My Swing Trading Approach

I booked my profits in NFLX at $354 for a +3.2% profit yesterday. I added one additional long position, but that is all I am working with in this market. I am not looking to get aggressively long, and may even flip to the short side, if the bulls lose the 50-day moving average.

Indicators

- Volatility Index (VIX) – VIX giving up little-to-no ground here. Up another 1.7% to 15.95. Struggling to maintain intraday gains, but not retracting into the gains of previous days.

- T2108 (% of stocks trading above their 40-day moving average): Dropped 4% yesterday down to 31%. Continues to trend lower off of the 5-day moving average.

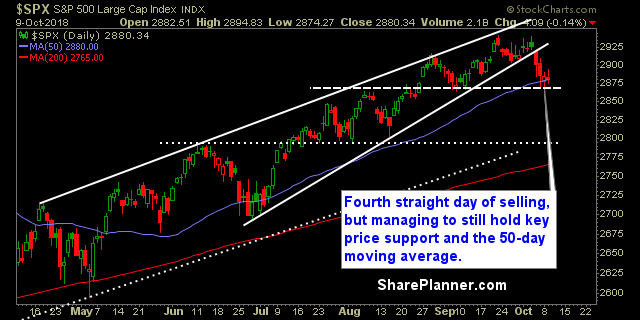

- Moving averages (SPX): Broke the 50-day moving average intraday again, but managed to close above it by the close. Third day in a row that has happened, and putting together some notable support there.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy breaking out of its bull flag pattern yesterday, while Utilities continues its push higher. Healthcare continues to see profit-taking as it is now trading below its 50-day moving average. Financials on the verge of testing a key support level that if it breaks will send it back to its June lows. Technology sold off for the sixth time in the last seven trading sessions, and due for a hard bounce here off the 200-day moving average.

My Market Sentiment

The 50-day moving average barely held, and price support in the short-term is holding it together as well. The bulls continue to buy the dip at these levels and nearing oversold levels, while some sectors have already reached that. The market eventually bounces hard, so if you are short over the past week, you need to be protecting profits here. The potential for a bounce looms large.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Long Position

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.