The market hasn’t been overly exciting for traders since the dump and pump following the Brexit vote.

In fact when you consider the price action it is some of the tightest trading bands this market has seen in decades.

This kind of market takes patience and lots of discipline as there are a number of stocks that simply are not moving at all.

But you also have others that are moving, and finding those trading opportunities and capitalizing on them is key.

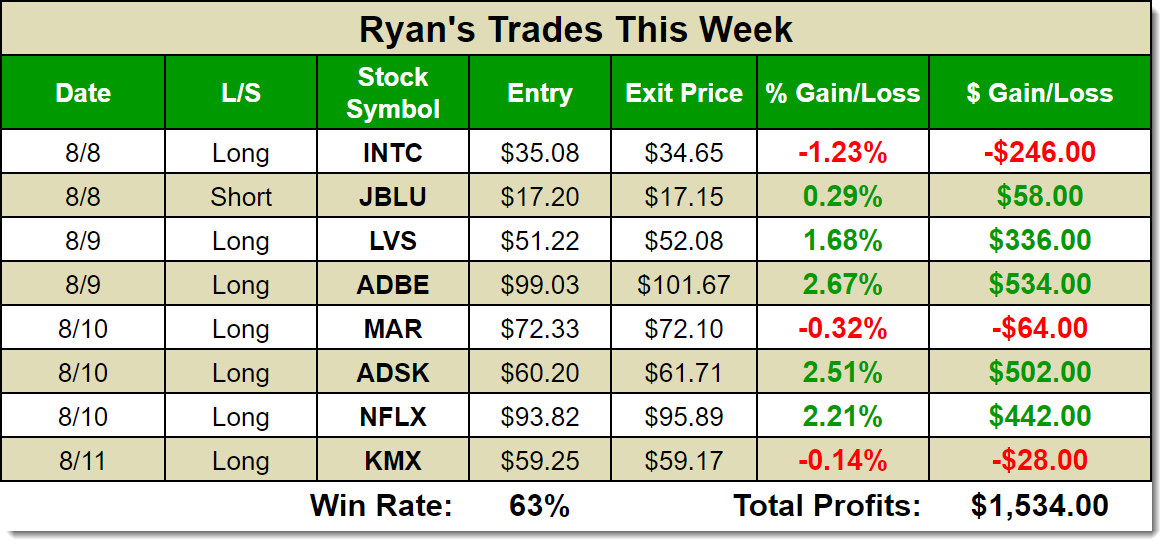

Check out the trades that I have made so far this week and you’ll see that I, and members of the SharePlanner Splash Zone are having a good week overall.

When it comes to losing trades, I don’t have much patience with them.

When it becomes clear that a stock is not living up to the reasons that propelled me to make the trade in the first place, then I cut the trade out. When a stock becomes lackadaisical and complacent, I cut the trade out of the portfolio. When I make a solid trade and it does what the trade rationale called for, I keep it and ride it as long and as hard as I possibly can.

So far Intel (INTC) and Jetblue (JBLU) are the two stocks that I have closed out this week. Marriott (MAR) is testing my patience while the remaining positions show plenty of promise and upside still.

And unlike other trading services out there, I keep a public past performance that you can, at any time, view and evaluate for yourself if my trading meets your standards. There are no surprises when it comes to the Splash Zone. When you join you know that you are getting premium swing trade ideas and that my performance will speak for itself.

Do what is right for you and for your trading experience and sign up for a Free 7-Day Trial to the SharePlanner Splash Zone.

With your membership you will get access to all of my real-time trades, the chat room that I trade from each day, as well as my real-time trade alerts via text and email. It is Free for the first 7 days and you can cancel at anytime. If you don’t have the time to trade for yourself, you can trade through eOption or Global Auto-Trading and they will automate all my trades for you.

With The Splash Zone, you will get my low risk and high probability trade setups that no other trading service can offer.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.