I was stopped out of Disney (DIS) – other than that, I had a really good day of trading yesterday. And it came from some random bank that honestly, I know nothing about. But that has been the difficulty with trading DIS of late – and I’ve traded it about six times this year, and only two

I’ve been watching with great interest to see whether Oracle (ORCL) is going to pull it together and bounce at critical trend-line support or whether it is going to break below it and eventually establish lower-lows under $40. Right now, I say it is still bullish until proven otherwise, but the window of opportunity

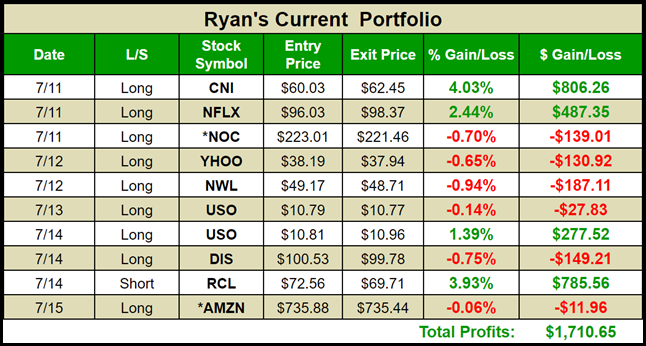

Solid week of trading! The market started off by establishing new all-time highs and breaking out of a two-year trading range that had previously rejected any such attempt. But this time it was different and as a result, quickly establishing a long bias was absolutely critical to maximizing profits in this market breakout. Here are

The Cisco (CSCO) trade setup has a lot of appeal to it right now. It has broken out and above the year-long resistance that has formed around the $29.00-40 level with authority. At this point though you have to be careful about adding new long positions on momentum, because it is going to take a

Apple (AAPL) is on a tear heading into earnings and they report in less than two weeks (July 26th to be exact). It is hard to say how they’ll do following their earnings, especailly after the sell-off we saw back in April. What was once the market darling is now a stock that everyone demands

Trading is one of the hardest endeavors you can ever undertake. It taxes your emotions, plays games with your mind, and can really bring out traits in your personality that you didn’t realize existed. I’ve experienced the good, the bad,an the ugly over the course of my 20 years of trading. And no matter how

Today is a perfect reason why you don’t chase price when the market starts running hard and fast without you. Here is what happened to price chasers over the last seven trading sessions: Friday, June 24th: (First day after the Brexit): Must short the market. Everything is crashing. Monday, June 27th: Press those positions. Dow

Safe to say that everyone is thrilled that it is a 3-day holiday weekend on Wall Street. Count me in that group as well. Following the massive sell-off on Friday and again on Monday, and then the face-ripping rally that followed through the close today, we have all seen our share of action over the

I have a lot of concerns when it comes to implementing Warren Buffett’s approach to the stock market. I think the buy and hold approach is outdated and highly risky. Today’s market requires that you actively manage and trade your portfolio and not allow naivete or passive investing hamper your ability to trade the stocck

With the stock market having tumbled over 600 points on the Dow Jones Industrial and over 75 points on the S&P 500 today, people's 401(k)'s, IRAs and investment accounts took massive hits. But that is because people are investing in their futures under faulty assumptions. They think because Warren Buffet says you should buy and