only thing that would put it back in the bearish extremes and keep this reversal from coming to fruition would be a strong sell-off that took out some key support levels below.

What do I think? Well, until this market can breakout on the S&P 500 (SPX) to convincing new highs (that means some follow through as well), I am going to be skeptical of anything that this market does.

Consider this, and this isn’t any attempt to get political here…but the banks are in big for Hillary Clinton, Wall Street as a whole is donating cash double-fisted. An incumbent’s fate (in this case the democrats) hinges on how well the stock market is doing in an election year. Don’t believe me? Just ask John McCain in 2008 and history as a whole. The likelihood that the Fed would raise rates in September and send the market spiraling downward or the the banks not doing everything to keep the market stable by buying every freakin’ dip between now and the election isn’t just probable, it is happening right before us. So while I remain suspicious of this market, it is mainly because this market is begging for a sell-off and the central banks and Wall Street refuse to allow that to happen. Thus the stalemate of the past two months.

Free markets? Invisible Hand? Pfffftt!