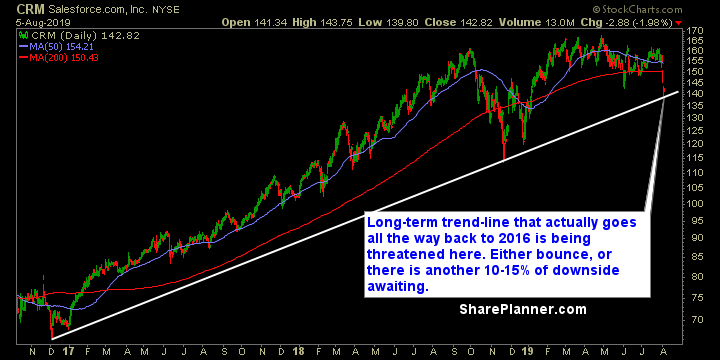

Tueday’s Swing-Trades: $CRM $CG $LMT Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Salesforce (CRM)

Happy Monday and -100 SPX handles to you! Holy cow, I know we opened up over forty points to the downside, but seriously, another 60 points lower is going to be a tough pill to swallow for a lot of investors. I’ll admit, I wish I still had my inverse ETF in SDS still, but

My Swing Trading Strategy I sold my inverse ETF position in SDS on Friday for a +3.2% profit. While I’d like to still be in that position today, considering how weak the market was, selling it on Friday did make sense as the price action was well below the lower bollinger band and the S&P

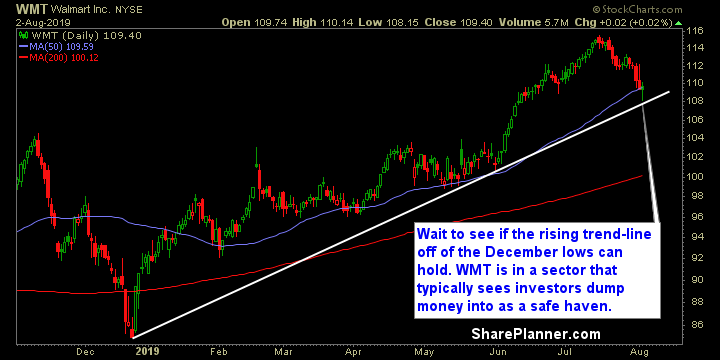

Monday’s Swing-Trades: $WMT $RF $TIF Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Walmart (WMT)

My Swing Trading Strategy Yesterday was a real clown act by the market. I originally closed out my position in SDS for a 0.6% profit, only to have jump right back in the trade later in the day following the Trump Tweet. Right now, I have one staple play and one short position. Indicators Volatility

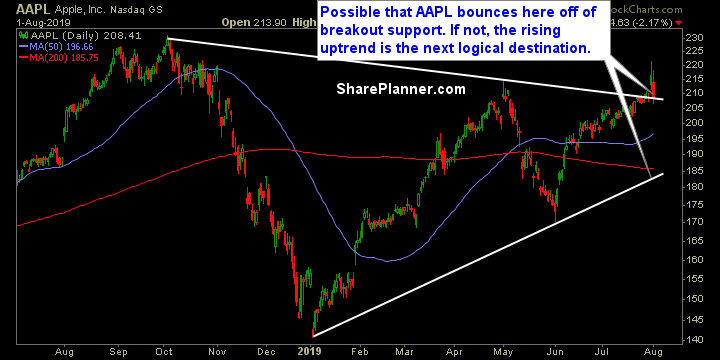

Friday’s Swing-Trades: $AAPL $NDAQ $DLTR Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Apple (AAPL)

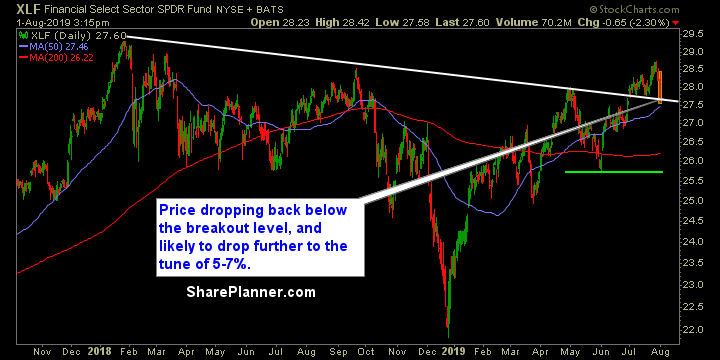

The market is shedding its bullish act, and taking on a much more bearish tone. Jerome Powell’s circus yesterday, coupled with Trump’s untimely Chinese tariffs tweets today, has instantly put this market into a tale-spin. Short -term support levels are being violated across the board, and traders are being whip-lashed all over the board. The

My Swing Trading Strategy My Long position SDS which provides a 2:1 inverse return of SPY did marvelously yesterday, and helped deflect some of the losses in the two positions I was stopped out of, due to Jerome Powell’s unbelievably and disastrous presser. Seriously, can we end these senseless press conferences already? It’s a dumpster fire every time.

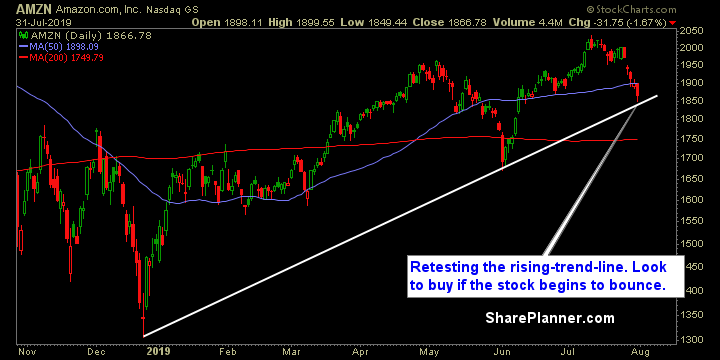

Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Amazon (AMZN)