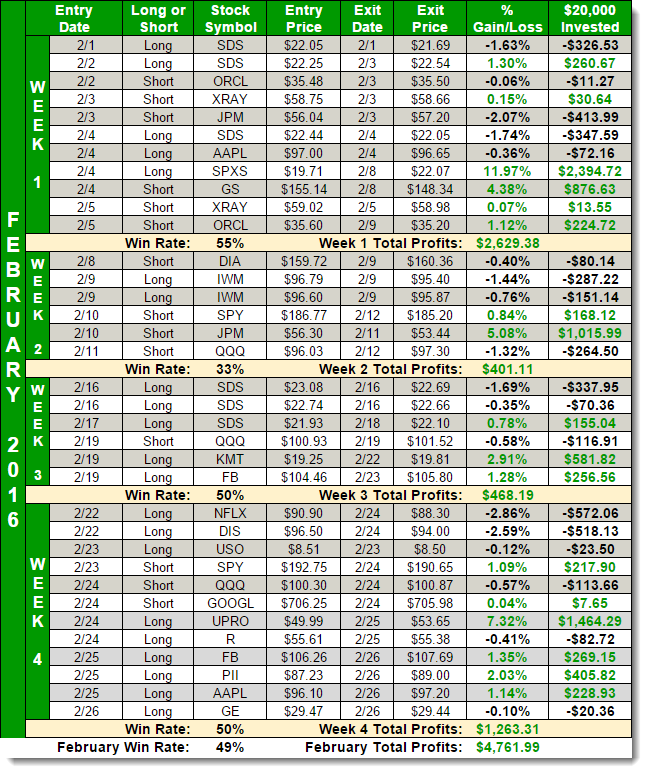

My job as a trader isn't to match the market dollar for dollar on every move it makes. Sometimes my moves will be more and sometimes it will be less. The key though is to be consistently profitable. And that is something I pride myself on as a trader. Yes, this week the market went

It has always amazed me how upset traders get when it comes to their views on the market or on a stock being opposed by someone else. Holding dear to a viewpoint that you have on either a stock or the market in general is not going to yield you a single dime in profits.

Oil is stabilizing. You have three recent lows dating back to January that form the outline of an inverse head and shoulders pattern that could play out strong in the days ahead. You have a downtrend that has finally been broken. You have an ascending triangle breakout. But…

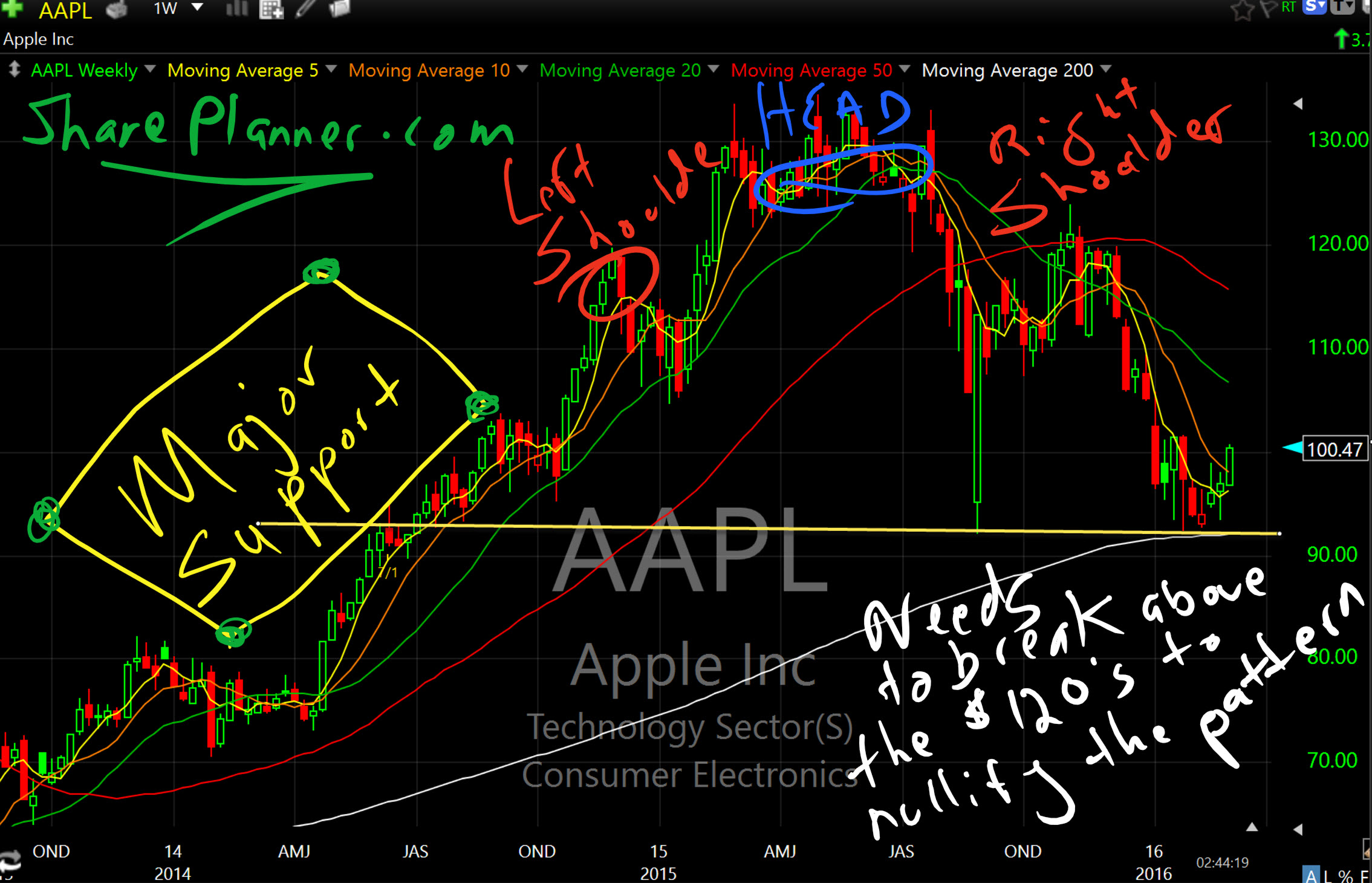

Great day for the Apple (AAPL) stock, but the weekly still poses some major issues. First there is still a full-fledged head and shoulders pattern that is still playing out, and if the weekly chart ever closes below $92, it will be doing so below a MAJOR support level that will likely push price even

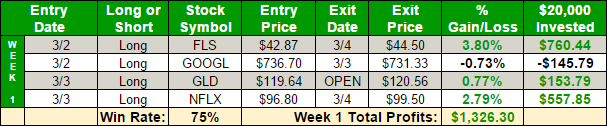

February has been yet another great month of trading in the SharePlanner Splash Zone! And yet for traders in general, it couldn’t be a more difficult month for navigating the markets. Just this week you had a market ready to breakdown, followed by a monster rally that took the market right up to a close

The Apple (AAPL) trade setup has been extremely intriguing to me over the past few days. There is a clear base that has formed over the past couple of weeks. And if this stock manages to drop below $92 which not only represents the August lows that everyone thought at the time was unreal and

Shake Shack (I’ve yet to eat at one of these magnificent places) is finally breaking through some key resistance to the upside. First it broke the downtrend last week which was huge, and today it is gaping above and running beyond key price resistance. Both of these developments bode well and should see a run

I see so many self-proclaimed trading philosophers on Twitter constantly spouting off fancy trading quotes and cliches. Here’s one I saw on Twitter this week, and it just about made me vomit: “What separates successful technicians from not so successful? No matter the chart style, it comes down to the analysis of price action.” Sounds

Forget about the news, forget about the WMT earnings, forget about the market’s epic rally here. Just take a moment to look at this beautiful technical bounce out of Walmart (WMT) today.