My Swing Trading Strategy One additional trade was added to the portfolio on Wednesday, however, I am a little hesitant in adding another trade today as the market is showing weakness ahead of the bell with a strong jobs number. Indicators Volatility Index (VIX) – Another decline on Wednesday, this time to the tune of 2.8%

My Swing Trading Strategy I added one new trade to the portfolio yesterday and will look to add another long position today. Indicators Volatility Index (VIX) – As mentioned yesterday, don’t be surprised to see a push into the 12’s on the VIX indicator, and that is exactly what the market provided yesterday. I expect it

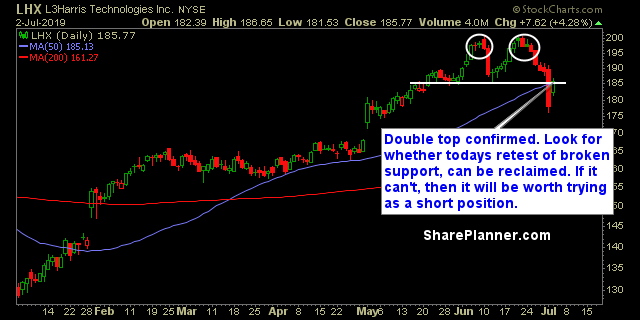

Wednesday’s Swing-Trades: $MRK $WMB $LHX Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Merck (MRK)

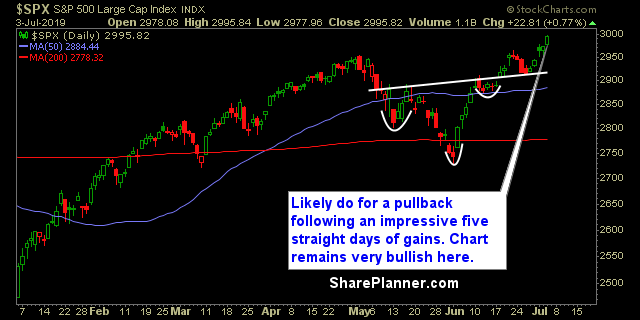

A lot of people are calling for a market top with yesterday’s big move. They are doing that because when SPX made new all-time highs in May and then again in June, we immediately faded and dropped rather hard. So the same is being expected here, but rarely is the market that predictable. So

My Swing Trading Strategy I closed out four positions yesterday: Best Buy (BBY) for a 4.6% profit, Take Two (TTWO) for a 2.1% profit, Netflix (NFLX) for a 1.8% profit, and Lyft (LYFT) fora 1.7% profit. I also added one additional trade to the portfolio as well. Indicators Volatility Index (VIX) – VIX saw

Tuesday’s Swing-Trades: $UAL $PKI $PAYX Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: United Airlines (UAL)

It's that time of year where us Americans get to flex our muscles some...okay a lot. And by flex, I mean run to the local firework store, get a ton of illegal fireworks, sign wavers that they are to scare off the birds only, and hope to God, you don't blow your fingers off in

My Swing Trading Strategy I added one new trade to the portfolio on Friday, while closing out a losing position in the early going. All four positions that I have are poised to benefit from the pre-market strength and will look to add a new position today. Indicators Volatility Index (VIX) – A 4.7% decline on

Monday’s Swing-Trades: $AMZN $FB $PHM Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Amazn (AMZN)