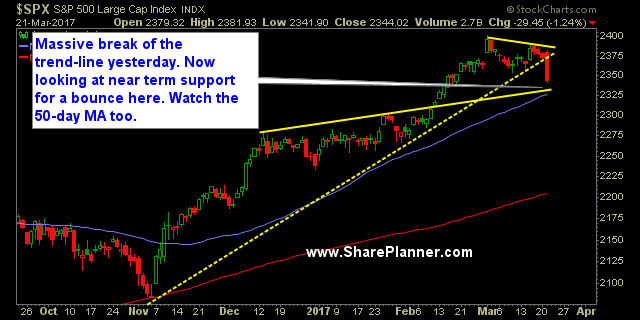

That’s why I say managing risk is so important Yes, it not a fun subject to talk about, but it is not something you cannot afford to ignore. From the highs to the lows of the day, SPX sold off 40 points and broke its key trend line. That is a massive swing considering

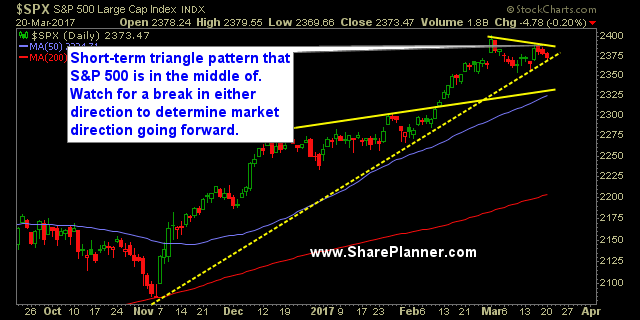

Short-term triangle pattern on SPX SPX has been coiling in a triangle pattern the past three weeks now, or essentially, this entire month of trading. It has pulled back to the rising trend-line that forms the bottom half of the triangle pattern. However, it has only experienced a mild, light volume pullback over the past

Watch the trend-line on the chart of the S&P 500 A lot can change here today or this week if the rising trend-line as noted in the chart of the S&P 500 below fails to hold. You have a potential topping pattern – emphasis on “potential” – with a new all time high that was

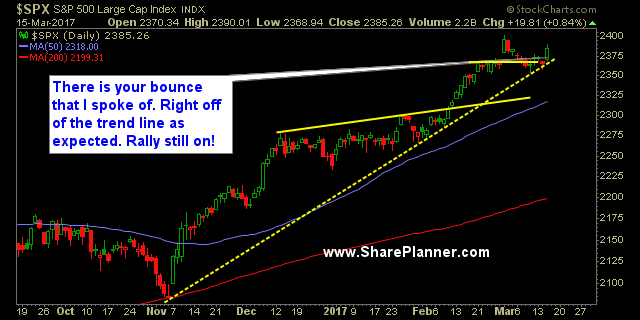

The Fed Up Rally Takes Price Back to Almost All-Time Highs Of couse I am using a play on words as this Fed Up Trump Rally is hated and despised by most and defies the logic of investing in general. I mean, c'mon it has been since last October - almost a half of a

Technical Analysis of the S&P 500's current stock trend remains in tact That doesn't necessarily mean that all the stocks out there are holding it together because most of them are not. But the large caps, the ones that really drive the market's direction, like Apple (AAPL) for instance, is still holding it together and

Technical Analysis: Another “sell-off” that was hardly a sell-off on Friday, where price basically stood still. Right now, it is more likely that the bulls are alleviating overbought conditions through “time” rather than “price”. The steep rising uptrend on S&P 500 (SPX) could possibly be tested today at 2252. The only rising uptrend that has been broken

If you are looking for a trend on the daily or any clue as to the direction of this market, you won't find it by looking at the daily chart on the S&P 500 (SPX). In fact, you will have to drill down into the intradays, namely the hourly or half-hour chart to find what

After breaking out of its recent base, oil has been on a roll, breaking out of its rising channel and crushing the hopes and dreams of bears wanting to see $20 oil. Now the question is, does the bears have a renewed sense of hope here with a possible break in the rising trend-line? We