Goldman Sachs (GS) has repeatedly struggled with resistance overhead, even as it comes out of its bull flag pattern. Particularly this week, every move to the upside has been faded.

Nice base forming on $NIO daily. Watch for the breakout above resistance. $GS currently testing the declining trend-line & on the verge of pushing through here. Financials are higher risk plays with FOMC on Wednesday.

$IDXX testing a key support level here. If borken may not see support until 445-453 area. Two ways to play $RYAN - 1) wait for the pullback to major support and play the bounce, or 2) play the bull flag break out. Potential destination for $DIS stock long-term. $NVAX struggling with major resistance above and

Another day of selling in $SHOP could create a really good bounce opportunity off of the rising trend-line. Bull flag in $GS looks sharp, but a very problematic declining trend-line just above the breakout level. Bull flag developing in $ABBV - resistance overhead currently sitting at $161. Nice trade setup here. $PYPL Currently sitting at

Goldman Sachs (GS) breakout of cup and handle pattern but I can't trust it ahead of 4/18 earnings. Alibaba Group (BABA) Bull flag pattern failed to breakout and broke to the downside instead. Second consecutive day where the Real Estate Sector (XLRE) could not hold the breakout level. Watch American Airlines (AAL) as

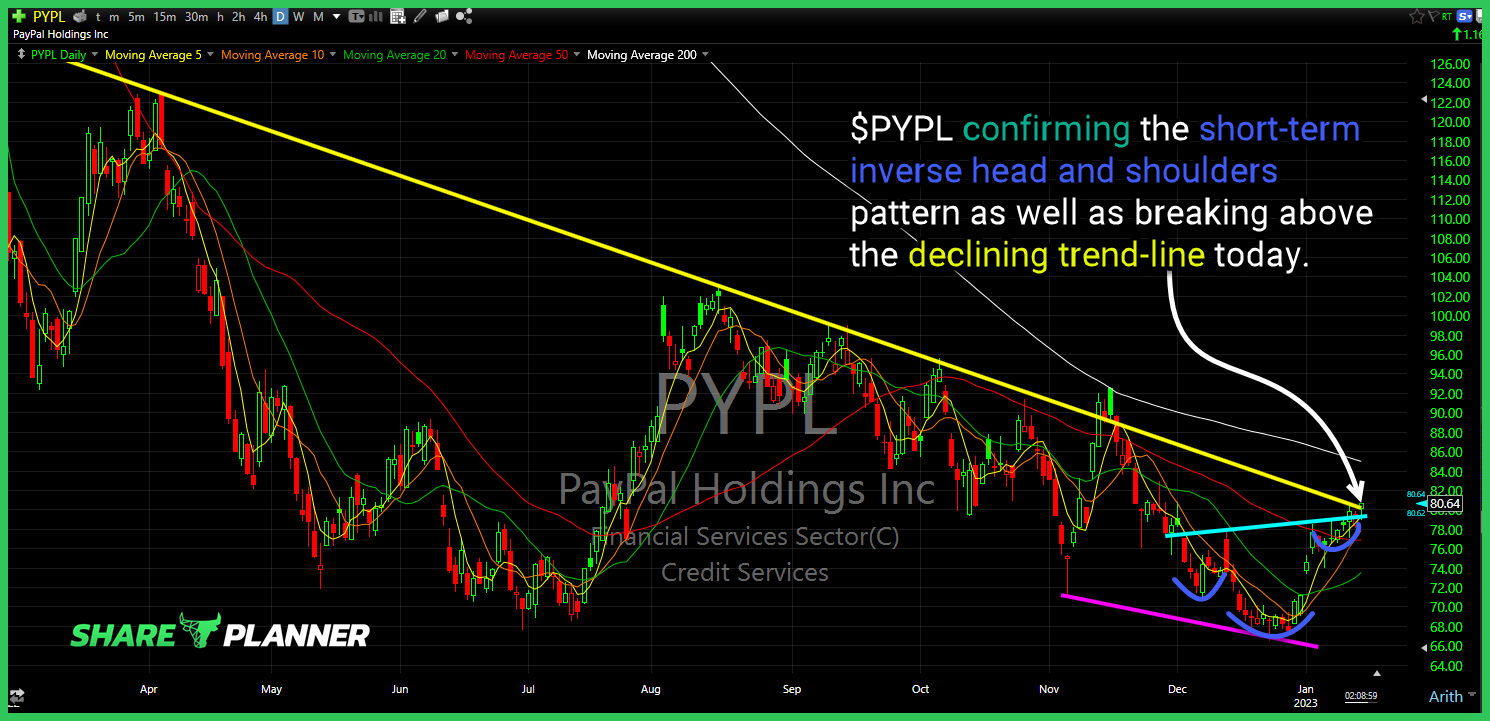

$PYPL confirming the short-term inverse head and shoulders pattern as well as breaking above the declining trend-line today.

$GS Double topping, but far from confirming.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Market rally is impressive, but are we really dead set on a market bottom? Goldman Sachs (GS) is out there telling you that the bottom is in, so is Morgan Stanley (MS). But should they be trusted? Could there be ulterior motives at play there? I’m just not buying this hype that suddenly all