Let’s take a look at the weekly chart of oil and what it means moving forward. And lets just say shorting it at this point is a high risk trade simply because it has broken through one resistance level and is challenging another right now that, once broken leaves plenty of upside for the commodity

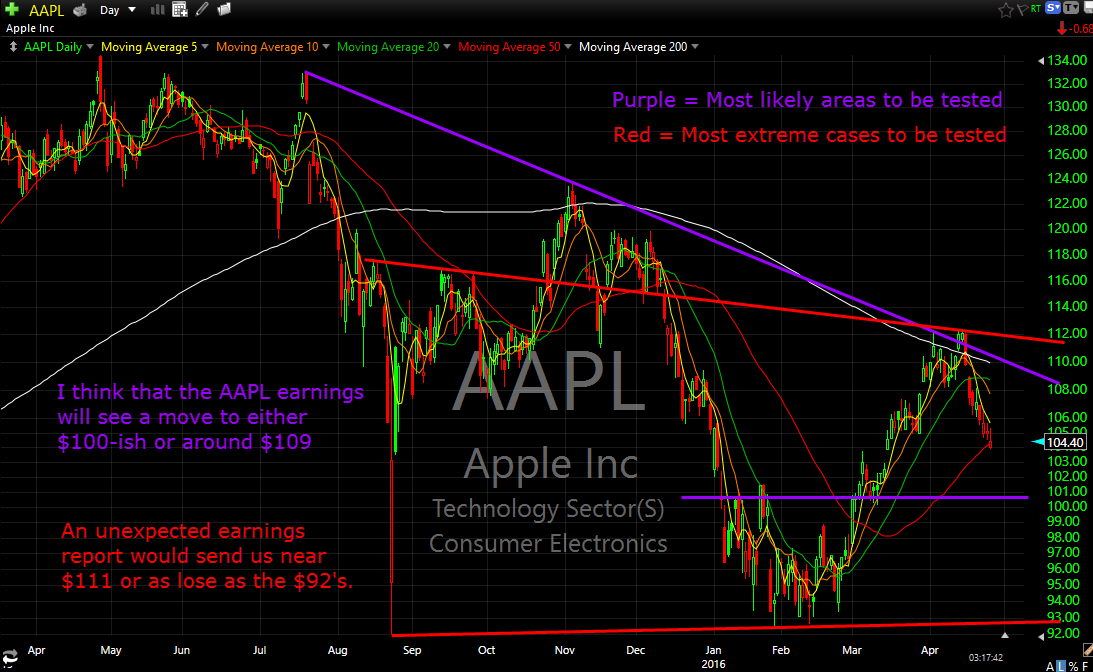

Here’s my prediction for the Apple earnings scheduled to come out around 4:30pm eastern. Tell me what you think.

Alright folks – I have been following $USO and the price of crude very closely of late. I’m of the belief that crude is ready to drop – another 5-6% this week, and in the process, allow for those who took the short set up at recent highs, a great return for the risk. I’m

There are two major trends in the Apple (AAPL) chart and none of them help their cause at all. Overhead you have a declining level of resistance that continues to reject price hard,and underneath price you have an area that price continues to be drawn to following the aforementioned rejection pattern. See for yourself…

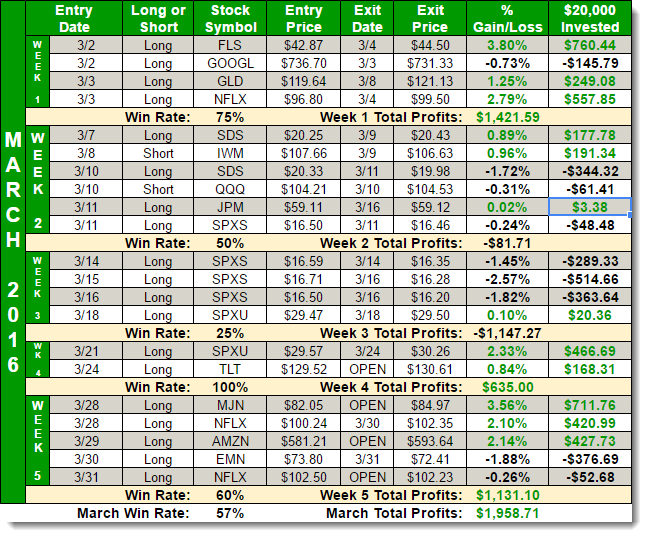

Well… that was one crazy month…one crazy quarter! In fact it was the first time a quarter sold off more than 10% and finished in the green overall. To say the least, it was a historic quarter, and highly unlikely we’ll see anything remotely close to it for the rest of the year. That doesn’t

Any time you are trading on a roll, it is easy to start watching the dollars in the account. For example, today, I bought into Amazon (AMZN) at $581, it is now at $594. I bought Netflix (NFLX) yesterday at $100.24 and now it is at $104. Not to mention Mead Johnson Nutrition

This is really a “choose your poison” type of moment for the markets. Here is what it boils down to:

The big banks appear to be setting up for a bigger move here. I am already long in JP Morgan (JPM), but all four of these charts are posting solid reward/risk ratios with the potential to break higher any day now. Take a look at each chart, you’ll see that over the past two

Check out the chart below to see what I am watching on the USO play. Some good developments unfolding for the bulls, but still remains on shaky ground until it can prove itself. Here’s the technical analysis on USO:

Far too many traders become engrossed by how much “money” they make on a single trade. In my opinion, almost every trading flaw can be rooted in this issue of watching the dollars. Have you ever wondered why you trade better in a paper account? It is because there is no real money and if