My Swing Trading Strategy

I added one additional long setup on Friday, while holding on to the one other position I came into the day with. I suspect the price action in the market to be limited this week ahead of the FOMC Statement and presser on Wednesday.

Indicators

- Volatility Index (VIX) – VIX could see a push into the 11’s today, either way, the index continues to sit in an area where movement in equities remains limited to the upside, and the potential for a hard sell-off in the stock market is heightened.

- T2108 (% of stocks trading above their 40-day moving average): A 5% increase on Friday, which keeps the indicator in a sideways consolidation as has been the case for all of July.

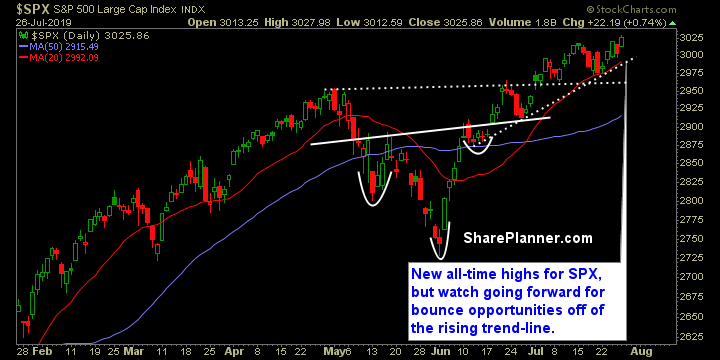

- Moving averages (SPX): The 5-day and 10-day moving averages crossed back to the upside. SPX currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

A 1.5% move out of Technology on Friday was the main driver behind the market rally on Friday as it closed yet again at new all-time highs. Staples attempting to breakout of its month long trading range too and should be a focus of traders going forward. Financials setting up for further gains, following a solid week. Healthcare working on a semi-bull flag pattern. Industrials also prepared to push out of consolidation for the month of July. Energy is by far the most problematic of all the sectors, as it has begun to roll over, and looks to test the May lows, and possibly even the December lows in the coming weeks.

My Market Sentiment

Another big earnings week ahead, highlighted by Apple (AAPL), but the main focus will be on FOMC Statement on Wednesday. Until then, expect low volume and limited price swings in either direction. Not that there can’t be any volatility, but the expectation is that their won’t until the FOMC comes out.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 long positions.