My Swing Trading Strategy I have been playing more conservative ahead of the FOMC Statement Today, I have long and short positions to give my portfolio a more “neutral” balance to it. Depending on how the market reacts to the Fed and its interest rate cut, will determine how I trade going forward. For now,

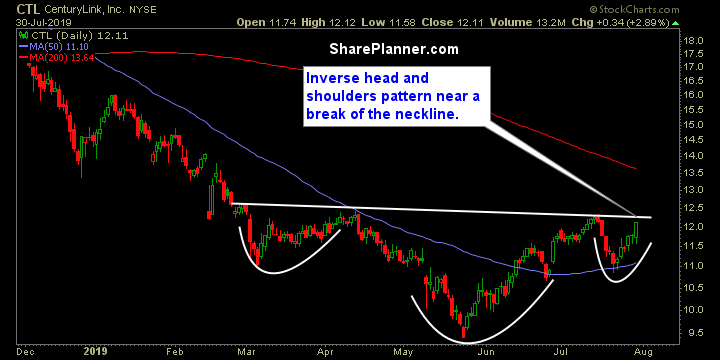

Wednesday’s Swing-Trades: $FE $CTL $AAP Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: First Energy (FE)

One of the dullest summer months you’ll ever see. First few days of July were okay, heck there, was even a four day stretch in the middle that was quite interesting. But these past eleven trading sessions have been some of the most boring trading sessions you’ll ever see. We’re seeing lower and lower

My Swing Trading Strategy I went more conservative yesterday, adding a utility play while also being stopped out of my software play. The market is showing a sketchiness towards growth plays this week, so far, and I’ll be looking to avoid such plays until the market can steady itself. Indicators Volatility Index (VIX) – Downtrend in

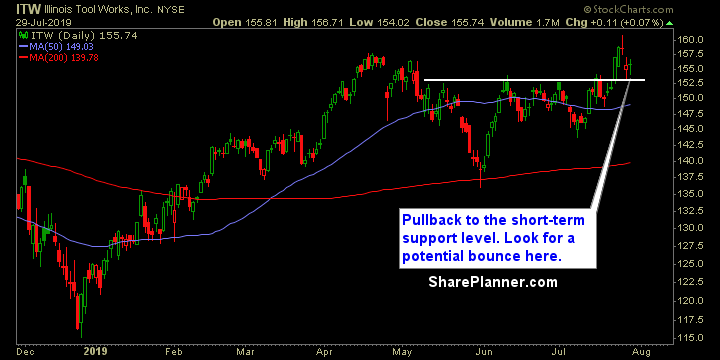

Tuesday’s Swing-Trades: $ITW $CE $L Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Illinois Tool Works (ITW)

This week has not gotten off to the best of starts. After having closed out my three previous trades for profits, Shopify (SHOP) got the best of me, hitting my stop-loss in the very early going and leaving me with just one position in the portfolio. Technology stocks are getting killed today, and right now,

My Swing Trading Strategy I added one additional long setup on Friday, while holding on to the one other position I came into the day with. I suspect the price action in the market to be limited this week ahead of the FOMC Statement and presser on Wednesday. Indicators Volatility Index (VIX) – VIX could see

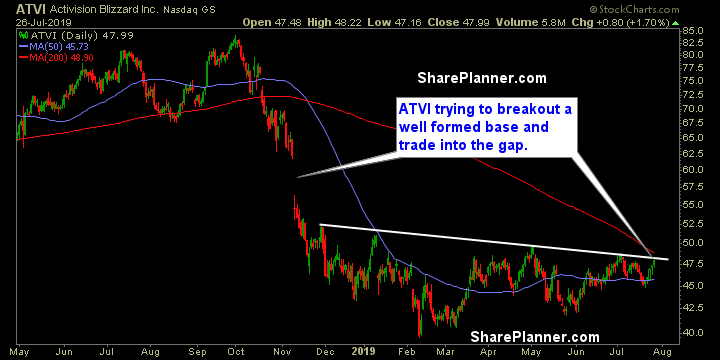

Monday’s Swing-Trades: $FLT $ATVI $DVN Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: FleetCor Technologies (FLT)

My Swing Trading Strategy Profits were booked in Regions Financial (RF) for a +3.1% profit. I also closed out Square (SQ) at just a shade above break even due to the earnings and market pressures. That became a mute point for the stock though. I added one position yesterday, and will look to add one more today too.