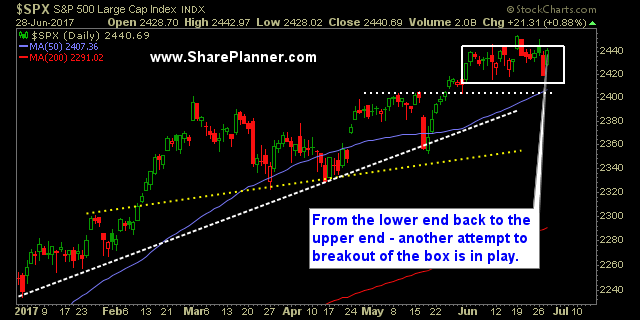

Nasdaq selling off again, SPX flat

The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday’s bounce looked reminiscent of the bounce following the May 17th sell-off, but today, there are some questions about whether this is a bounce that can keep it all together today.

This will likely be a day, where I will try and play it safe and not add any additional long exposure, unless the price action can gain some stability. As it stands this morning, that doesn’t seem to be the case.

A lot of your media stocks yesterday like Netflix (NFLX) and Walt Disney (DIS) rallied hard and I’ll be curious to see if that trend continues into today.

The VIX wiped away most of the rally from Tuesday by dropping a solid 9.3% on the day.

The rally on the S&P 500 and the other indices, minus the Nasdaq, completely wiped out all of the losses from the day prior. So it will be a bit surprising, considering the strength in yesterday’s bounce and the tendency of late for bounces to lead to new all-time highs, if the market can’t hold it together, and may be a bigger sign of vulnerability in the market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

- 5 Long Positions

Recent Stock Trade Notables:

- Intel (INTC) Short at $35.21, covered at $34.46 for a 2.1% profit.

- Nvdia (NVDA): Long at $155.57, closed at $157.53 for a 1.3% profit.

- IBB: Long at $298.24, closed at $303.74 for a 1.8% profit.

- SPXU: Long at $15.68, closed at $15.25 for a 2.7% loss.

- Whirlpool (WHR): Long at $190.46, closed at $195.19 for a 2.5% profit.

- Ferrari (RACE): Long at $84.60, closed at $89.93 for a 6.3% profit.

- Amazon (AMZN): Long at $964.70, closed at $1001.23 for a 3.8% profit.

- American Airlines (AAL): Long at $49.18, closed at $50.62 for a 2.9% profit

- Alibaba Group (BABA): Long at $124.95, closed at $137.51 for a 10.1% profit.

- Starbucks (SBUX): Long at $61.78, closed at $63.68 for a 3.1% profit.

- Western Digital (WDC): Long at $91.24, closed at $89.29 for a 2.1% loss.

- Broadcom (AVGO): Long at $236.65, closed at $241.15 for a 2% profit.

- SPXU: Long at 16.60, closed at $16.98 for a 2.3% profit.

- JP Morgan Chase (JPM): Long at $87.84, closed at $85.98 for a 2.1% loss.

- Micron Technology (MU): Long at $29.00, closed at $28.04 for a 3.3% loss.

- Alibaba Group (BABA): Long at $116.25, closed at $124.09 for a 6.7% profit.

- Southwest Airlines (LUV): Long at $58.35, closed at 57.23 for a 1.9% loss.

- Broadcom (AVGO): Long at $223.63, closed at $228.65 for a 2.2% profit.

- Workday (WDAY): Long at 86.00, closed at 90.32 for a 5% profit.

- Univar (UNVR): Long at $30.96, closed at $32.20 for a 4% profit.

- Alibaba Group (BABA): Long at $111.91, closed at $115.48 for a 3.2% profit.

- Redhat (RHT): Long at $85.21, closed at $87.21 foor a 2.4% profit.

- Darling Ingredients (DAR): Long at $15.19, closed at $14.90 for a 1.9% loss.

- Apple (AAPL): Long at $143.82, closed at $147.11 for a 2.3% profit.

- Teradyne (TER): Long at $31.16, closed at $33.03 for a 6.0% profit.

- UPRO: Long at $92.75, closed at $94.78 for a 2.2% profit.

Sign up for Trading Block here.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.