This shouldn’t be any surprise for traders following the Apple (AAPL) product launch of the iPhone 7 and whatever those wireless earbuds are that has Apple groupies all excited. Since Steve Jobs’ death, every time we have one of these “new product” unveilings, the stock sells off unapologetically. Why? Because they aren’t carving any new

The dip buying… what can be said that hasn’t already been said. Everyone is tired of this market. Everyone is tired of the market that won’t sustain a move in either direction. The daily bands on this market are so tight, historically tight, and price can’t move above or below it, and sustain that move.

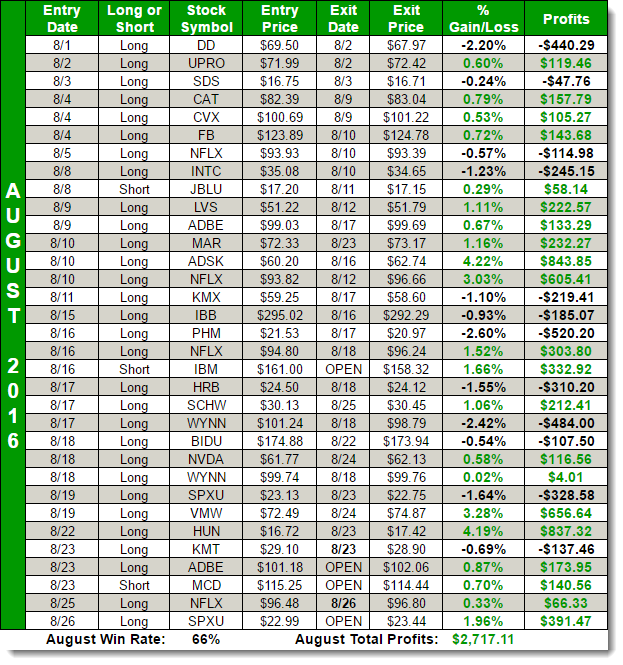

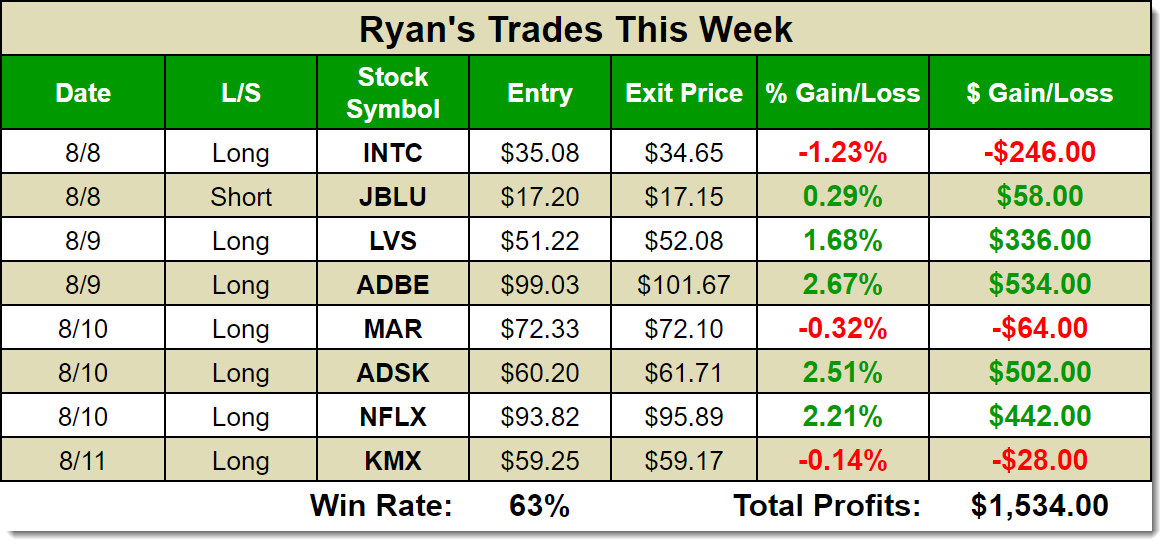

The S&P 500 (SPX) is down for the month, meanwhile, traders in the SharePlanner Splash Zone are trading with profits. The market has frustrated traders across the spectrum with its mind numbing and dull price action, but in Splash Zone, I have managed to add another month of profitability. Here are August’s results so

I’m going to let the chart do the talking on this post, as I have detailed much of what I am seeing on Apple (AAPL). Essentially, I think there is more downside to the stock than there is upside and that a pullback or even gap fill from late July is possible. I just wouldn’t

I’m not trying to dog-pile on Freeport-McMoran (FCX) here, but there is some major technical problems arising in this stock. Up until yesterday, it was still a play you could take as a bounce off of support. Although, I didn’t play it (simply because bounces off of breakout support usually happens quite rather and doesn’t

This chart speaks for itself in that the rally that we have seen in oil for the entire month of August may be quickly coming to an end if this move off of the August lows is part of a larger head and shoulders. The only way to dispell this theory is by break the

While the SPDR Gold Trust (GLD) is having a solid day of trading today, there is some developments that should be of concern for you traders holding a long position in it. Now, I’m not saying to short it right here, right now. Far from it, because it could easily breakout to new highs

Watch these big banks! Namely: JP Morgan (JPM), Citigroup (C), Bank of America (BAC) and the notorious Goldman Sachs (GS). All of them are breaking out as I am typing this and they look like they could be solid runners for the entire week. Rarely do you find them or any

The market hasn’t been overly exciting for traders since the dump and pump following the Brexit vote. In fact when you consider the price action it is some of the tightest trading bands this market has seen in decades. This kind of market takes patience and lots of discipline as there are a number of

Every once in a while I like to update my readers on the biggest “Sucker’s Trade” on Wall Street. How these types of ETFs are even allowed to exist is beyond me. Most people don’t understand how the VIX is computed much less a leveraged derivative of VIX. Yet people buy this stuff